Worldcoin looks set for comeback despite Nvidia’s 22% crash

- Worldcoin price offers potential buy-the-dip opportunities.

- Nvidia’s influence on AI coins seems to have waned after the recent bounce in WLD.

- On-chain metrics support a recovery rally for WLD.

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia, whose stock price has plummeted by double digits in the past few weeks.

Also read: Crypto AI token comeback likely after Apple's potential on-device LLM

Nvidia and AI Coins

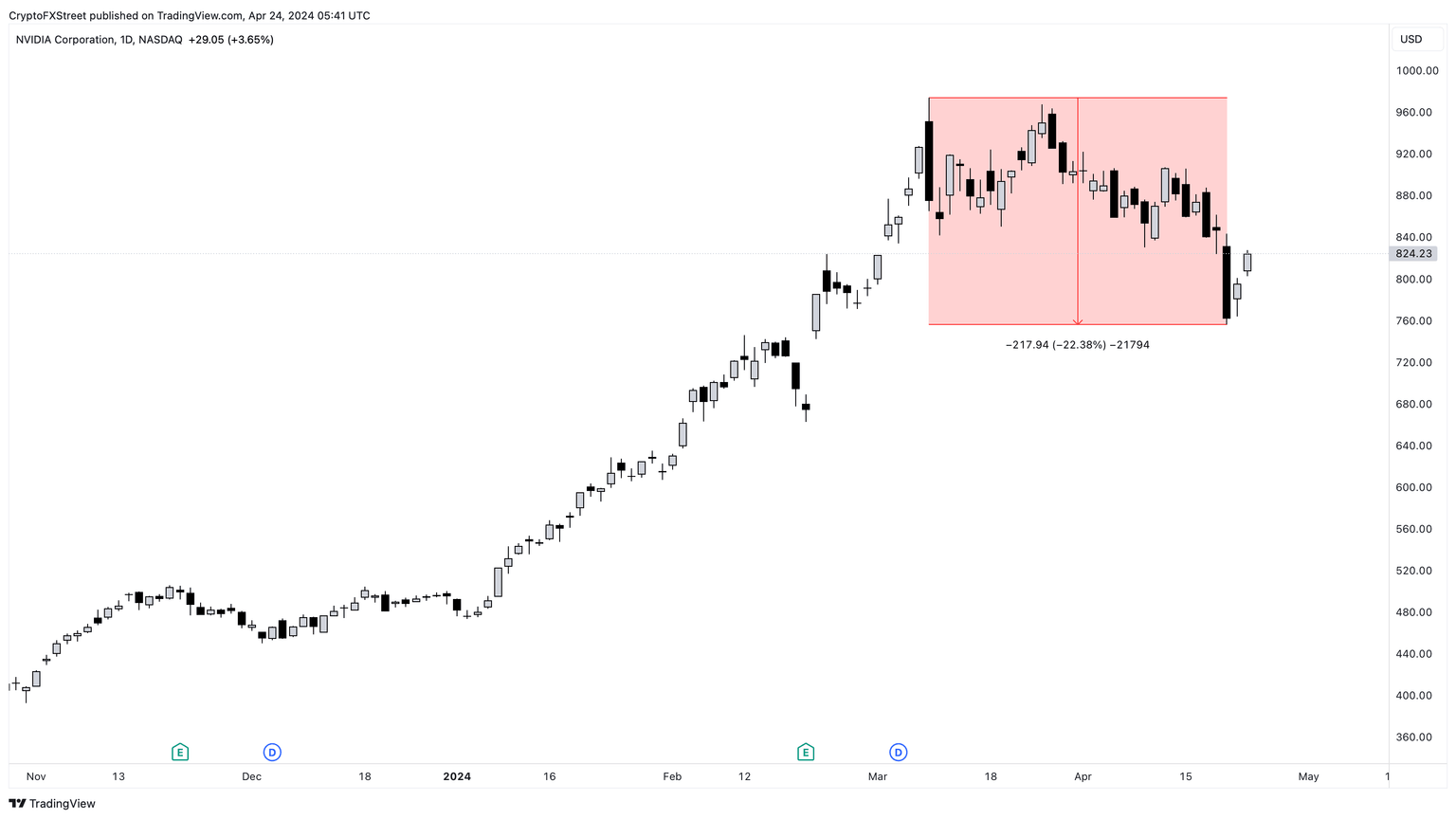

Nvidia, the American technology giant that manufactures Graphical Processing Units (GPUs) and is responsible for the continuous development and improvement of Artificial Intelligence technology, has seen its stock price crash by 22% in the past six weeks. The market capitalization of NVDA has dropped from $2.37 trillion to nearly $2.0 trillion.

NVDA 1-day chart

This sudden downtrend spread to AI crypto tokens, which also suffered a steep correction.

For example, Worldcoin price registered a 69% crash between March 10 and April 13. However, recent developments show that WLD is primed for a comeback.

Read more: AI safety group proposes criminal liability on developers, tokens suffer steep declines in prices

Worldcoin price attempts a comeback

In late December, the Worldcoin price overcame the $2.71 hurdle and flipped into a support floor before kick-starting a 454% rally. Recently, when WLD crashed 69%, it retested the $4.22 support floor and triggered a minor bounce that has the potential to evolve into a recovery rally.

The declining trend line connecting Worldcoin’s all-time high (ATH) of $11.99 shows that the downtrend is still intact. The volume profile indicator’s high-volume nodes align perfectly with the $6.70 and $8.55 resistance levels, which are the next targets for bulls.

Ideally, a flip of the $6.70 resistance level into a support floor is required for sidelined buyers to gain confidence and buy more WLD. But investors must be cautious about Bitcoin’s influence on altcoins, including AI-related tokens. If the pioneer crypto slides lower, WLD could pull the early 2024 outlook and dip below $6.70 before rallying higher.

The Relative Strength Index (RSI) has yet to flip its mean level of 50, which could catalyze a minor retracement for Worldcoin price, giving patient investors an opportunity to accumulate. The Awesome Oscillator (AO) also shows that the bearish momentum is on the decline and a flip of the mean level of 0 will confirm that the bulls are in control.

WLD/USDT 1-day chart

According to Santiment, Worldcoin’s 30-day Market Value to Realized Value (MVRV) ratio recovered from -36% on April 13 to near-zero levels.

The MVRV index is used to asses good buying/selling opportunities. A large positive value is a sell signal because it indicates that the unrealized profit is high, and a potential profit-taking action could result in a sell-off. Likewise, a negative value shows that the short-term investors who purchased the asset are underwater and are less likely to sell. Long-term investors tend to buy weakness, and hence, these areas serve as a buy signal.

The MVRV at -36% on April 13 was a clear buy signal. Since then, Worldcoin price has shot up nearly 69%, indicating a potential reversal rally.

WLD 30-day MVRV

Furthermore, Santiment’s Network Realized Profit/Loss (NPL) indicator shows that the April 13 crash was followed by a massive capitulation event on April 17, which was another buy signal.

This indicator computes a daily network-level ROI based on the coin’s on-chain transaction volume. Simply put, it is used to gauge market pain. NPL takes the price at which it was last moved and assumes this to be the coin's acquisition price. Once the coin changes address again, NPL assumes it was sold.

As a result, strong spikes suggest investors are selling their bags at significant profits, while dips indicate capitulation and serve as a buy signal.

WLD NPL

To conclude, the technical perspective for Worldcoin has shifted from extremely bearish to bullish. Additionally, signs from on-chain data suggest that buying the dips or accumulating WLD could be a good idea.

However, if Bitcoin price decides to crash, it has the power to influence altcoins as well. In such a case, if WLD flips the $4.22 support floor into a resistance level, it will invalidate the bullish thesis. This development could lead to a 15% crash to the next high-volume node at approximately $3.73.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B11.26.55%2C%252024%2520Apr%2C%25202024%5D-638495386442166833.png&w=1536&q=95)

%2520%5B11.47.47%2C%252024%2520Apr%2C%25202024%5D-638495386643005295.png&w=1536&q=95)