Will crypto catch up with the rising S&P 500 after record levels of FUD?

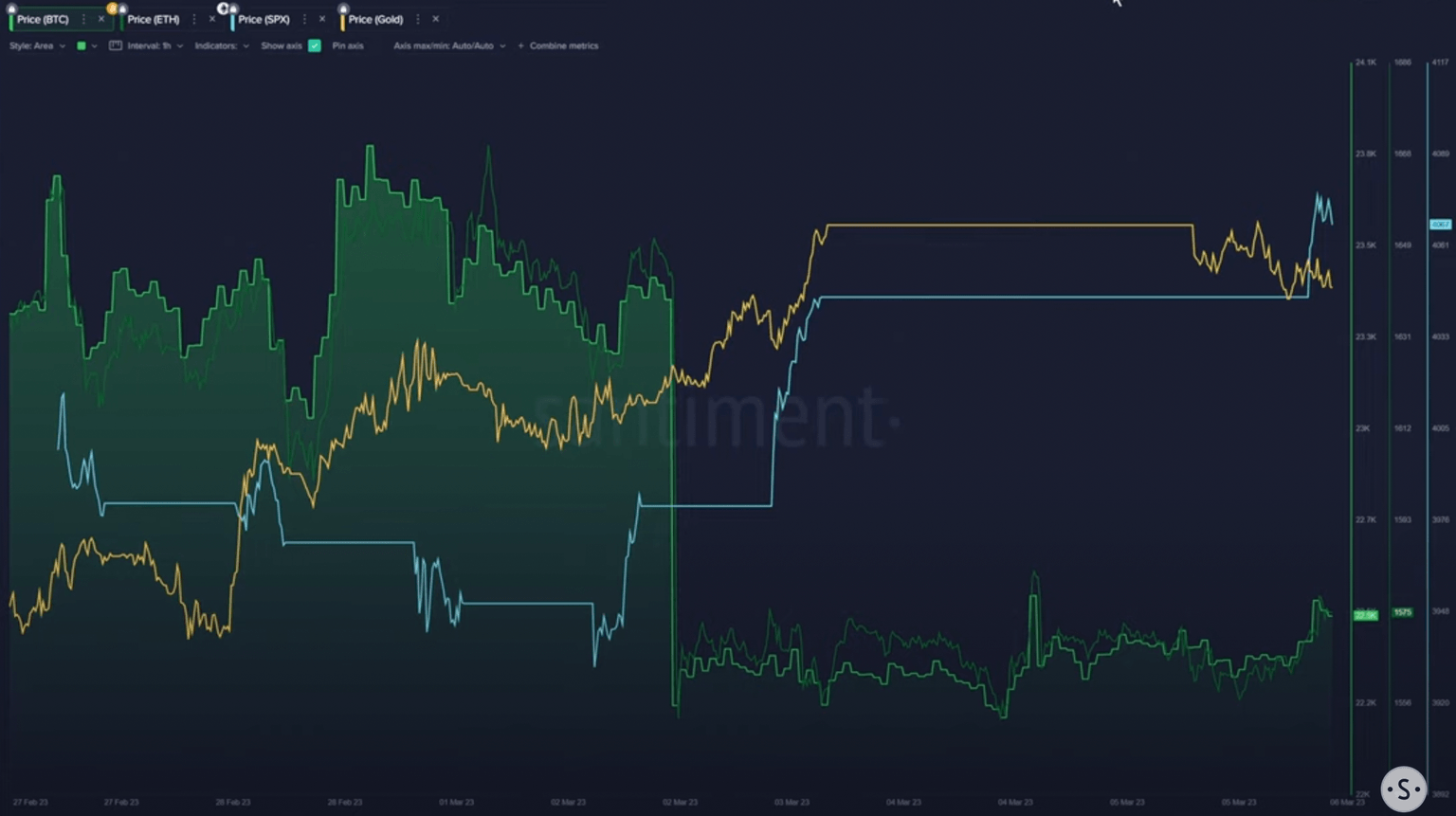

- Bitcoin and Ethereum price recovery is lagging behind the spike in S&P 500, following the Silvergate FUD.

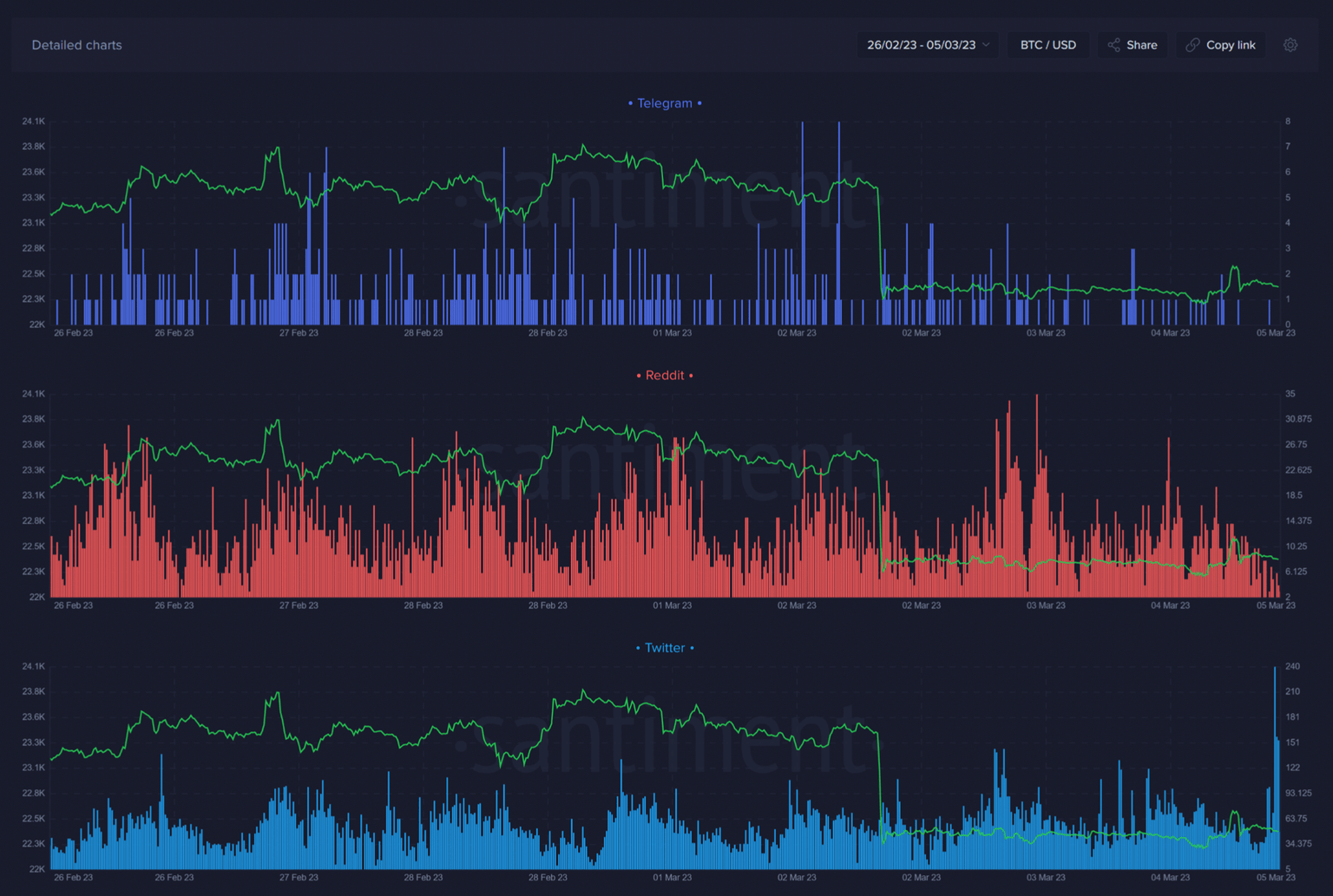

- Analysts measured record levels of crypto fear and doubt on Twitter, with a huge spike in bearish sentiment.

- As US financial regulators toughen their stance on crypto firms, crypto gears up for a volatility-filled week.

Bitcoin and Ethereum prices witnessed a decline on March 5, in response to the uncertainty surrounding Silvergate bank and its announcement of investigations by US financial regulators. Since March 5, the S&P 500 have recovered, soaring higher as sentiment among market participants turned bullish.

In the case of crypto, the sentiment is largely bearish, on Twitter and social media platforms. It remains to be seen whether Bitcoin, Ethereum and cryptocurrencies will continue to lag or catch up with the S&P 500.

Crypto lags behind the S&P 500 as US equities traders turn bullish

Cryptocurrencies with large market capitalization, Bitcoin and Ethereum are struggling to recover from the recent decline on March 5. S&P 500 and US equities climbed higher as the sentiment among investors turned bullish.

S&P 500 climbs higher while Bitcoin and Ethereum struggle to recover

In a recent YouTube video, experts from Santiment argued that the Fear, Uncertainty and Doubt (FUD) among traders after crypto clients dropped Silvergate Bank and US financial regulator’s tightening stance on cryptocurrency regulation are fueling a bearish sentiment among market participants.

Crypto intelligence tracker Santiment noted high levels of negative crypto sentiment, one of the highest levels of FUD ever recorded by the Santiment Feed.

Sentiment among traders turned negative

Experts believe traders can capitalize on this level of negativity on the markets, and overwhelmingly bearish sentiment typically leads to a bounce. According to analysts, the negative sentiment can be explained by the current events and the Securities and Exchange Commission’s critical stance on cryptocurrencies and crypto firms.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.