Will the CPI announcement be a bullish event for Ethereum price?

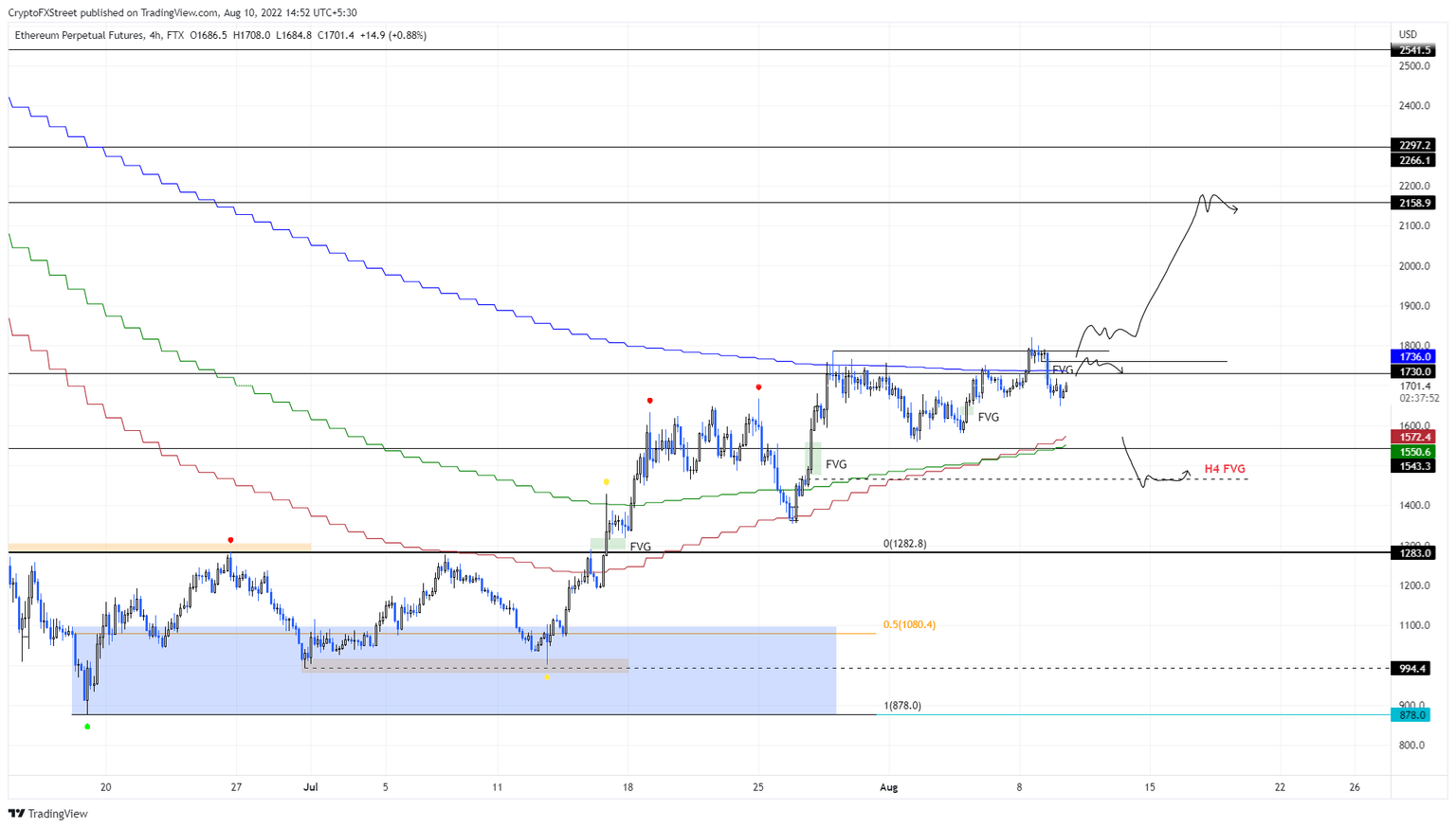

- Ethereum price remains steady around the $1,700 level, trying to establish a directional bias.

- Although a downward move seems likely for ETH, the CPI announcement could propel ETH to $2,100.

- Investors need to be prepared for another leg down in case the announcement fails to prop up the crypto markets.

Ethereum price is facing issues trying to establish its directional bias after taking a massive loss recently. However, the US Consumer Price Index (CPI) announcement is likely to induce a massive amount of volatility in the market, so market participants need to exercise caution.

Ethereum price follows BTC into the ground

Ethereum price has promptly followed Bitcoin price and crashed roughly 9.4% over the last 24 hours. Due to the high correlation with BTC, ETH will take a cue from the big crypto regardless of the bullish development, aka Merge, set to happen on September 19.

As ETH hovers around $1,700, the bulls are planning a recovery and are eyeing a retest of the $1,761 level. investors need to note that there is a ton of liquidity resting to the downside, which is still uncollected.

Hence, technically, a downward move seems likely for ETH. Therefore, investors should be prepared for an eventual move to $1,466. However, this correction could prematurely halt at $1,550 due to the confluence of the 30-day and 50-day Exponential Moving Averages.

ETH/USDT 4-hour chart

Inflation data and its effect on ETH price action

While a downside move seems obvious, market participants need to be prepared for a highly volatile environment as the US Consumer Price Index (CPI) announcement will be announced today at 8:30 A.M. Eastern Time.

The actual CPI print has exceeded expectations over the last two announcements on June 10 and July 13. This time, the forecasted CPI is at 9.1%, which is unchanged from the last report.

CPI data

An interesting observation was that the July 13 CPI data caused the crypto markets to crash temporarily and then violently rip higher, triggering a massive altcoin bull run. If the data exceeds expectations again, then the Federal Reserve is most likely going to continue its quantitative tightening by increasing interest rates.

While this development is necessarily bad for the traditional markets and US citizens, crypto markets seem to pump during such events.

Although this might seem counterintuitive, if history repeats, investors should be prepared for a recovery above the $1,730 resistance level and a further rally to the $2,000 psychological level or the $2,158 resistance level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.