Will Binance Coin price face a drawdown as Binance suspends USD bank transfers from February 8?

- Binance failed to provide a reason behind this move but assured the impact would be minimal.

- Binance CEO Changpeng Zhao stated that only 0.01% of the monthly users use USD bank transfers.

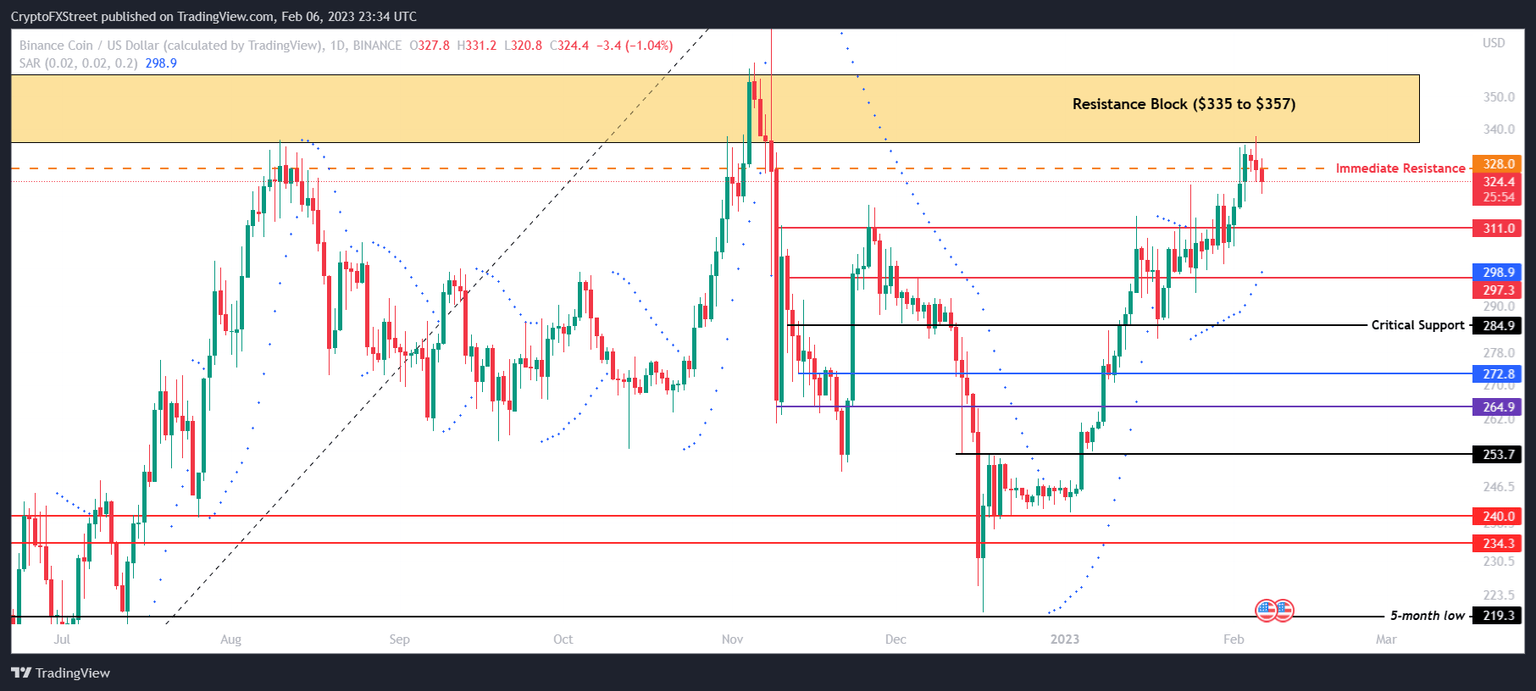

- Binance Coin price tagged the resistance level at $335, failing to breach it for the third time in eight months.

Binance is the biggest cryptocurrency exchange in the world. It also emerged as a key player in the crypto industry owing to its initiatives following the FTX collapse in November 2022. Consequently, any change made by them is expected to have an impact on the crypto market, but their latest move remains a mystery.

Binance halts USD bank transfers

Binance, in a tweet on Monday, announced that the cryptocurrency exchange would be suspending all its bank transfers in the form of USD temporarily. Binance failed to provide both the reason and the time period for the payment method that will come into effect on February 8.

However, the exchange did confirm that all the other methods of buying and selling cryptocurrencies will remain active and that this suspension is not applicable to Binance.US users. Binance added,

“Only a small proportion of our users will be impacted by this and we are working hard to restart the service as soon as possible.”

This was very soon confirmed by the Chief Executive Officer (CEO) of Binance, Changpeng Zhao (CZ). The executive also highlighted that the USD bank transfers are used by merely some 0.01% of their monthly active user base. He further tweeted,

While some banks withdrawing support for crypto, other banks are moving in. Some setbacks were expected from last year's incidents. Long term, keep building.

— CZ Binance (@cz_binance) February 6, 2023

Binance Coin price misses again

Binance Coin price, although noted no immediate impact following the announcement of the USD bank transfer suspension, did observe a failed attempt at a rally over the last few days. Trading at $323.8, the cryptocurrency tagged the resistance level at $335 and came back down below the immediate resistance level at $328.

This is the third time in the last eight months that BNB has failed to make it through, with the exception of November 2022, which was immediately followed by a 25% crash. Flipping the $335 resistance into a support level is crucial for the altcoin to rise further and recover the November losses by tagging $354.

Going forward, the chances of a decline seem relatively lower as the Parabolic Stop and Reverse (SAR) indicator is still highlighting an uptrend. The presence of the blue dots far below the candlesticks is evidence of the same.

BNB/USD 1-day chart

Nevertheless, if prices decline again and Binance Coin price falls below the $311 support level, it will have another opportunity to bounce back at $297. A decline below it would result in BNB tagging the critical support at $284.9, losing, which would invalidate the bullish thesis, bringing the cryptocurrency to November lows.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.