- Binance CEO Changpeng Zhao has stepped down after pleading guilty.

- Coinbase executive says Binance exchange could pay its $4.3 billion fine without any crypto asset sales.

- In an earlier report, a portfolio manager had predicted spot Bitcoin ETF approvals once Binance is dethroned.

- Binance coin is down 8%, breaking out of the ascending parallel channel with prospects for an extended slump.

Bitcoin (BTC) exchange-traded funds (ETFs) come to mind once again after striking news that Binance CEO Changpeng Zhao (CZ) has pled guilty and agreed to step down. The crypto exchange, the largest in the world by trading volume, will be paying up to $4.3 billion in settlement fees as the US Department of Justice (DoJ) looks to resolve the case.

Bitcoin spot ETF now has leeway for approval after Binance capitulation

Bitcoin (BTC) spot ETFs might now have space for approval after Binance CEO CZ capitulated to the DoJ’s charges of money laundering, bank fraud, and sanctions violations among other charges. The exchange will be expected to pay up to $4.3 billion in settlement fees.

The news comes after Travis Kling, a former equities portfolio manager, said, “There is no chance, and I mean zero, that this [BlackRock] ETF is approved with Binance in its current position of market dominance.”

Lots of chatter on this Blackrock #Bitcoin ETF. And rightfully so. Blackrock more or less IS is the US government. They’ve also received approval on 575/576 of ETF applications.

— Travis Kling (@Travis_Kling) June 16, 2023

One thing I’ll say- there is no chance, and I mean zero, that this ETF is approved with Binance in…

According to Kling, the approval of an ETF would mean Binance is either gone entirely or their role in price discovery is massively diminished. Now that the exchange’s top executive has capitulated to the US government, there might be room for the Securities & Exchange Commission (SEC) to begin approving spot BTC ETFs.

Meanwhile, investors are fielding client inquiries as SEC eyes approval, with a Bloomberg report touting an ETF as “crypto’s big breakthrough on Wall Street.” If approved, it would “kick open digital-currency investing to the institutional and retail masses.”

With big institutional players such as BlackRock, Fidelity and Invesco, among others, in the mix, the spot-Bitcoin ETF market has the potential to grow into a $100 billion crusade in time, according to Bloomberg Intelligence estimates.

Notably, there are two months to go before the SEC faces another set of deadlines. The financial regulator will have to decide on multiple applications for spot bitcoin ETFs, with analysts speculating on how approval of such vehicles would impact the crypto industry.

Recently, reports revealed that the SEC was already engaging with exchanges to have the ETFs do cash creates as opposed to in-kind crypto. This is on the grounds that broker-dealers cannot deal in Bitcoin, unlike exchanges. But if the ETFs do cash creates, the broker-dealers – who are essentially the institutional players tabling their spot BTC ETF applications to the SEC – would take the initiative to transact in BTC.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Binance exchange could pay the $4.3 billion fine without any crypto asset sales

At the same time, Conor Grogan, director of product strategy and business operations at Coinbase, says Binance exchange could pay the $4.3 billion fine without any crypto asset sales.

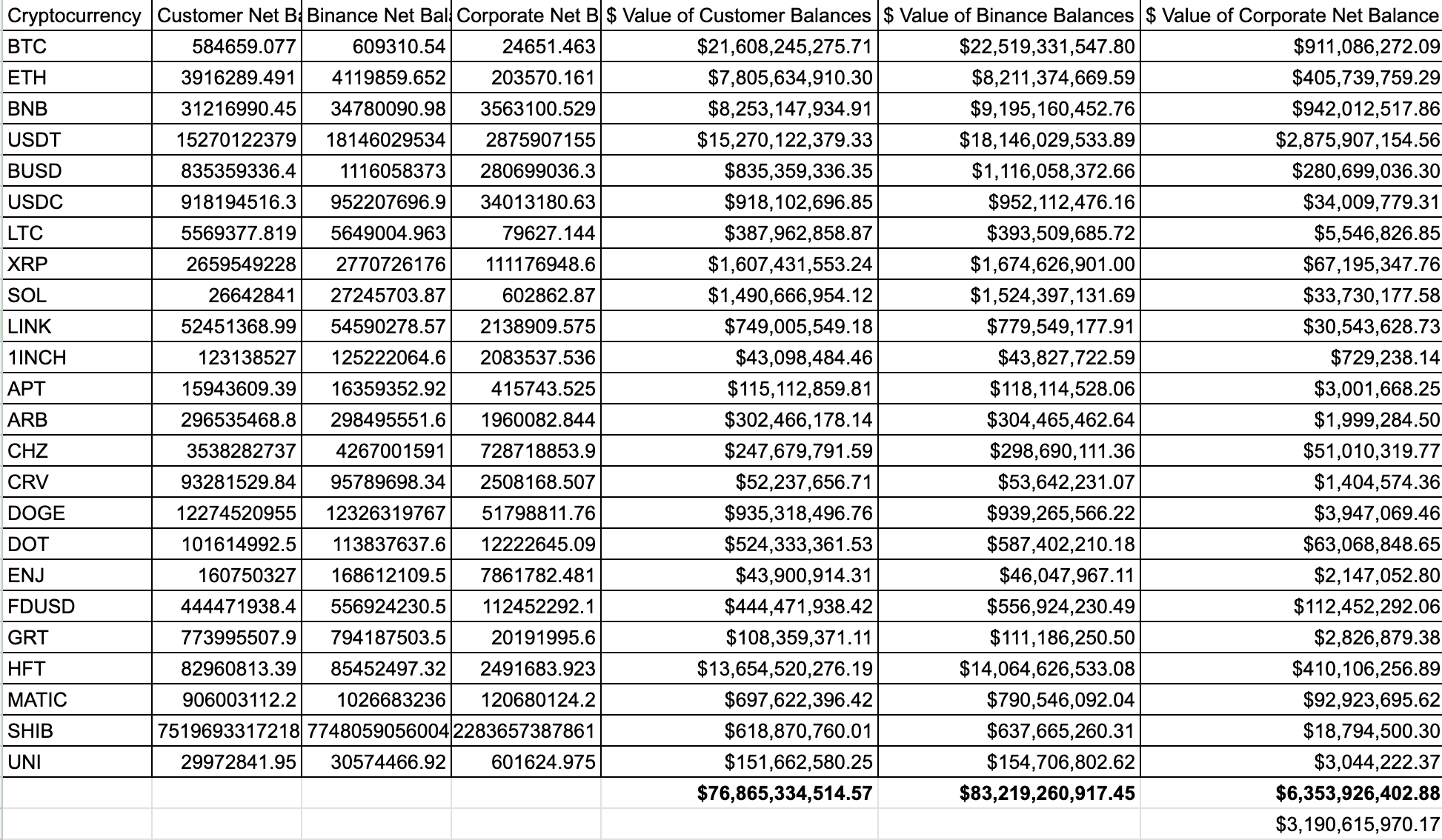

Binance Corporate's crypto holdings

His analysis comes after working out Binance Corporate's crypto holdings from their Proof of Reserves (PoR), where he established that the exchange had $6.35 billion in total assets, with $3.19 billion in stablecoins. Notably, the numbers do not include off-chain cash balances or funds held in wallets not included in PoR.

Nevertheless, Grogan appreciates that considering the charges levied against CZ, it may be prudent to take the exchange’s self-reported PoR with a pinch of salt, because we actually do not know which assets belong to users and which ones are corporately owned.

Seems weird to take their self reported PoR at face value when the CEO is in cuffs for money laundering though... we actually don't know which assets are users vs corporate.

— Adam Cochran (adamscochran.eth) (@adamscochran) November 21, 2023

The news of CZ stepping down and admitting to the charges has sent Binance Coin crashing, down almost 10% within an hour. At the time of writing, BNB is trading for $236.70.

BNB/USDT 1-day chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.