Will MATIC price plummet 15% as Arbitrum's ARB token trading goes live?

- Polygon price slightly recovered after the turmoil from overnight events.

- MATIC nearly slid 5% lower on the back of comments from Powell and Yellen.

- Big concerns are creating headwinds for Polygon price, which could tank another 15% lower if sentiment does not change.

Polygon (MATIC) price was a clear proof that global market concerns are and can influence cryptocurrency performances. The nearly 5% drop MATIC underwent when US Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen were speaking is a telling sign that needs to be factored in going forward. With their dire message, the current longer-term recovery rally will take a small dip and search for support with the first focal point nearby at $0.96 or 15% lower.

Polygon prices in the risk premium of another bank collapse

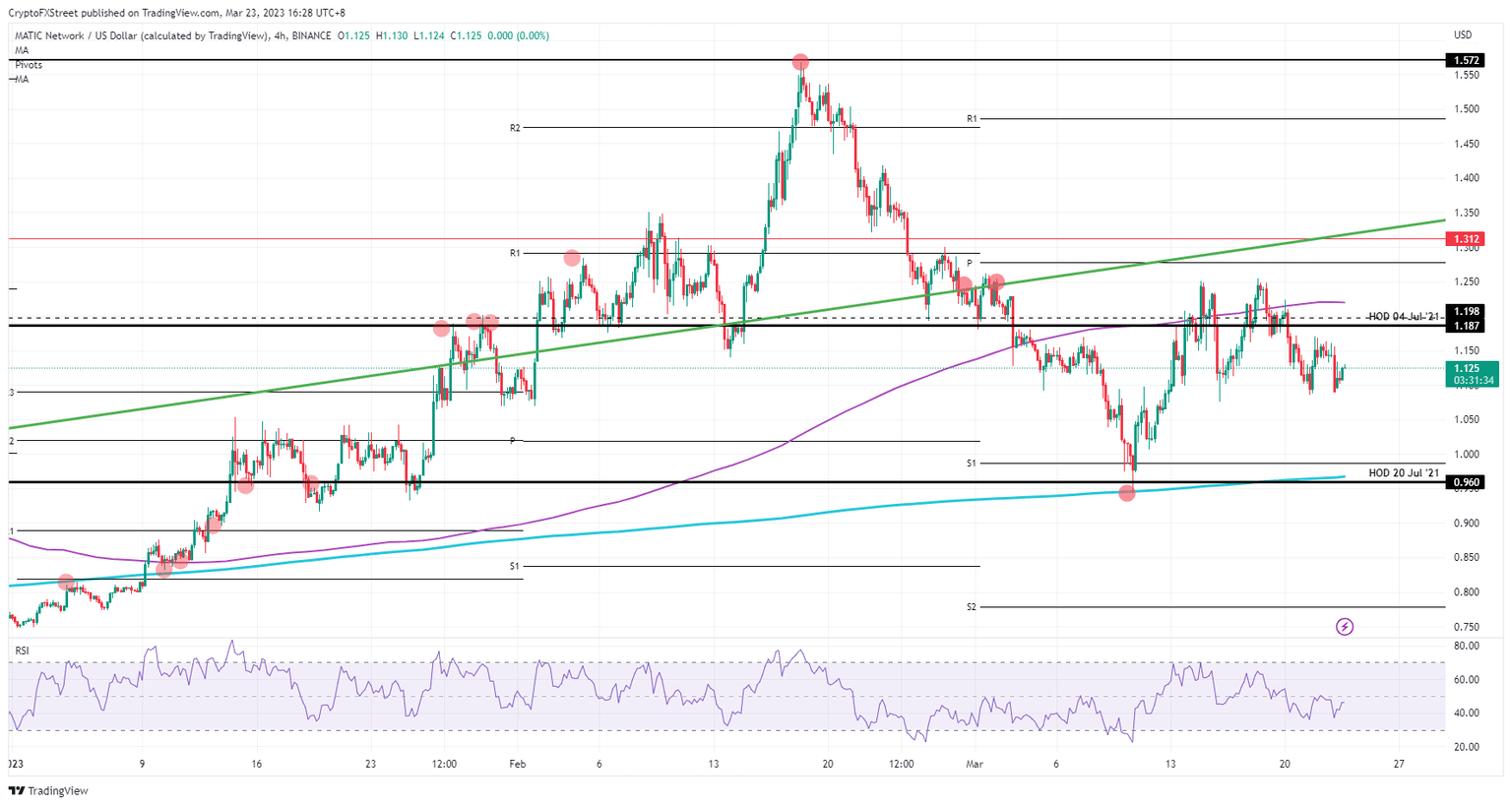

Polygon price sees its recovery rally from March broken as the sentiment has turned since last week. After its peak at $1.25, Polygon bulls have been giving up on holding important levels such as the 55-day Simple Moving Average (SMA), the pivot level at $1.187 and no new highs being printed for this week. A much more telling sign that clearly another bank collapsing or more turmoil means MATIC traders are pricing in a higher risk premium.

MATIC will thus continue its decline in the coming days as this global turmoil takes over from the initial front running that arrived with this year’s Gaming Expo. That event triggered a buying wave in altcoins and cryptocurrencies overall. Expect to see the decline continue toward $1.00 or even $0.96. In that area some support comes in at the S1 monthly support. This is a historical pivot level that coincides with the 200-day SMA, which already caught the drop on March 10.

MATIC/USD 4H-chart

A quick turnaround could be in the cards as active addresses for MATIC have spiked substantially. Whales holding 1 to 10 million tokens have increased from 54 to 60 in an accumulation move just before Abitrum ARB tokens are set to airdrop. Expect to see more inflow as investors are pushing their cash to crypto with Polygon price quickly spiraling higher to $1.31.

MATIC coins holders

MATIC Network Activity

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.

%2520%5B14.08.13%2C%252023%2520Mar%2C%25202023%5D-638151638710941964.png&w=1536&q=95)

%2520%5B14.07.43%2C%252023%2520Mar%2C%25202023%5D-638151639991654054.png&w=1536&q=95)