Worldcoin price nears all-time highs, what WLD holders should anticipate

- Worldcoin price rallied 54% on December 16 and came close to hitting new all-time highs.

- But profit-taking seems to have taken over, which could lead to consolidation before a new setup forms.

- Investors can expect WLD to restart its rally by December 19 and hit new highs next week.

Worldcoin (WLD) price saw a massive surge in buying pressure on December 16, which propelled it up by 86%. But as investors began to book profits, the daily candlestick closed at a 54% gain. Going forward, WLD is likely going to slip into consolidation before a new wave of bullish momentum kickstarts another leg up to new all-time highs.

Also read: Worldcoin price bullish outlook abounds as WLD commits to robustness, expansion and neutrality

Worldcoin price to consolidate

Worldcoin price retraced 59% after its listing on July 24 and slipped into sideways movement. This price action is typical after a highly anticipated coin gets listed on major exchanges like Binance, Coinbase, Bybit etc.

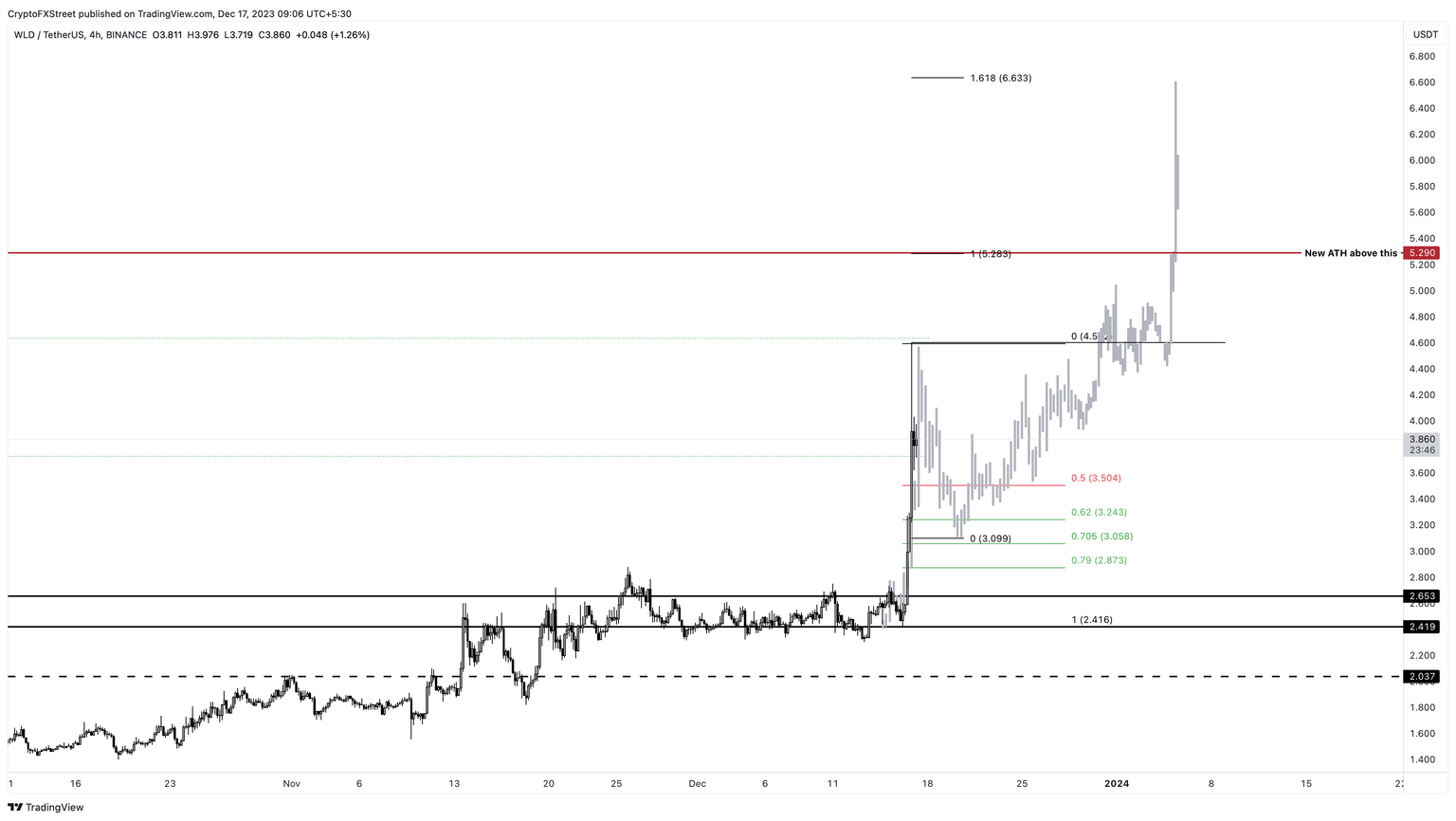

Between November 12 and December 15, the Worldcoin price started to range between $2.419 and $2.653. After a retest of the lower limit of the range, WLD kickstarted an 86% rally and set up a local top at $4.592. Interestingly, this level coincides closely with the 79% retracement level of 59% wick formed after the token’s listing on July 24.

WLD/USDT 1-day chart

Read more: Bitcoin Weekly Forecast: BTC cool-off prepares markets for crypto’s final two weeks of 2023

WLD’s potential consolidation outlook

Going forward, investors can expect a retracement to $3.504 and $3.243 levels, which are the 50% and 62% retracement of December 16’s range. In some cases, the 70.5% retracement level at $3.058 could also be tagged.

Either way, a retest of these key levels is likely going to be followed by a quick run-up that will attempt a retest of the local top at $4.592. Overcoming this barrier would lead to contesting the all-time high of $5.290 and eventually setting up new highs at $6.633.

This move would constitute a 115% gain from the 70.5% retracement level of $3.058.

WLD/USDT 4-hour chart

The outlook for Worldcoin price is no doubt bullish after the recent rally. But if WLD retraces and flips the $2.419 support level into a resistance barrier, it would create a lower low and invalidate the bullish thesis.

In such a case, Worldcoin price could revisit the $2.037 support level, roughly 16% away from $2.419.

Also read: Solana price breaches key weekly resistance, SOL gains are likely sustainable

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.