With 96% of the investors suffering losses, Algorand price might need more than new 2023 highs

- Algorand price is currently trading at a four-month low even as many other altcoins have charted year-to-date highs.

- About 96% of all ALGO holders bought their supply out of FOMO around September 2021 highs of $2.4.

- Over time a lot of these investors moved their supply around, which is, at the moment, in the hands of mid-term holders.

Algorand price has seen lesser growth over time, and while most of the market is recording recovery, this altcoin is lingering at the lows of its current trading price. The problem here is not just a lack of growth but also a lack of support from the investors, who cannot be blamed for their nominal conviction given their current conditions.

Algorand price needs a miracle rally

Algorand price trading at $0.18 is at a near four-month low. Usually, this bearishness is offset by the cryptocurrency's investors' bullishness, but this will not be the case with ALGO. The reason behind this is that ALGO holders have no incentive to act bullish at the moment. And it is not just a certain chunk that is bearish, it is over 96% of the investors.

ALGO/USD 1-day chart

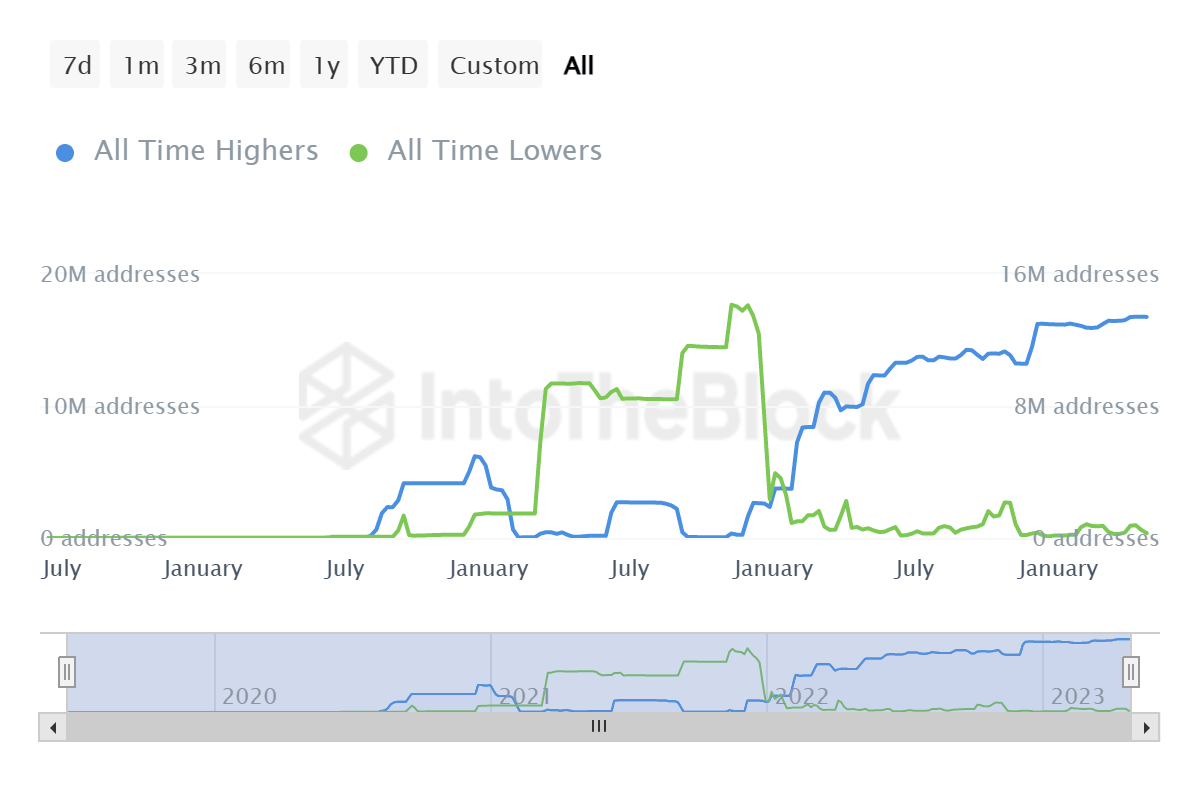

Most of the holders bought their supply around the 20% range of the altcoin's all-time high of $2.38 in September 2021. These investors are known as all-time highers, and all of them have amassed their stash at prices above $1.89. Generally, this cohort represents a small part of all the investors, but in the case of Algorand, it is the other way around as 16.75 million addresses or 96% of all the investors are all-time higher.

Algorand all-time highers

With Algorand price at the present price levels, all these investors are currently underwater and for their supply to turn profitable again, the altcoin would need to chart a rally between 870% to 1000%. Since the possibility of this happening is highly unlikely, it seems like the only option for these investors is to either HODL or dump their stash.

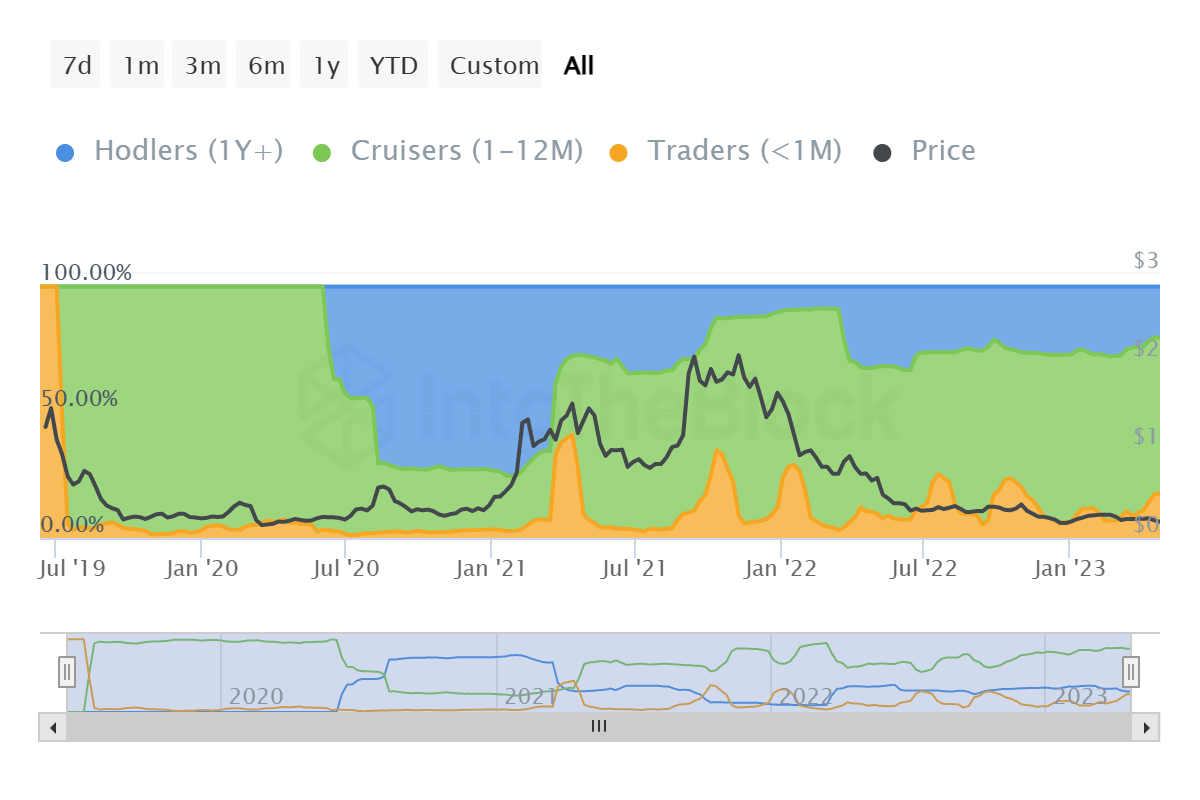

By the looks of it, this might have happened as balance upon being categorized by time shows that most of the ALGO supply is in the hands of mid-term holders. These mid-term holders, also known as "Cruisers", are the addresses that have held their supply for a time period between 1 month and 12 months.

About 67% of all ALGO has been held for this time period, and only 20% of the supply has remained unmoved for more than a year, classified as "Hodlers". This makes Cruisers potentially detrimental as mass selling at their hands could trigger a further decline in Algorand price. Since this supply lacks the conviction of long-term holders, even a nominal fall in prices could lead to panic selling.

Algorand supply by time held

The only way to counter this situation is by Algorand price miraculously marking gains and climbing back to aforementioned targets, as even a new year-to-date high will not be able to do much for the cryptocurrency.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.