Will Uniswap V3 save Binance Coin price from a brutal 20% crash?

- Uniswap protocol’s proposal to deploy Uniswap V3 on Binance Chain has reached 40 million UNI with 58.45% votes in favor.

- A16z, an investor in LayerZero, used its full voting rights, 15 million UNI, to quash the launch on the BNB chain and oppose the use of Wormhole.

- BNB price is on track to nosedive 20% to the support zone between $257 and $229.5.

A proposal to deploy Uniswap V3 on the BNB chain has ignited a battle in the crypto community. A California-based venture capital firm, Andreesen Horowitz, known as a16z, has used its full weight and deployed 15 million UNI to vote against the proposal to deploy Uniswap V3 on BNB Chain.

Influencers in the crypto community identified that the proposal uses Wormhole as a cross-chain bridge while a16z is a leading investor in competitor LayerZero.

Also read: Is there more upside to Dogecoin-killer Shiba Inu’s rally after 100% gain in 90 days?

Uniswap V3 proposal to deploy on Binance Chain faces stern opposition from a16z

A proposal for DeFi protocol Uniswap V3’s deployment on Binance Chain is facing opposition from a16z, aka Andreessen Horowitz. The venture capital (VC) firm threw in 15 million UNI to oppose Uniswap V3’s deployment on the BNB Chain, proposed by 0xPlasma Labs.

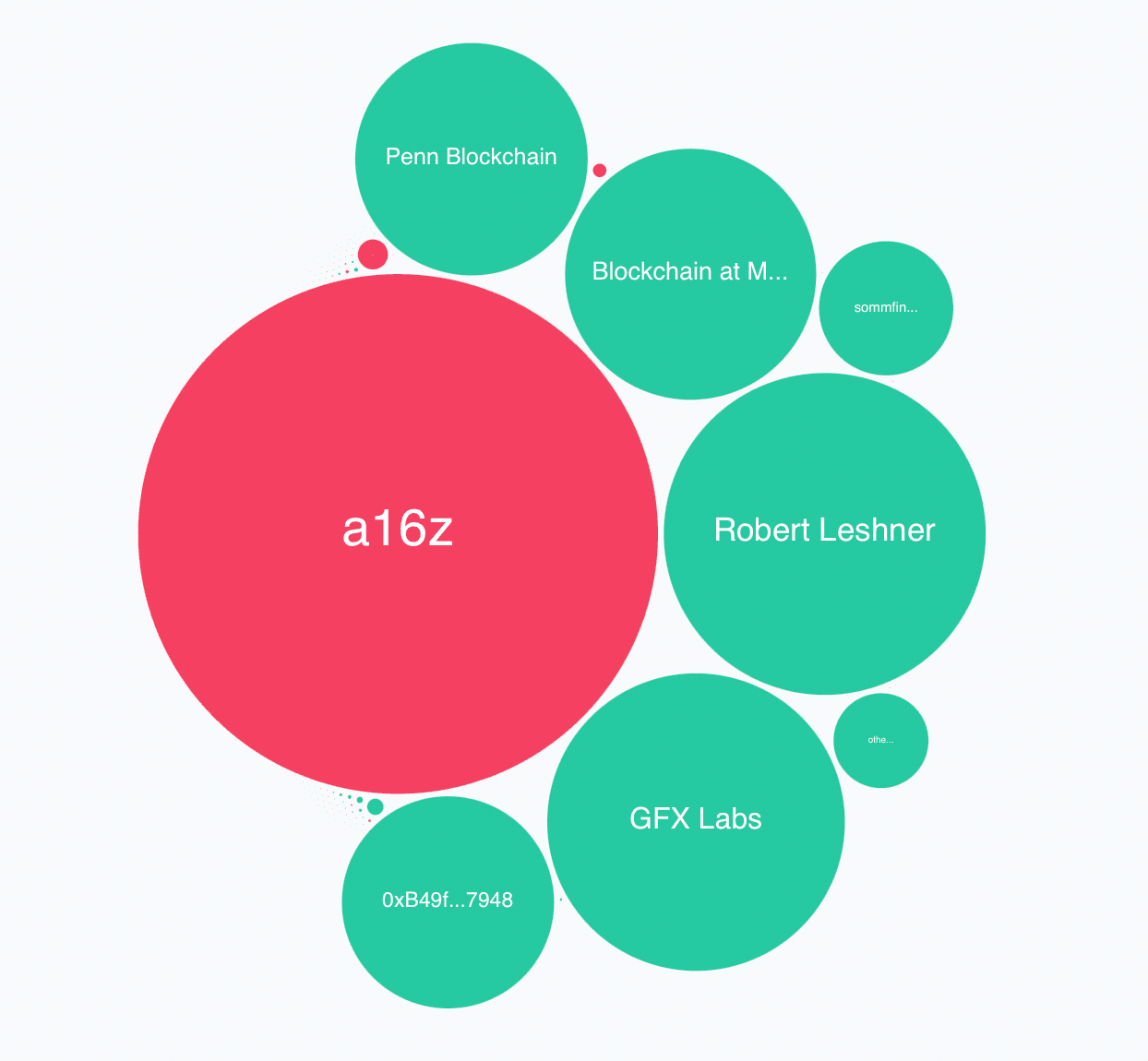

Voting on proposal to deploy Uniswap V3 on BNB Chain

The proposal uses Wormhole as a cross-chain bridge, while a16z is a backer of LayerZero, a competitor to Wormhole. As of now, Wormhole appears to be the choice in the community, however this may not be the final choice.

There is a behind-the-scenes battle going on between deep-pocketed VCs that could swing the vote on which cross-chain bridge will be used for Uniswap V3’s deployment on BNB Chain. Changpeng Zhao shared the details of a16z influence on Uniswap V3’s latest proposal with 8.1 million crypto followers.

Uniswap controlled by a16z? https://t.co/9QTi1KjVjG

— CZ Binance (@cz_binance) February 5, 2023

A community temperature check vote swung in favor of Wormhole, however this isn’t technically final and the official vote to approve the bridge between Ethereum and BNB chain is yet to come. The outcome could potentially swing in a different direction with hundreds of millions of Dollars at stake.

A16z and Jump are the two venture capital firms that back LayerZero and Wormhole respectively. A source close to the matter revealed that a16z's 15 million voting tokens could not participate in the temperature check due to the custodial set-up of its tokens.

Eddy Lazzarin, an investing partner at a16z commented on a forum post and asked the community to count them in favor of LayerZero, in the temperature check. Wormhole won the temperature check vote by approximately 11 million token votes.

Binance Coin is at risk of 20% drop to support zone

While the community votes for or against Uniswap V3’s deployment on BNB Chain, Binance’s native token BNB is at risk of a 20% drop. In the last two weeks of December, Binance Coin price ranged between $257 and $229.50, the support zone for the exchange’s native token.

As seen in the chart below, the Relative Strength Index (RSI) for Binance reads 45.41, and it is below the neutral zone. RSI shows that BNB’s recent uptrend lacks underlying strength. There is a likelihood of a 20% decline to the support zone at $257.

BNB/USDT price chart

BNB price has support at the 23.6% and 50% Fibonacci retracement levels of $310 and $278.9 respectively. BNB price could bounce back from the support zone and begin its recovery in the event of a decline.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.