Worldcoin price dips 46% in a month as Sam Altman’s project faces investigation worldwide

- Worldcoin’s WLD token price dropped 46.37% within a month of its launch.

- The project is currently under investigation in Germany, France and the UK, and WLD price continues its downward trend.

- An alleged whistleblower raised red flags in the project and claims to have worked on Worldcoin since before its token launch.

Worldcoin, a crypto project by ChatGPT founder Sam Altman, has garnered growing scrutiny from regulators and watchdogs worldwide. The project has earned a reputation for possible violations of national data protection laws, because of its eye-ball scanning orbs that enroll users.

In an interesting turn of events, a whistleblower who claims to have worked with the Worldcoin team since before WLD token launch, has come forward with red flags and allegations. WLD price continues to bleed as authorities in Germany, France and the UK investigate the project.

Worldcoin WLD token plummets 46% in 30 days

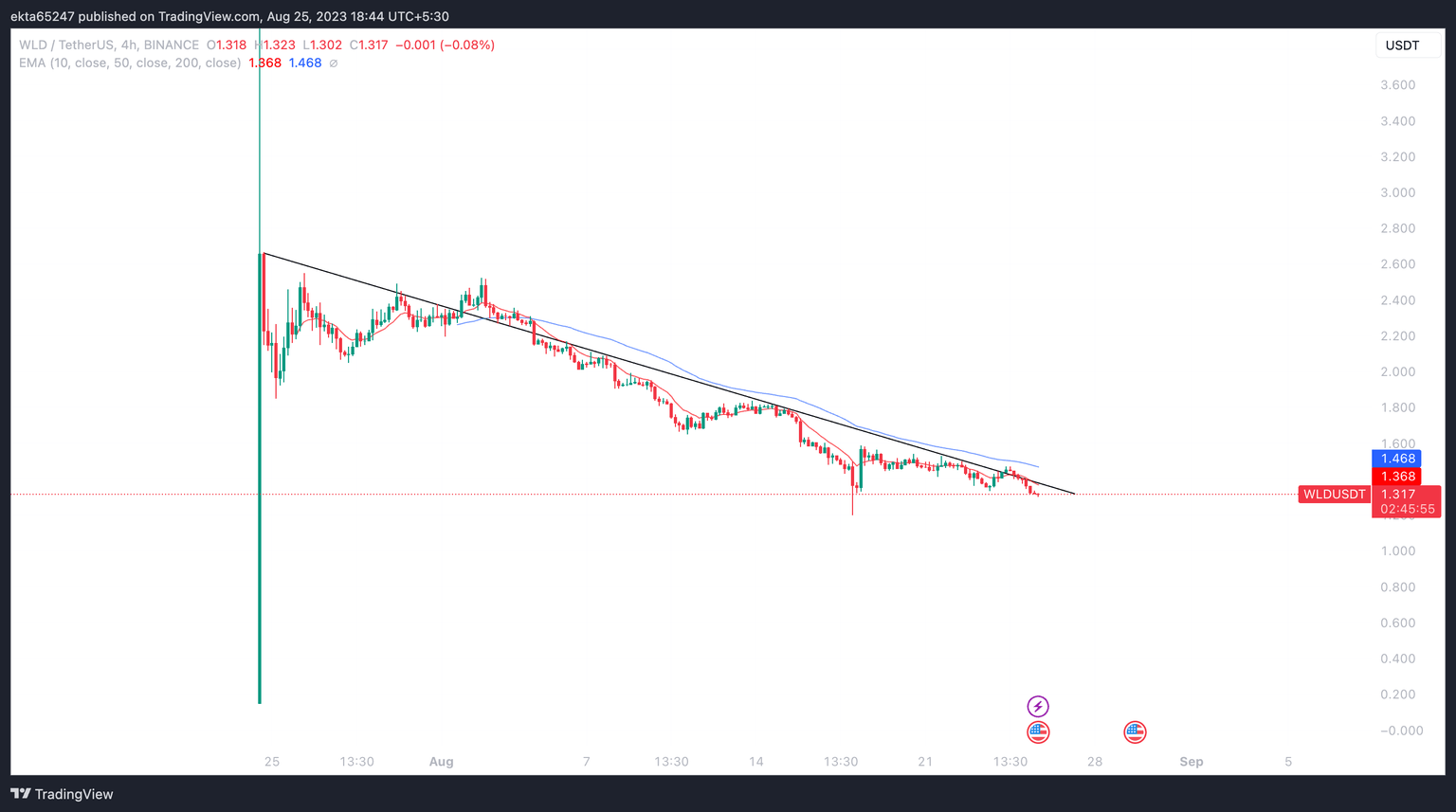

WLD token traded at $2.456, on July 25, the day following its listing on Binance. Since then, WLD price dropped to $1.317, as of Friday morning. In a 30-day timeframe, WLD shaved off 46.37% of its price. This is a significant decline for a token, when several altcoins and cryptocurrencies went through a period of market crash followed by a recovery within a few weeks.

WLD/USDT price chart on Binance

Developments around Worldcoin and ongoing investigations from authorities in different countries have acted as an influence on WLD token’s price. The project aimed at creating decentralized identities for users has raised concerns on account of its enrollment process. The scanning of eye-balls through orbs and collecting biometric data, is likely a violation of national data protection laws.

Several governments have flagged the same and Worldcoin is currently under investigation in Germany, France and the UK.

Alleged whistleblower points at red flags

Nadir Hajarabi, an alleged whistleblower who describes his association with Sam Altman’s team since before WLD token launch, issued a video statement on YouTube. Hajarabi says he left the project post the release of the token and the whitepaper.

Describing himself as a believer in Universal Basic Income, Hajarabi characterizes Worldcoin as an organization that executed the same “horrendously” and shared several red flags associated with the project in his video. Without elaborating on specific details, Hajarabi explained that he released his statement with the consent of his legal team.

FXStreet has contacted Worldcoin for comments. Watch this space for updates.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.