With Binance CEO’s support for crypto Bitcoin price rallied 5%, what's next?

- Bitcoin price rallied 5% within an hour following Binance CEO Changpeng Zhao’s announcement to support crypto projects with a recovery fund.

- CZ wants to revive projects hit by a liquidity crisis post FTX-Alameda collapse.

- Analysts predict a short-term recovery in Bitcoin price with more downside from a macro outlook should the current support levels give way.

Binance CEO Changpeng Zhao’s (CZ) announcement of his plan to rescue crypto projects hit by the recent liquidity crisis triggered a recovery in Bitcoin. The largest asset by market capitalization rallied 5% within an hour of CZ’s announcement. Analysts remain bullish on BTC and particularly decentralized exchange tokens and related altcoins and expect a spike in buying pressure in today’s US trading session.

Also read: Bitcoin price bearish macro outlook will not stop BTC bulls from scalping corrective rally

Bitcoin price begins recovery after Binance’s announcement

Bitcoin price yielded 21% losses for holders over the past week following the collapse of FTX exchange and sister trading firm Alameda Research as investor confidence hit rock bottom. BTC crumbled under rising selling pressure from traders lining up to exit the risk asset after FTX’s bankruptcy filing.

Binance CEO Changpeng Zhao announced his plan to put together an “Industry Recovery Fund,” and offer a second chance to projects hit by a liquidity crisis. In response to the news of the announcement, prices of Bitcoin, Ethereum and other altcoins in the top 30 recovered 5% within an hour.

To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon. In the meantime, please contact Binance Labs if you think you qualify. 1/2

— CZ Binance (@cz_binance) November 14, 2022

Bitcoin price rallied from its 24-hour low of $15,906 to a high of $16,580. This move fueled bullish sentiment amongst BTC holders after the recent run of negative headlines.

Bitcoin price could attempt further recovery as CZ unveils a plan to rescue crypto projects.

Traders are betting on Bitcoin price rally

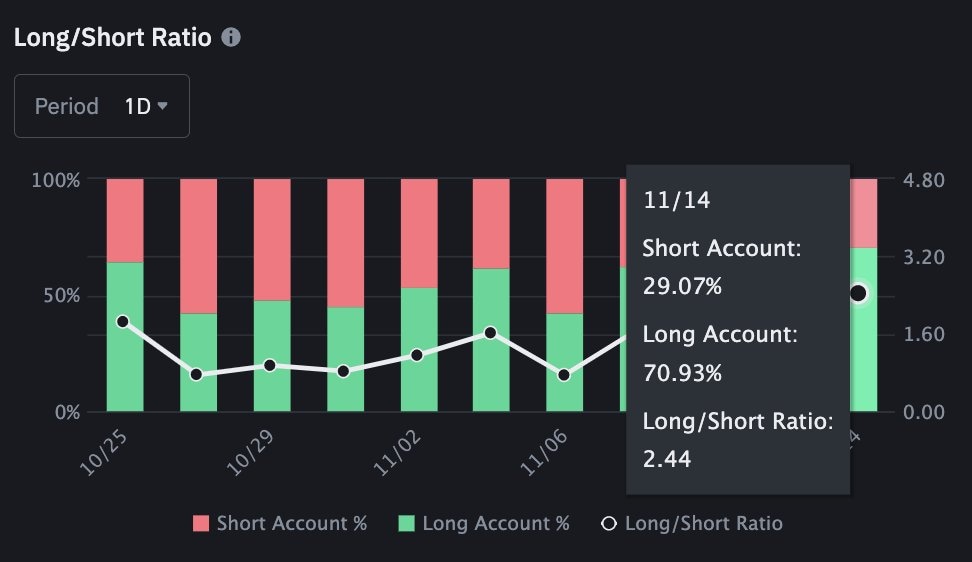

Nearly 71% of all accounts with an open position in Bitcoin on Binance Futures exchange are betting on a BTC price rally. This is an affirmation of the fresh bullish sentiment among traders as Binance paves the road for crypto recovery.

Binance Futures long/short ratio

After its lowest weekly close in two years, Bitcoin price is ready for a recovery. Elon Musk, CEO of Tesla tweeted that

Bitcoin will make it, but it might be a long winter.

Bullish affirmation from the self-proclaimed Dogefather and crypto proponent Musk and a plan for recovery from Binance CEO CZ have lent a bullish start to the week before the New York trading session opens.

RektCapital, crypto analyst and trader argues Bitcoin price is currently down 75% from its all-time high. In previous bear markets, the retracement has averaged around 84.5%. Thus, by historical standards there isn’t much downside left to go, and Bitcoin price could therefore begin its steady climb in the short-term.

Historical average of previous #BTC Bear Market retracements is -84.5%$BTC is currently down around -75%

— Rekt Capital (@rektcapital) November 13, 2022

By standards of history, there isn’t too much more downside left#Crypto #Bitcoin

Bitcoin price could retest $17,251

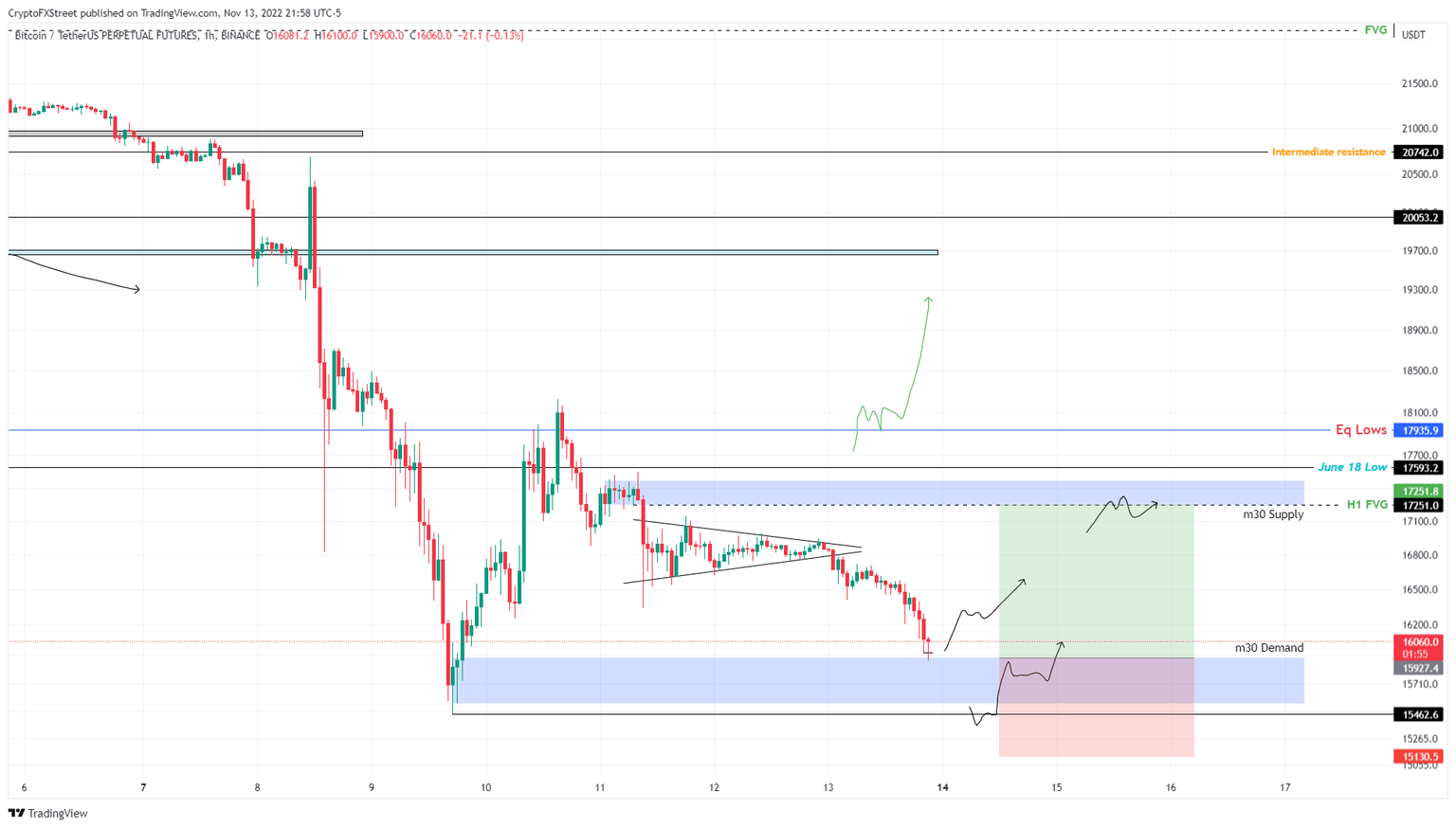

Akash Girimath, technical analyst at FXStreet evaluated the BTC/USDT perpetual futures chart and argued that Bitcoin price could witness an 8% upswing and retest the inefficiency known as the Fair Value Gap (FVG) at $17,251.

BTCUSDT perpetual futures chart

If Bitcoin price manages to flip the hurdle at $17,593, it would invalidate the bearish bias and extend its gains from $17,251 to $19,500.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.