Will Bitcoin begin its recovery rally ahead of US Nonfarm Payrolls data?

- Nonfarm Payrolls in the US are forecast to increase by 205,000 in February, after a surprising uptick in January.

- Jerome Powell’s relatively hawkish statement on Tuesday pushed Bitcoin and cryptocurrency prices lower.

- If upcoming jobs and inflation data beat expectations, the Fed will likely deliver a bigger interest rate hike, pushing BTC and crypto lower.

US Nonfarm Payrolls (NFP) data surprised investors with a relatively high spike to 517,000 jobs in January. The forecast for February is a more modest 205,000, and it remains to be seen whether there will be any surprises in the data.

Analysts expect the Federal Reserve to continue its aggressive interest rate hiking if jobs and inflation numbers continue to exceed expectations. This could increase the selling pressure on risk assets like Bitcoin and cryptocurrencies.

Also read: US February Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

What is Nonfarm Payrolls data and why it acts as key input for US Fed’s policy making?

Nonfarm Payroll measures the number of workers in the United States, except those in farming, private households, non-profit and the active military. The Bureau of Labor Statistics (BLS) surveys private and government entities throughout the US and reports Nonfarm Payrolls to the public through a monthly “Employment Situation” report.

The NFP additions and the unemployment rate are the two headlines of the report, however policymakers use all available data to assess the state of the US economy and forecast future economic activity.

It is important to note that an increase in NFP indicates that the economy is growing, spending is expected to increase and a sudden increase in jobs could drive inflation higher. This is viewed as negative for the economy, and factors in the US Fed’s decision making when determining the next interest rate hike.

What has happened in the last five NFP reports?

US NFP data has surprised market participants for the past five times. Each time the employment data came in the labor market was tight despite firms bracing for economic slowdown and tech layoffs.

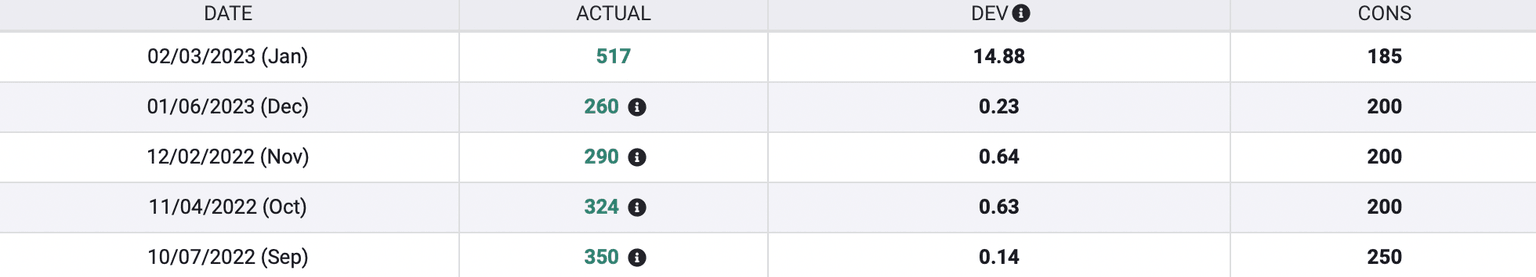

Historical US NFP data from FXStreet

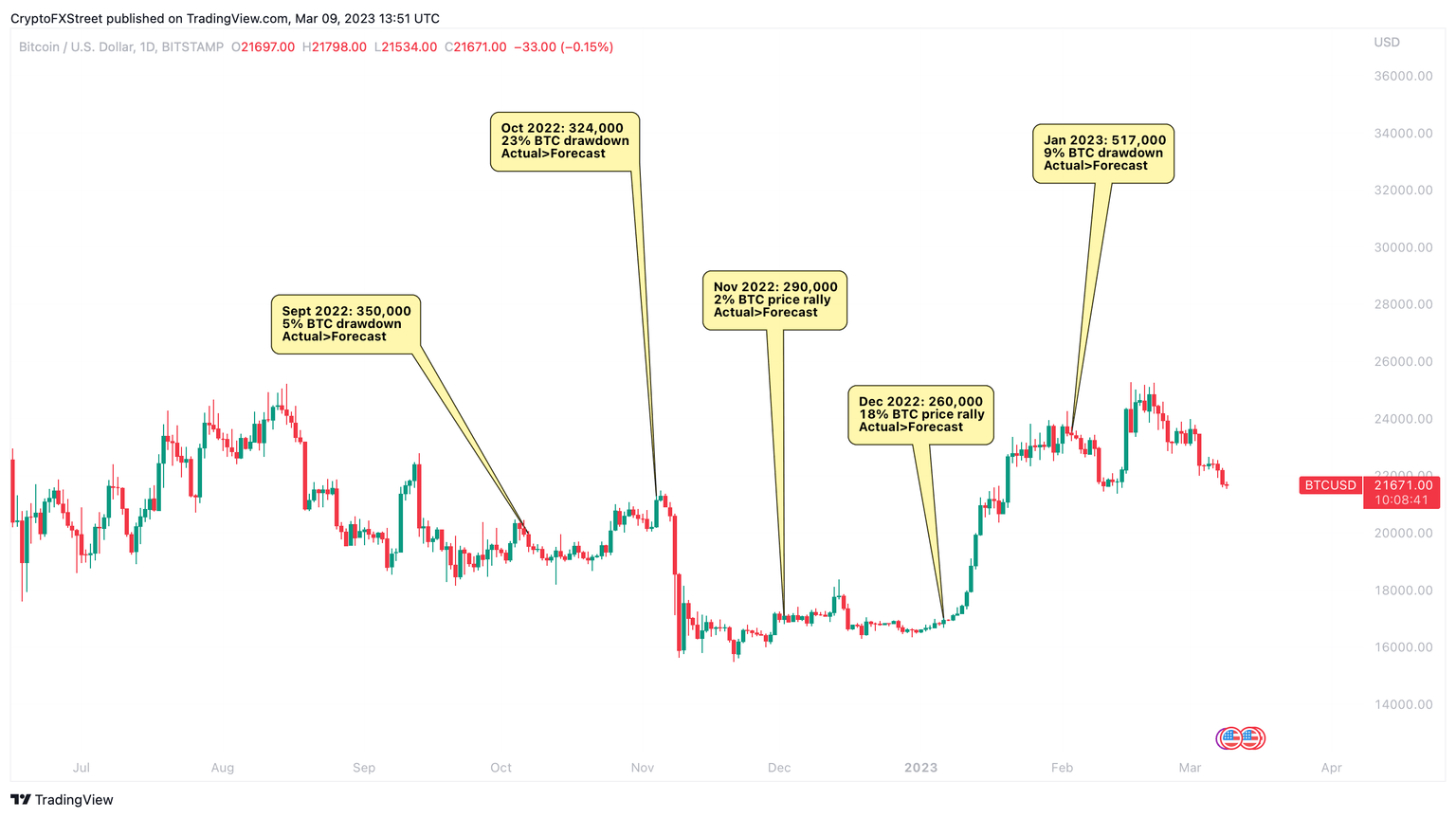

It's important to note that rather than the employment numbers in itself, the difference between actual and forecasted data influences the market’s reaction. As seen in the chart below, Bitcoin price reacted differently to the past five US NFP data releases, where actual numbers were greater than the forecast.

The numbers shown in the chart below account for BTC price reaction in the week following the US NFP data release.

Bitcoin price reaction to US NFP data release

Other factors influencing Bitcoin price during the past five data releases include FTX exchange’s collapse, bankruptcies of several crypto lenders and firms, US regulatory crackdown on cryptocurrency exchanges and stablecoin issuers, announcement of Mt.Gox’s BTC return to creditors, among others.

The chart reveals that the immediate (same day) reaction was a decline in Bitcoin price. When the actual NFP figure has been 300k or higher it typically results in an increase in selling pressure on risk assets like Bitcoin and cryptocurrencies.

The forecast for February is an increase of 205,000, according to data from FXStreet.

Jerome Powell’s recent hawkish commentary pushed Bitcoin and crypto lower

In a testimony to the Committee on Financial Services at the start of the week, the US Federal Reserve Chair Jerome Powell submitted hawkish remarks. Powell commented on data from January on employment, consumer spending, manufacturing production, and inflation and stated that the softening trends have partly reversed.

Powell was quoted as saying:

...Still, the breadth of the reversal along with revisions to the previous quarter suggests that inflationary pressures are running higher than expected at the time of our previous Federal Open Market Committee (FOMC) meeting.

The Fed Chair affirmed that inflation has been moderating in recent months, but the process of getting inflation back down to 2% has a long and bumpy way to go. With the latest economic data coming in stronger than expected, the ultimate level of interest rates is likely to be higher than previously anticipated. Analysts are pricing in a 50 basis point hike, instead of 25, in March.

Expert speak: What to expect from risk assets

Eren Sengezer, Lead Analyst at FXStreet commented on the US Senate’s preparedness to increase the pace of rate hikes. Sengezer notes that hawkish Fed bets have been dominating the markets. The expert believes that a disappointing NFP print, below forecast, could make room for a recovery in risk asset prices.

The analyst was quoted as saying:

The CME Group FedWatch Tool shows that markets are pricing in a 78% probability of a 50 bps rate hike in March, suggesting that there is more room for additional US Dollar strength in case NFP surpasses the market consensus. In that scenario, risk-sensitive assets are likely to have a hard time finding demand.

On the other hand, a disappointing NFP print - at around 100,000 - could cause investors to second guess themselves about the probability of a 50 bps hike at the next meeting. In that case, we are likely to observe a risk rally, at least until next week's Consumer Price Index data.

The state of Bitcoin and where BTC price is headed next

Bitcoin market participants are bearish ahead of US NFP data release. The Silvergate FUD – read more about it here: Cryptocurrency exchanges reassure saftey after Silvergate bank shuts down – has negatively influenced Bitcoin price.

BTC holders are concerned about rising selling pressure from a combination of Powell’s hawkish commentary and an above-expected increase in Nonfarm Payrolls in February 2023. Bitcoin is fighting an uphill battle to recover from its March 3 decline from $23,539 to $22,259.

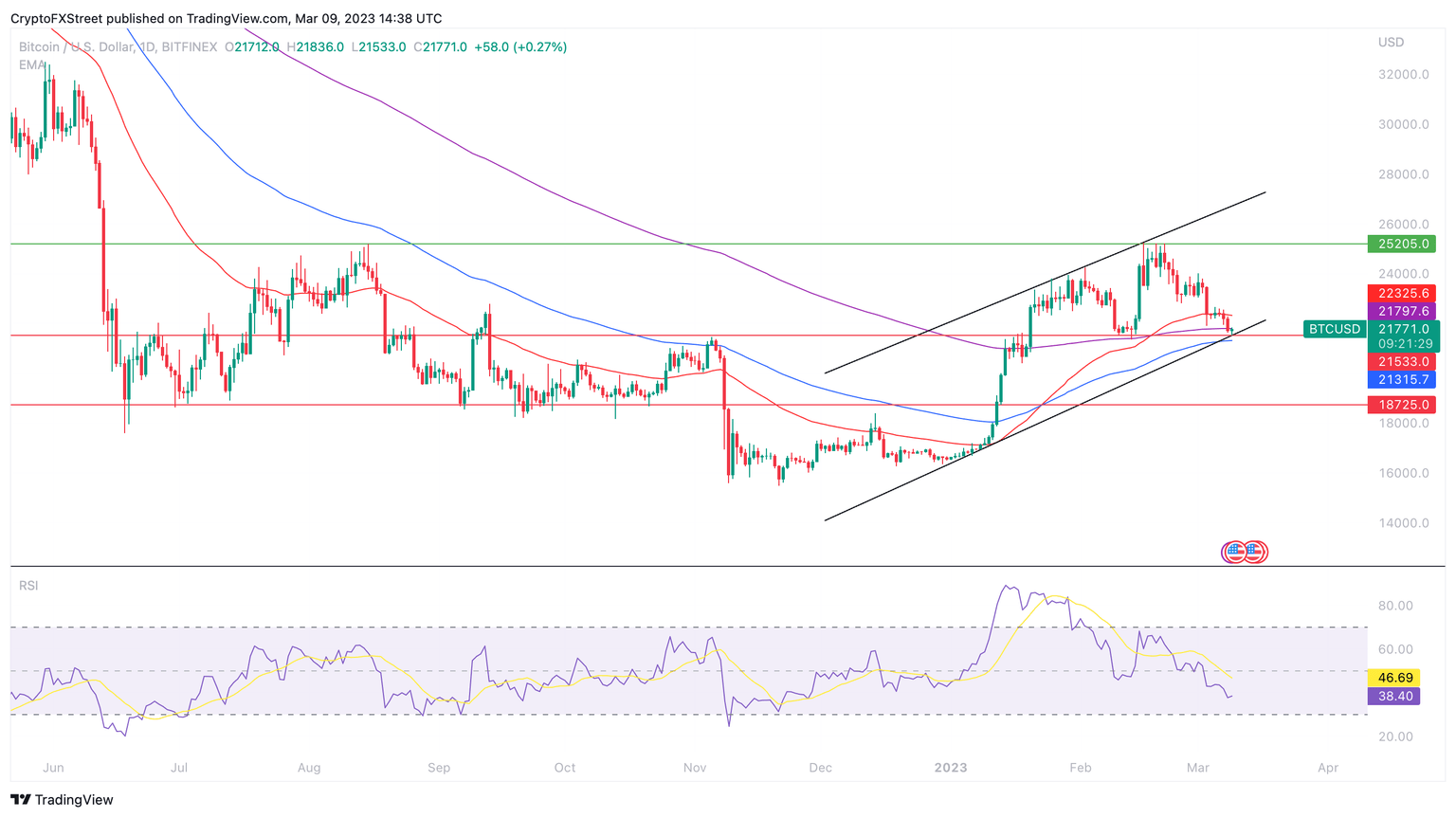

As seen in the chart below, Bitcoin price is in a short-term uptrend that started in January 2023. The asset is currently trading sideways since its drop from the $25,200 level in February. BTC price is currently below its long-term Exponential Moving Averages, 100 and 200-day.

At $21,771, Bitcoin price is above the 50-day EMA at $21,315.

BTC/USD 1D price chart

If Bitcoin begins its relief rally, the asset is likely to face resistance at the 100-day and 200-day EMAs at $22,325 and $21,797. The upside target is the $25,205 level that has acted as resistance for most of 2022 and 2023.

The downside targets are $21,533 and $18,725, both levels acted as resistance and were flipped into support by Bitcoin during its rally to $25,205.

Relative Strength Index is currently 38.40, with no sign of divergence on the one-day price chart. There is room for recovery in the largest asset by market capitalization, although it remains to be seen how US Nonfarm Payrolls data influences Bitcoin price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.