Will Terra Luna Classic price outperform Dogecoin and Shiba Inu?

- LUNC burn mechanism has been adopted by top exchanges like Binance, so far the platform has destroyed about 12.5 billion Luna Classic tokens.

- Despite the new burn tax and reduction in supply of LUNC, it is currently outperformed by most altcoins and meme coins like Dogecoin and Shiba Inu.

- Analysts believe LUNC price could witness a trend reversal in the short-term.

Luna Classic (LUNC) is being supported by nearly 40 decentralized applications (dApps) and the list keeps growing. The world’s largest exchange by volume announced higher frequency of LUNC burn and analysts believe the asset could soon outperform Dogecoin and Shiba Inu.

Also read: AAVE price: What to expect from Aave with upcoming deployment on zkSync 2.0 testnet

LUNC burn will take place on Binance in December

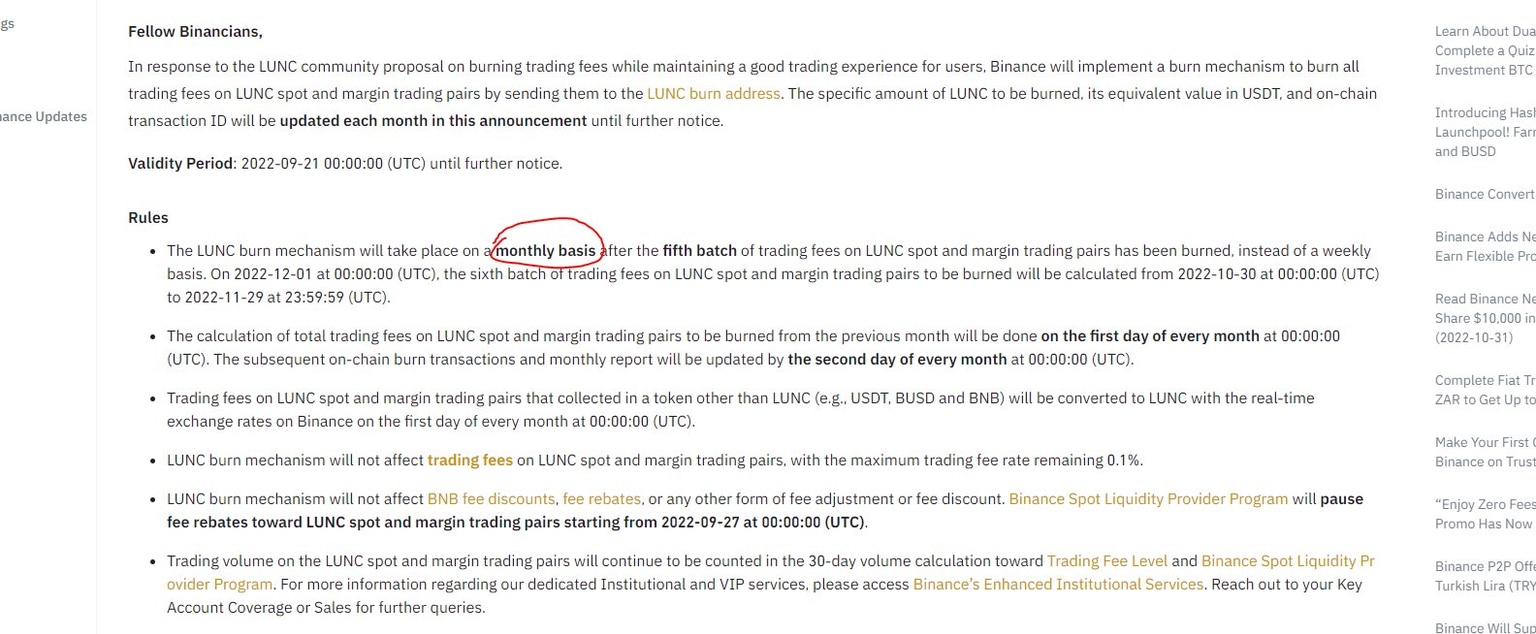

Binance updated its LUNC burn mechanism and announced that after the fifth batch of trading fees on LUNC spot and margin trading pairs has been removed from circulation, this practice will take place monthly instead of weekly. Binance’s last weekly burn destroyed 1.5 billion LUNC.

The next big LUNC reduction in supply will now take place post December 1, 2022. Binance has burned 12.5 billion Luna Classic tokens so far, reducing its supply and permanently pulling them out of circulation. Trading fees collected in USD Tether (USDT), Binance USD (BUSD) and Binance Coin (BNB) is converted to LUNC at the exchange rate ahead of the scheduled burn.

Binance update on LUNC burn mechanism

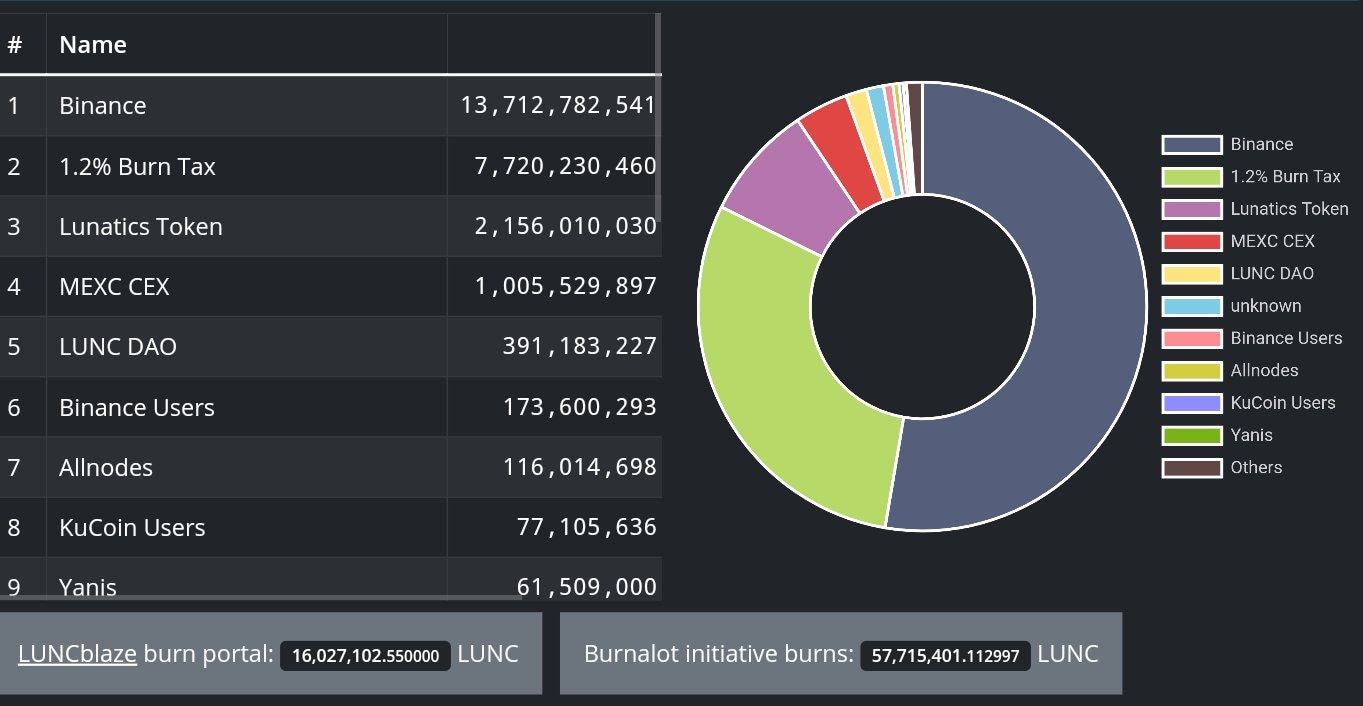

MEXC centralized exchange, LUNC DAO, KuCoin users are the other key entities destroying massive amounts of LUNC. Typically, removing an asset from the circulating supply reduces the selling pressure on it, across exchanges. This is expected to push LUNC price higher, in the long-term as supply dynamics directly influence price.

LUNC burn implementation by different entities

Will Luna Classic outperform Dogecoin and Shiba Inu?

While the burn tax implementation, entities like Binance and other exchanges removed massive volume of LUNC from circulation. This has failed to push LUNC price higher, meme coins like Dogecoin and Shiba Inu are currently outperforming Luna Classic.

Experts have evaluated the Luna Classic price trend and set long-term targets for the asset. Telegaon, a cryptocurrency price prediction website, predicted the minimum and maximum price of LUNC in 2025 will be $0.0089 and $0.028. Technical analysts analyzed the price performance of LUNC and set an average price of $0.015 for the asset.

Sources at Coinpedia, fintech and cryptocurrency news media are not as optimistic about LUNC’s future performance. Coinpedia believes LUNC could hit a high of $0.002846 and a low of $0.001094 in 2025. The asset’s average price would be $0.001776.

Analysts believe bulls can defend Luna Classic price against further drop

Luna Classic is currently exchanging hands at $0.000241 at exchanges and has yielded 4.6% gains for holders over the past week. Analysts at NewsBTC evaluated the LUNC/USDT price chart and argued that a trend reversal in Luna Classic is likely if bulls push the asset above the 21-day EMA at $0.000277.

As long as LUNC price stays above the key level of $0.000277, Luna Classic could yield higher gains for holders and a future relief rally is likely.

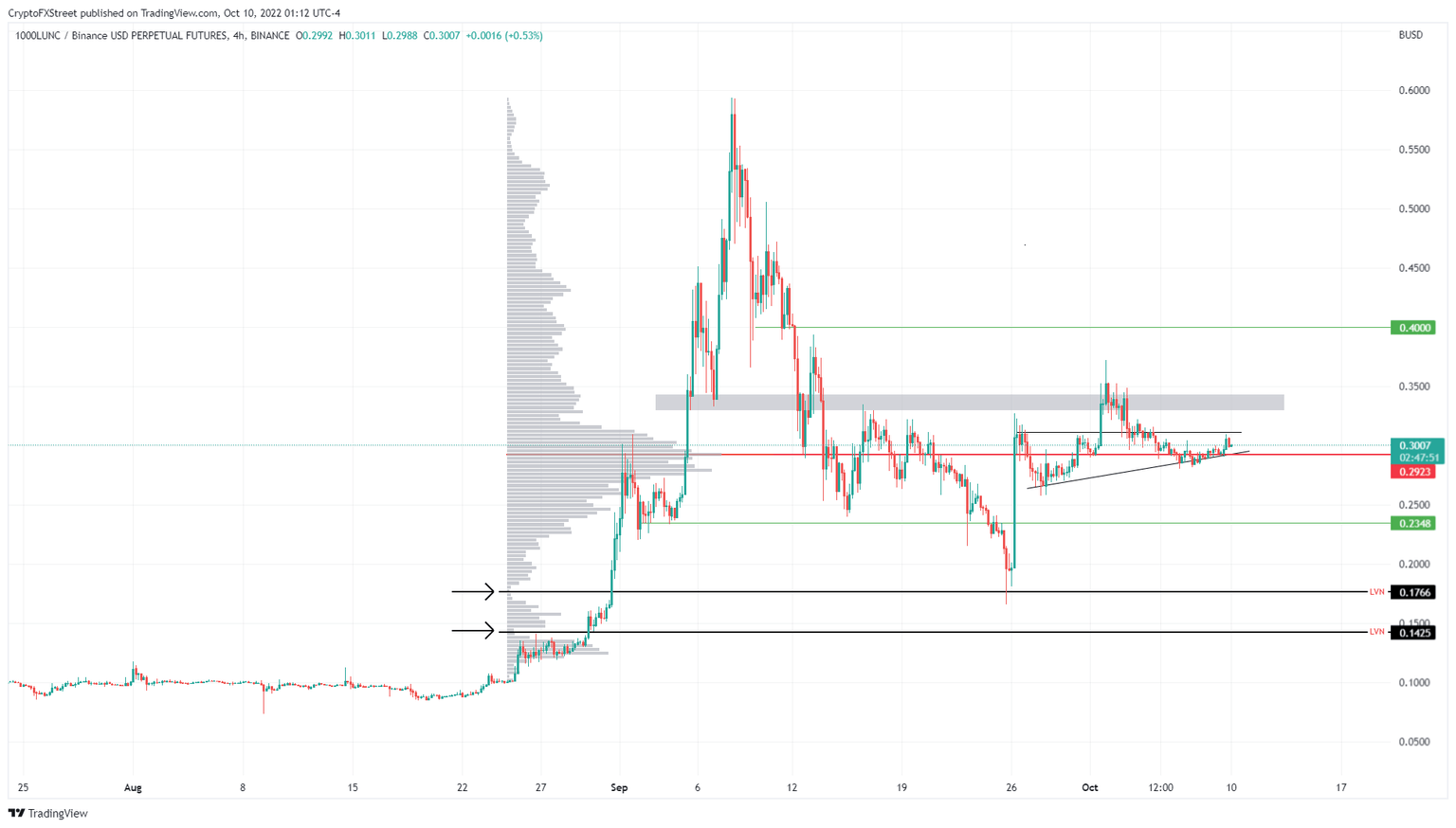

LUNA/USDT price chart

If the bullish thesis is invalidated, Akash Girimath, analyst at FXStreet believes Luna Classic price could bleed 50% and hit the low volume nodes at $0.000176 and $0.000142. Girimath evaluated Luna Classic’s volume profile and noted that the altcoin is hovering above the Point of Control (POC) at $0.000292. This is the highest volume traded level since August 24. Since Luna Classic bulls failed to defend the volume POC, a decline to $0.000234 is likely.

LUNC/BUSD perpetual futures

In the ongoing bear market, as Bitcoin’s dominance wanes, altcoins and meme coins are taking center stage. With a recovery in its price, Luna Classic is therefore likely to yield gains for holders and make a comeback before the end of 2023.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.