- Bitcoin and Ethereum prices remained flat for the last week, as bulls await silver lining with FOMC meeting minutes release.

- The US Federal Reserve is expected to reveal why high inflation persists as the economy enters 2023.

- Bitcoin price appears anchored but it is unclear when the asset will hit the current cycle bottom.

Bitcoin and Ethereum are tightly correlated with a coefficient of 0.89 but both BTC and ETH prices remained largely unchanged over the past week in anticipation of the FOMC minutes release. The minutes of the US Federal Open Market Committee’s meetings are under the spotlight today as experts look for an explanation for why high inflation could persist in the economy.

Concluding its December 13-14 meeting, FOMC policy makers published new projections for expected inflation in 2023 which were higher than previously thought. This has resulted in wider support from experts for an interest rate increase of over 5% in 2023, something which could push up the value of the US Dollar.

The US Dollar Index is struggling to hold ground and if it falls following the minutes it would be positive for cryptocurrencies. The event, therefore, could turn out to be the year’s first silver lining for risk assets like Bitcoin which enjoy an inverse correlation with DXY.

Will Bitcoin price break resistance at $16,900 as bulls anticipate FOMC minutes release?

BTC price remained largely unchanged over the past week. The US Federal Reserve has raised interest rates seven times in a row and the consensus among analysts is that this will repeat at the end of January 2023.

The majority of the economists expect a 25 basis point hike to level off the trend from the US Fed. In the last meeting, US Fed Chair Jerome Powell admitted that interest rates would keep going up, however, the hawkish tone of the central bank did not have a significant impact on cryptocurrency prices.

Bloomberg analysts believe that the Fed is expected to provide an explanation for why it anticipates high inflation to persist as the US economy enters 2023, in its minutes today. Fed officials revised their inflation forecasts for the end of 2023 and released them after their December 13-14 meeting. Experts are therefore supportive of the estimate that interest rates would need to increase over 5% in 2023.

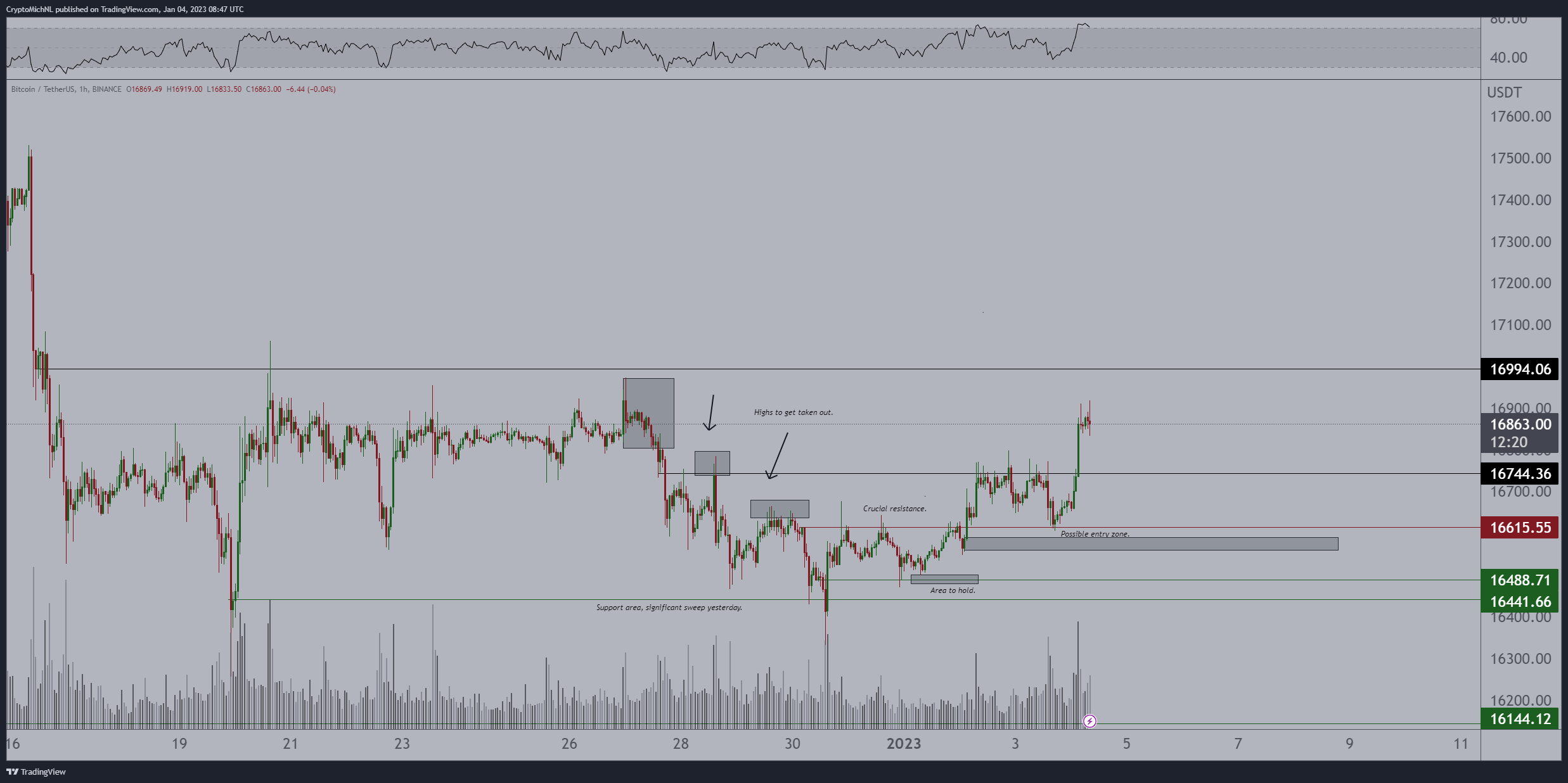

The largest cryptocurrency by market capitalization bounced from a possible entry zone at $16,615 and bulls are now targeting the $16,904 level.

BTC/USDT price chart

The Fed will publish the minutes of the FOMC meeting on Wednesday at 14:00 ET (19:00 GMT).

Ethereum and Bitcoin remain tightly correlated

Based on data from cryptowatch, the correlation between Bitcoin and Ethereum is tight, at 0.89. The two large cryptocurrencies are in lockstep, therefore the altcoin is expected to mirror BTC’s moves.

Digital assets including Bitcoin and Ethereum are not out of the woods, however, according to senior market analysts at foreign exchange cooperation OANDA. Edward Maya, senior analyst was quoted as saying:

This is still a difficult time for crypto as everyone waits to see which will be the next crypto company to fail. Regulation is taking its time but guidelines should start to take hold this year. A top US regulator delivered a joint warning on crypto activities, which did not contain any new risks. Bitcoin appears anchored but it is still not clear when we will test and possibly make a new bottom.

The Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency issued a statement,

It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system. The agencies will continue to closely monitor crypto-asset-related exposures of banking organizations.

With agencies monitoring the spreading FTX contagion and highlighting the importance of crypto regulation, it remains to be seen whether interest and trade volume in Bitcoin and Ethereum steadies or declines.

Why FOMC minutes could have a big impact

Sources close to the matter argue that the minutes from December’s meeting could have a bigger impact due to members of the committee having been silent since the holidays. Traders setting up for the coming year will treat the minutes as the first explanation for the year of the US Fed’s take on inflation trends.

The US Fed Chair was not the only hawkish member at the last meeting when the median rate expectation was boosted from 4.5% to 5.0%, meaning that the consensus among members is more hawkish than it was at the end of the third quarter.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.