Will Cardano network activity by ADA whales fuel a price rally in the Ethereum-killer?

- Cardano transactions exceeding $100,000 on the ADA network are on the rise, signaling a spike in interest from whales and institutional investors.

- Cardano developers announced that the Ethereum-killer network is going full peer-to-peer, boosting decentralization.

- ADA price yielded nearly 8% gains for holders over the past week, with rising whale activity on the blockchain network.

Cardano hit an important milestone in its developmental journey going full peer-to-peer with node 1.35.6. Developers called all Staking Pool Operators (SPOs) to get on the testnet and test the speed and efficiency of the Ethereum-killer blockchain network.

ADA’s rising popularity among institutional investors and large wallet holders could emerge as one of the drivers of the altcoin’s price rally.

Cardano network sees spike in whale activity

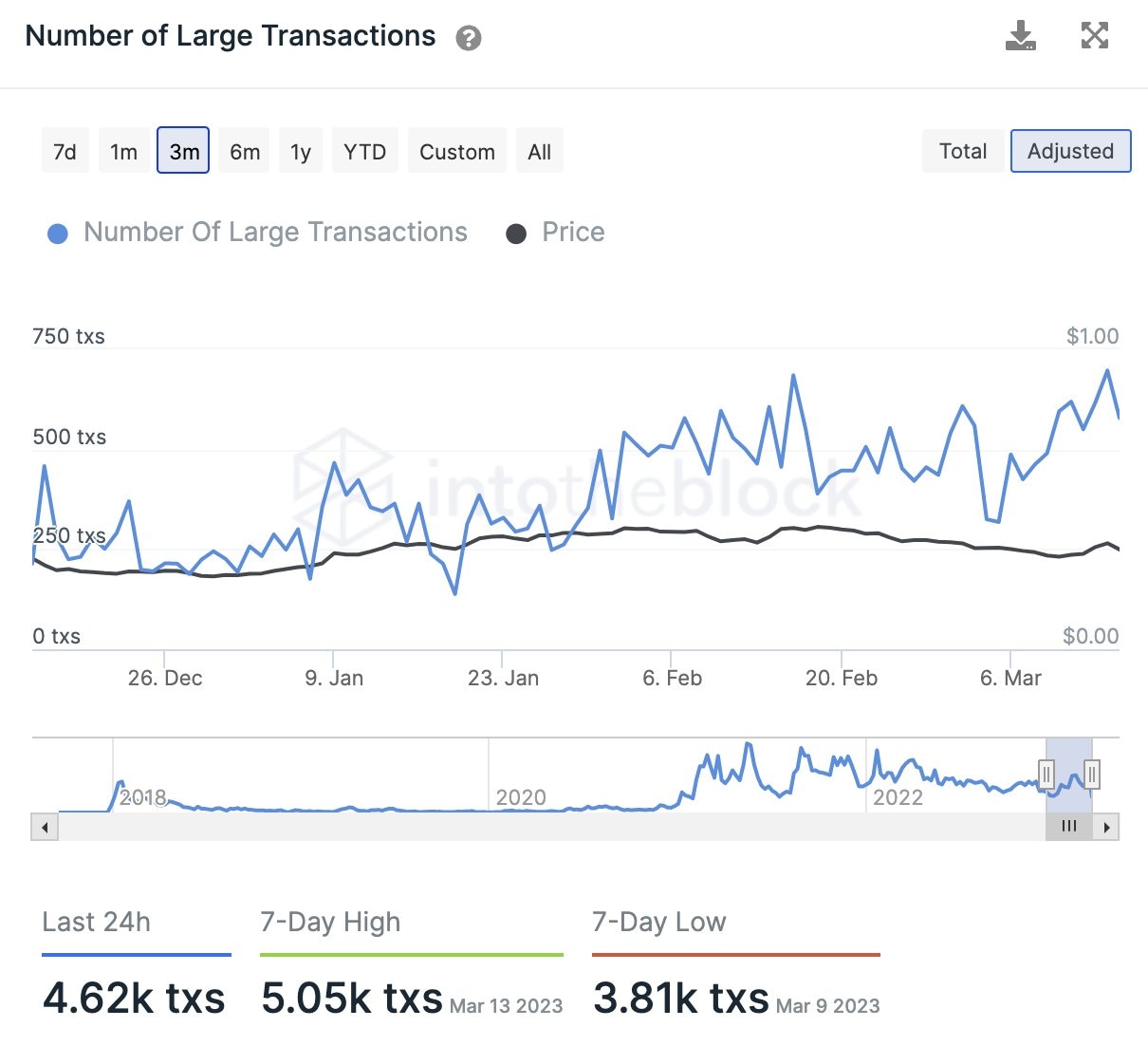

Based on data from crypto intelligence tracker IntoTheBlock, the volume of large Cardano transactions exceeding $100,000 is on the rise. The trend indicates that institutional investors and Cardano whales are increasing their engagement with the Ethereum-killer token.

Cardano network’s large volume transactions

While a spike in whale activity is typically considered indicative of a correction in the asset’s price, large volume transactions on ADA network are accompanied by a steady increase in the asset’s price. Over the past week, ADA yielded nearly 8% gains for holders.

Cardano hits key developmental milestone

Cardano developers at Input Output Global (IOG) announced a boost in the Ethereum-killer’s decentralization with node 1.35.6. A recent tweet by developers called all Cardano Staking Pool Operators (SPOs) to get on the testnet and test the speed and efficiency of the new developmental update.

Dynamic #P2P networking is an important evolution for #Cardano and a further boost to the network's performance, resilience and decentralization. And it's rolling out from today...

— Input Output (@InputOutputHK) March 16, 2023

Read more: https://t.co/Mxz0F9qCqS pic.twitter.com/gQF5LhhTan

Going full peer-to-peer boosts the decentralization of the Cardano blockchain and increases the network’s resilience.

Interestingly, a key growth metric supports the bullish thesis for Cardano. Total Value Locked (TVL) in Cardano climbed 20% per month Year To Date (YTD). The growing TVL doesn’t factor in projects that are lined up for launch on the ADA network.

YTD, Cardano TVL grew 20% per month to 358m ADA. If this trend continues, it hits 1bn ADA in a year, which is $3bn if ADA goes back to all-time high. This doesn’t factor in yet to launch @axotrade, @GeniusyieldO, @TeddySwap, @yamfore, @SpectrumLabs_, new @liqwidfinance assets etc

— ADA whale (@cardano_whale) March 16, 2023

The latest developments in the Cardano ecosystem, including boost in decentralization and rise in interest from institutions is bullish for ADA’s growth.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.