Worldcoin could take a further hit with over $230 million unlocks in September

- Worldcoin will see its supply grow by over $230 million in September.

- WLD's price has shown an inverse correlation with its circulating supply.

- On-chain data shows that 95% of addresses are holding WLD at a loss.

Worldcoin (WLD) is up 2% on Monday but risks a heavy decline in the coming weeks following unlocks worth over $230 million in September. This follows a nearly 90% decline from its all-time high in March.

Why investors need to be cautious with WLD

Token Unlocks data reveals that crypto identity project Worldcoin will see one of the highest unlocks in September, with over $230 million worth of new supply entering circulation.

Unlocks often cause a token's price to decline if demand fails to catch up with the new supply.

With such heavy unlocks, WLD may see its price decline in the next few weeks. This is evident in its price movement following past unlock events. Since hitting an all-time high of $11.74 on March 10, WLD has had a series of unlock events, per Token Unlocks data. These unlocks, coupled with the crypto market correction, have sent WLD down 87% from its all-time high.

As evidenced in the Santiment chart below, WLD's price and its supply in circulation have been inversely correlated since May 2024.

WLD On-chain metrics

With a market capitalization of around $587 million and a fully diluted valuation of $14.5 billion, WLD still has a huge pool of unlocked tokens that could negatively impact its price in the future.

X user @CryptoCondom also commented on WLD's rising supply:

This is your your friendly reminder that @worldcoin is going to trend to zero. At a $15.1 BILLION dollar FDV, $WLD is exit liquidity for the goat farmers & VCs who are dumping on retail heads daily. $WLD supply inflates 9.56% every week$WLD supply inflates 40.95% every month… pic.twitter.com/noGNdbMZ8g

— CryptoCondom (@crypto_condom) August 28, 2024

A similar trend is visible in Santiment's 180-day Market Value to Realized Value (MVRV) ratio, which shows that all addresses that bought WLD in the past six months have lost an average of over 35%.

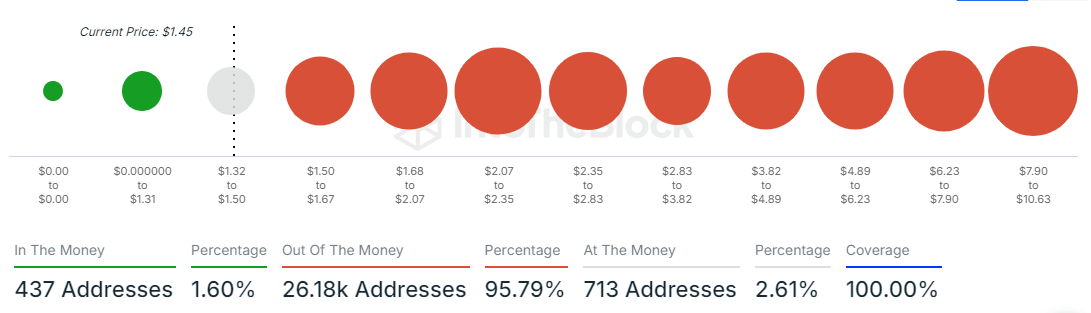

Additionally, IntoTheBlock's Global In/Out of the Money, which tracks the number of addresses/coins in profit/loss, reveals that over 95% of addresses are holding WLD at a loss.

WLD Global In/Out of the Money

WLD currently trades around $1.45, a price level last seen in October 2023.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B00.06.37%2C%252003%2520Sep%2C%25202024%5D-638609191348813954.png&w=1536&q=95)