With Ethereum Merge around the corner, here’s why you should pay close attention to Ethereum Classic price

- Ethereum Classic price has breached the 50-day EMA, indicating a major revival of bullish momentum.

- With the Merge approaching, Ethereum miners are likely to shift to ETC, which could be a reason for the next rally.

- Investors can expect ETC to trigger a 55% ascent to $32.62, the midpoint of the 76% downswing.

Ethereum Classic price has popped over the weekend, rallying a whopping 47%. In fact, the rally seems to have begun on July 13, hinting at more gains to come. The reason for this could be Ethereum miners jumping ship to Ethereum Classic due to the fast-approaching network upgrade known as Merge.

Fitting Ethereum, Merge and Ethereum Classic together

Ethereum, the second-largest cryptocurrency by market capitalization, is set to shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS) via a network upgrade known as “Merge.” Although this update has been touted for a long time, an Ethereum Beacon Chain community health consultant recently confirmed the timeline and noted that the Merge could occur on September 19.

This merge timeline isn't final, but it's extremely exciting to see it coming together. Please regard this as a planning timeline and look out for official announcements!https://t.co/ttutBceZ21 pic.twitter.com/MY8VFOv0SI

— superphiz.eth (@superphiz) July 14, 2022

While this timeline might be refreshing, investors or miners are not too stoked since Ethereum developers are known to delay scheduled upgrades.

A Chinese miner and Ethereum supporter Jiang Zhuoer posted on Weibo that “although Ethereum developers are expected to merge in September, it will generally be postponed, and DAPP needs to be adapted, there is a high probability of a merge between November and December finally.”

Regardless, miners seem to be risk averse and are likely migrating to other PoW coins. Decentralized storage coin Arweave has seen a 37% spike in hash rate over the past week. Ethereum Classic, a close relative of Ethereum with a slightly different mining algorithm, has also noticed a 41% increase in its hash rate.

While other PoW coins have a major impediment in accommodating migrating Ethereum miners, only a minor firmware update could see these miners comfortably mining Ethereum Classic.

Hence, as the Merge upgrade closes in, more ETH miners are likely to jump ship to mining ETC, which could trigger a rally in Ethereum Classic price. So far, ETC has already inflated by 56% since July 13 but the technicals indicate more gains are likely on their way.

Ethereum Classic price ready for an exponential run-up

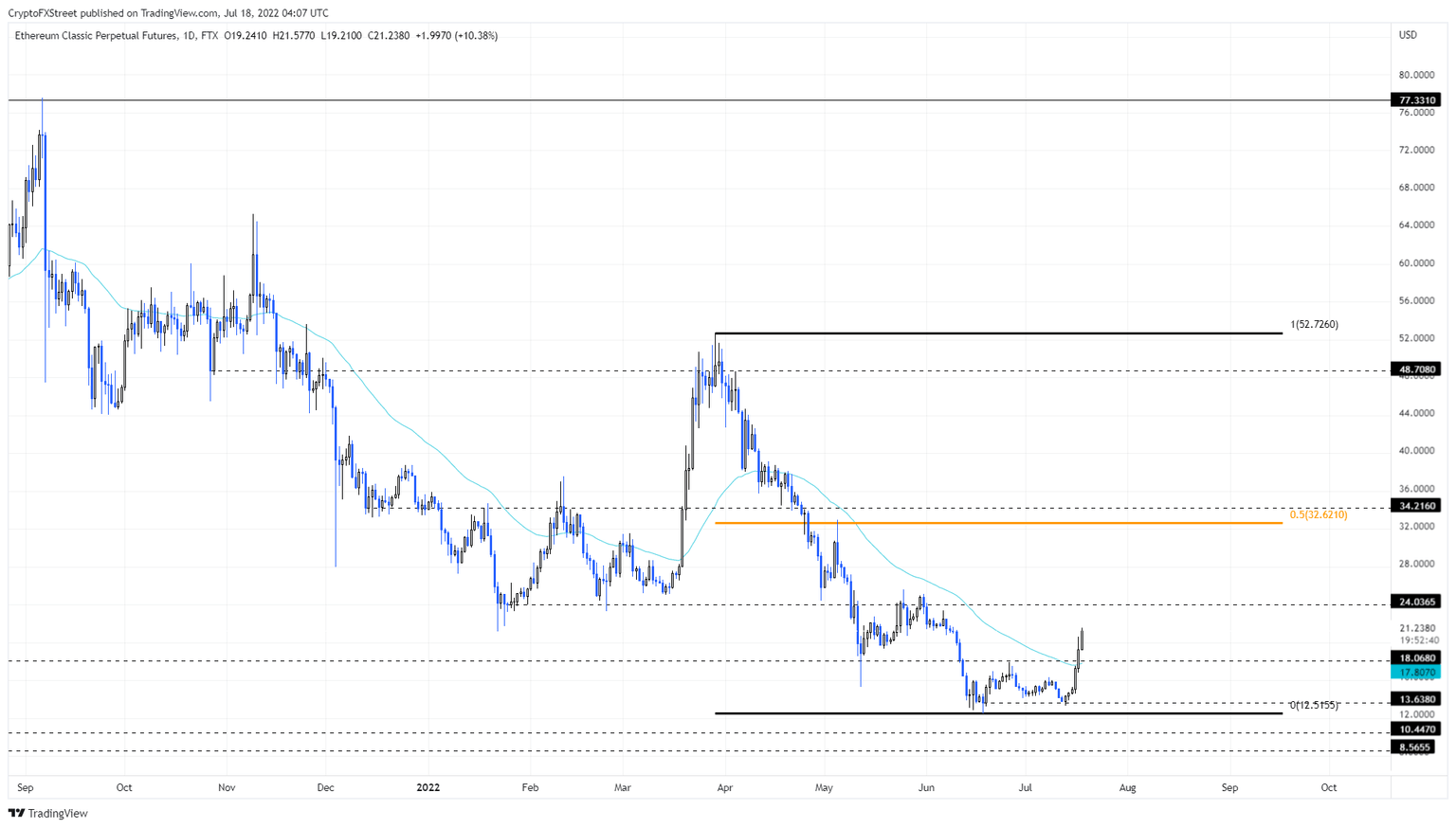

Ethereum Classic price set a range, extending from $52.72 to $12.51 as it crashed 75% between March 29 and June 17. After creating a higher low on July 13 at $13.33, ETC triggered a 61% upswing.

As Ethereum Classic price trades around $21.29, investors can expect a further bump due to the breach of the 50-day Exponential Moving Average (EMA). Going forward, market participants can expect ETC to retest the midpoint of the range at $32.62.

This run-up would constitute a 54% gain and is likely where a local top would form. On the other hand, a flip of this level into a support floor would accommodate more gains. Such a development would likely open the path for a retest of the range high at $52.72, with potential pit stops at $34.21 and $48.70.

ETC/USDT 1-day chart

While things are looking extremely bullish for Ethereum Classic price, investors need to note that the range low at $12.51 has never been swept. Therefore the liquidity resting below this level could be the reason for market makers to tank the market.

In a bearish case, if ETC produces a daily candlestick close that flips the range low at $12.51 into a resistance barrier, it will invalidate the bullish thesis.

In this situation, Ethereum Classic price could revisit the $10.44 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.