Will Tezos price sustain its Google-induced rally and hit the $1.75 target?

- Tezos price climbed 13% overnight, XTZ is battling resistance at $1.50.

- The open-source blockchain token is in a short-term uptrend, targeting the $1.75 level.

- Google Cloud partnered with Tezos, joining the XTZ network as a validator and securing its blockchain.

Tezos, the native token for an open-source blockchain that executes peer-to-peer transactions has witnessed a massive spike in its price with Google Cloud’s partnership announcement. Tezos (XTZ) price yielded 13.4% gains since February 22 and continued its short-term uptrend, targeting $1.75.

Also read: What do institutional giants know about GMX: Do Amber Group and Arca expect a 20% rally?

Tezos price rallied in response to Google Cloud’s partnership announcement

Tezos, an open-source blockchain that executes peer-to-peer transactions got a massive boost from its partnership with Google Cloud. The technology giant has joined Tezos as a “baker,” a validator that helps set up nodes for verifying transactions on the XTZ network and securing it using Google Cloud.

Google Cloud has partnered with Aptos and Solana in a similar manner, joining these networks as a block-producing validator.

Tezos price climbed to $1.44, gearing up to tackle key resistance at $1.50, in response to Google’s partnership news.

XTZ/USDT Perpetual Contracts 4H chart

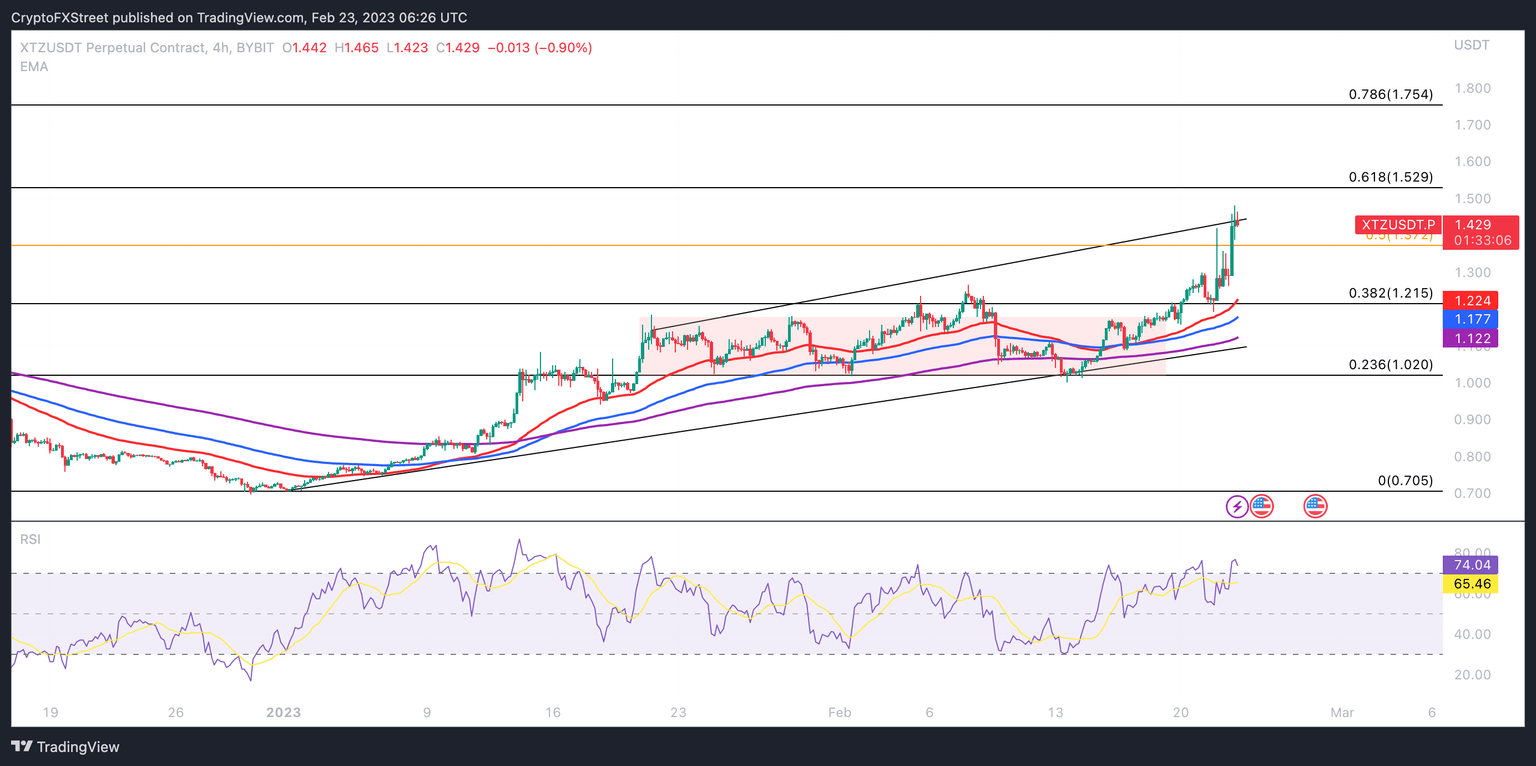

As seen in the chart above, XTZ price is currently in a short-term uptrend. On the 12H price chart, Tezos is in a downtrend. There is a significant support zone between $1.017 and $1.177 where XTZ spent nearly 30 days, from mid-January to February. Since the announcement of Google Cloud’s partnership, XTZ resumed its short-term uptrend, climbing to higher highs, close to the 61.8% Fibonacci Retracement at $1.529.

If bulls push XTZ to the 61.8% Fib retracement target, a run up to 78.6% at $1.754 is likely. On the 12H price chart, Relative Strength Indicator (RSI), a momentum indicator reveals a bearish divergence. While XTZ price is forming higher highs, RSI is forming lower highs between January 16 and mid-February 2023.

Bearish divergence in RSI signals a lack of underlying strength in the current uptrend. If XTZ price drops below 50% Fibonacci Retracement at $1.372, it could plummet to the support zone between $1.017 and $1.117, where it spent nearly 30 days.

If XTZ fails to sustain above the $1.300 level, it would invalidate the bullish thesis for the native token of Tezos protocol.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.