- Bitcoin miners are bolstering their efficiency by upgrading mining equipment.

- Mining rewards to be reduced to half as Bitcoin undergoes its third-halving.

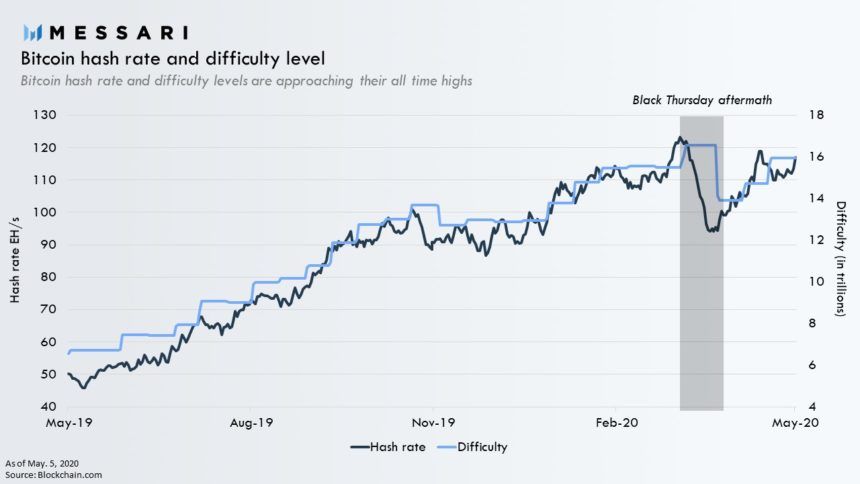

- The recent weeks have seen Bitcoin hash rate surge to new all-time highs; mining difficulty also on the rise.

Bitcoin block reward halving will take place in five days. Speculation is mounting and investors are balancing on the edge with a myriad of expectations in regards to the impact of the event. The halving occurs every four years; it a process that results in mining rewards being reduced to half. The main purpose of the halving in the Bitcoin network is to control inflation as well as to ensure that Bitcoin hits the 21 million maximum supply.

There have been discussions and opinions as to whether this halving will have the same impact as the previous halvings where Bitcoin price rallied in the months following the events. Some investors are choosing to be strongly bullish with predictions of up to $80,000 (by the end of 2021 according to PlanB, a pseudonymous crypto analyst).

Consequently, one guaranteed impact of the halving is its effect on mining rewards. For this reason, miners are working around the clock to ensure that they remain profitable after the halving. Some of them are upgrading to new equipment to improve the efficiency of the process.

Bitcoin hash rate surges ahead of the halving

In the past few weeks, the network’s hash rate, which measures the computational power within the network has rocked to new all-time highs. This parameter always rises and falls on the account of the miners’ contribution to the network and shows the coin’s fundamental strength.

At the same time, the mining difficulty has also increased significantly; an indication that miners are working on bolstering their efficiency to safeguard their profitability. Messari, a blockchain data platform wrote in a recent blog post:

After its third upward difficulty adjustment in a row, Bitcoin difficulty level is approaching its all-time high. Hash rate is up as much as 25% since its post-Black Thursday lows following Bitcoin’s recent price recovery.

At the time of writing, Bitcoin is trading at $9,024. The price action has been lethargic throughout the Asian session. However, downward price action has hit a wall at $8,922 (intraday low). On the upside, Bitcoin stalled at $9,075 (intraday high) ahead of the resistance at $9,100.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.