Will crypto survive if Genesis goes bust, Binance CEO CZ chimes in

- Genesis waits for bailout from potential investors following FTX contagion.

- Binance CEO CZ assures investors that crypto will survive even if Genesis doesn’t.

- Genesis is committed to solving the situation without filing for bankruptcy like the defunct FTX.

- Crypto markets hang on a loose thread as investors take time to absorb the pressure created in the aftermath of the FTX collapse.

Genesis Global Capital, a crypto lender that suffered a great deal due to the FTX contagion, is exploring various ways to prevent an untimely collapse. The Digital Currency Group (DCG) subsidiary confirmed hiring Moelis & Co. to protect investors days after suspending withdrawals.

Genesis eyes potential investors as the FTX debacle bites

Derar Islim, the acting CEO of Genesis, told investors that they have “begun discussions with potential investors and our largest creditors and borrowers, including Gemini and DCG.” The troubled crypto lender hopes to “expand conversations in the coming days” by hiring Moelis.

Genesis found itself falling like a deadweight in the air due to its exposure to the defunct FTX. Over the last three weeks, the company scrambled to secure investors to raise fresh capital. About $175 million from its derivatives unit can no longer be accessed – it’s locked in a trading account at FTX.

Meanwhile, hope appears to be on the horizon with DCG, Genesis’s parent company, injecting an additional $140 million to strengthen its balance sheet. Although withdrawals and new loan applications remain suspended, Barry Silbert, the CEO of DCG, said that other services like the trading arm and custody unit are still in operation.

Binance CEO believes crypto is stronger than Genesis and FTX

Binance CEO Changpeng Zhao (CZ), while speaking on Bloomberg TV Thursday, reckoned that the exchange should have acted sooner regarding the FTX saga that led to the collapse of a $32 billion crypto empire. Now the question is, did CZ know beforehand?

The CEO of the largest exchange by daily trading volume chimed in on the Genesis situation, saying that his team is engaged in talks to see how a bust can be avoided. CZ also assured investors that the crypto industry would stand strong even if something undesirable happened to Genesis.

Binance will provide details of the industry recovery fund later on Thursday. This information will be published on the Binance blog site. CZ announced the creation of a fund to help struggling businesses affected by exposure to FTX earlier this month.

Crypto markets hang on a loose thread as FTX contagion spreads

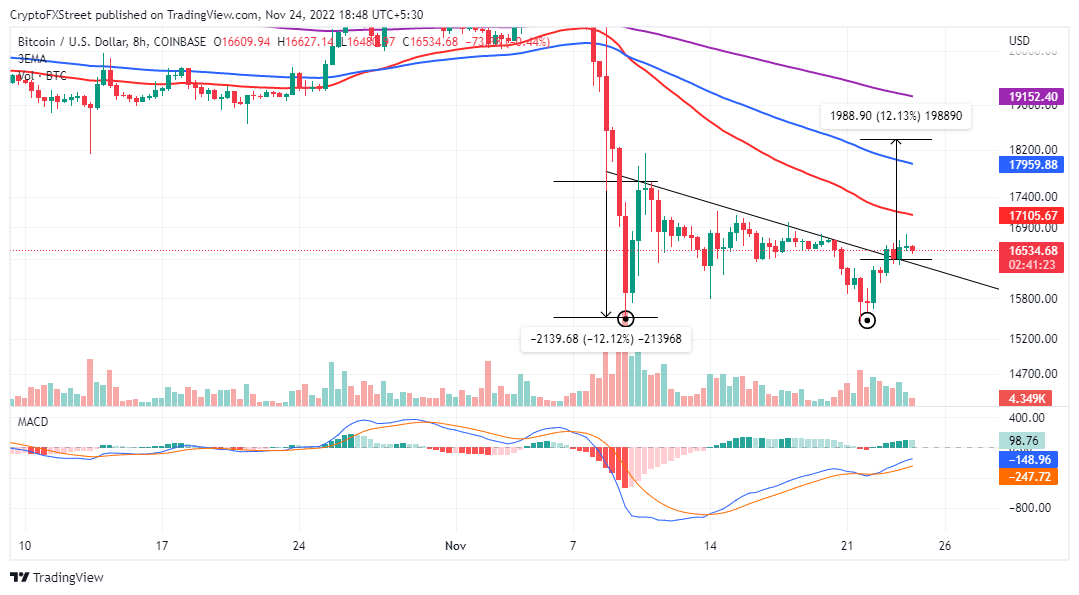

Cryptocurrencies enjoyed a midweek relief recovery on Wednesday day that saw Bitcoin almost close the gap to $17,000 from support at $15,484. The largest cryptocurrency also broke out of a double-bottom pattern with a 12.12% target of $18,386.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator confirmed the bullish outlook in Bitcoin price. However, the increasing overhead pressure stifled BTC’s northbound move.

BTC/USD eight-hour chart

Support at $16,500 must be defended at all costs to allow bulls another chance to battle their way to $18,386. Buy orders will have to wait until Bitcoin prints another green candle above the pattern’s neckline. Bitcoin price could gain momentum if the MACD crosses into the positive region – above the mean line (0.00) – since this will provide a buy signal.

An eight-hour candlestick close below the double-bottom pattern’s neckline at $16,397, however, could open the door to more declines, making short positions profitable toward support targeted at $15,484.

Bitcoin price could fall below $15,000 in the coming days

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren