- Bitcoin price has rallied nearly 25% over the past two weeks and altcoin gains from the past week reveal that profits are rotating.

- Asian investors who lost their funds to $17 billion Credit Suisse AT1 bond collapse could turn to crypto as “safe haven”.

- Altcoins, neglected by investors for the past few weeks, could see a spike in demand.

The global market turmoil got worse earlier today with the $17 billion Credit Suisse bond collapse. The Financial Times reported that risky AT1 Credit Suisse debt experienced a further wipeout after panicked Asian private bank clients pushed down AT1s after receiving margin calls.

With Bitcoin price hitting a nine-month high above $28,000, experts believe there is a likelihood of capital rotation to altcoins like liquid staking tokens, zero-knowledge and AI category of cryptocurrencies.

Also read: Can Cardano hit $100 as cynics criticize Bitcoin's $1 million bet?

Bitcoin price hits nine-month high with dominance testing resistance at 47.85%

The global market turmoil induced by the collapse of two large US banks fueled a “safe haven” narrative for the largest cryptocurrency by market capitalization. Bitcoin wiped out its losses and started a steady climb towards a nine-month high above $28,000.

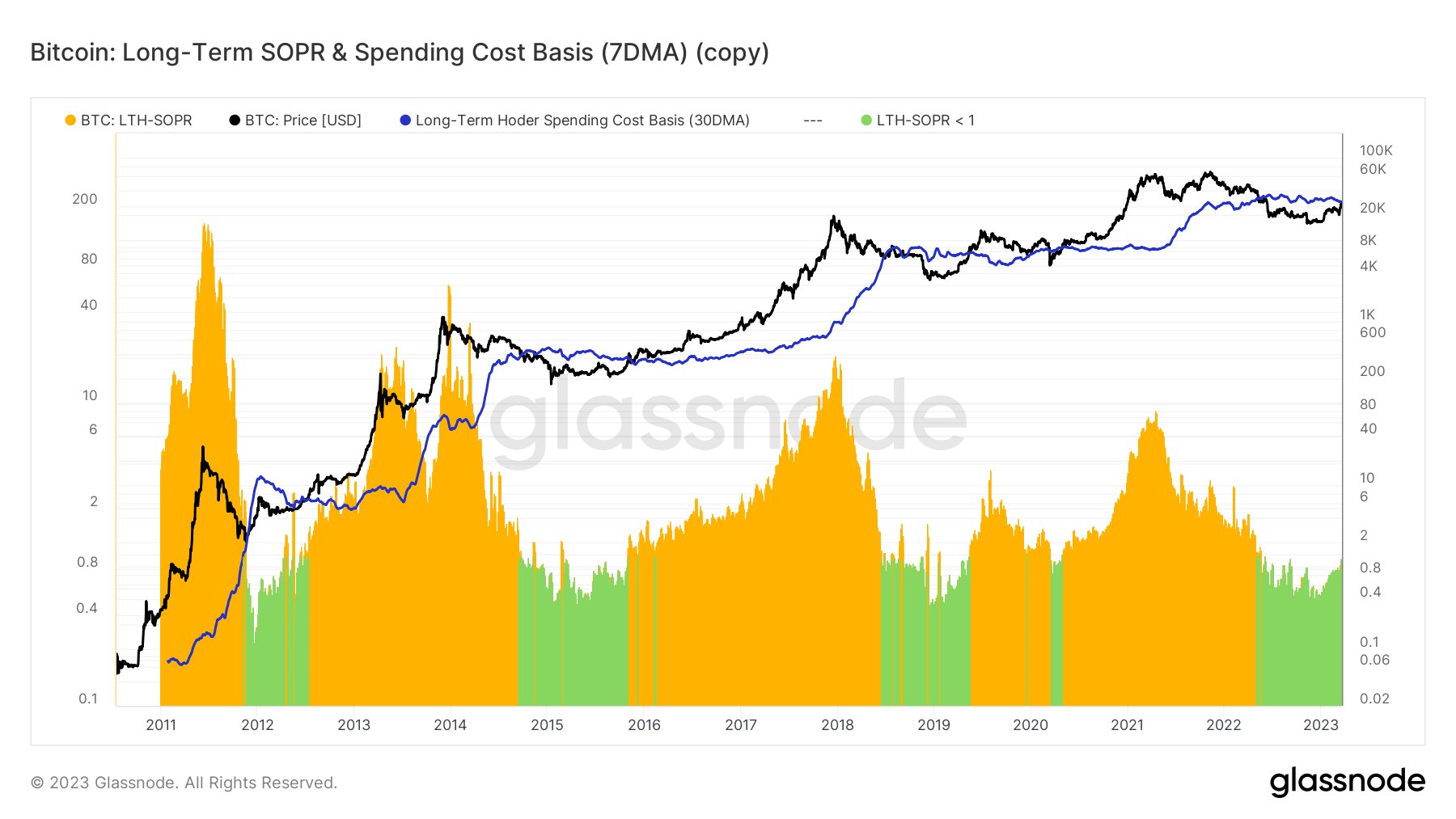

One of the most important factors in determining the transition of capital from Bitcoin to altcoins is long-term holder behavior. Based on data from crypto intelligence tracker Glassnode, long-term holders of the asset will turn a profit for the first time since May 2022 in the event that Bitcoin price crosses $29,102.

Bitcoin long-term holders turn profitable above $29,000

Once holders are profitable, it is typical to see profit-booking and flow of capital to alternative cryptocurrencies and stablecoins.

Bitcoin long-term holders turning profitable coincides with piling crises across global financial markets. Following the collapse of two large US banks, Asian investors were gobsmacked by $17 billion in Credit Suisse AT1 debt being wiped out earlier today.

Global market turmoil disappoints wealthy Asian investors

The most striking factor in the $17 billion AT1 bond collapse is that apart from European institutional investors, wealthy individuals, retail investors from Asia, were also hit by the wipeout.

Financial Times reported that retail investors in Europe typically do not hold AT1 as they are barred from doing so in jurisdictions including the UK.

In Asia, the instruments are popular with wealthy individuals who appreciate the brand names and the yields such as in the case of Credit Suisse bonds. In 2022, the institution issued a bond paying a 9.75 percent coupon and this was popular among wealthy Asian retail investors.

The Credit Suisse takeover by UBS upended the traditional hierarchy of creditors. While bondholders are usually given priority as creditors first, followed by shareholders, in the case of Credit Suisse, to make the deal palatable, something had to give, and in the end shareholders were prioritized at the expense of bondholders and additional tier one bonds were written down to zero. The surprise decision stung some retail investors in Asia who are exposed to AT1s, a class of debt designed to take losses when institutions run into trouble but generally believed to rank ahead of equity on the balance sheet.

Asian investors represent nearly 25% of the AT1 global market worth $260 billion. It remains to be seen where these wealthy individuals turn to, after being hit by the financial crises. Investors could turn to Bitcoin, with its rising correlation with Gold and “safe haven” narrative, or pick altcoins that are primed for higher returns this market cycle.

Altcoins are gearing up for upcoming capital rotation, which crypto will pump next?

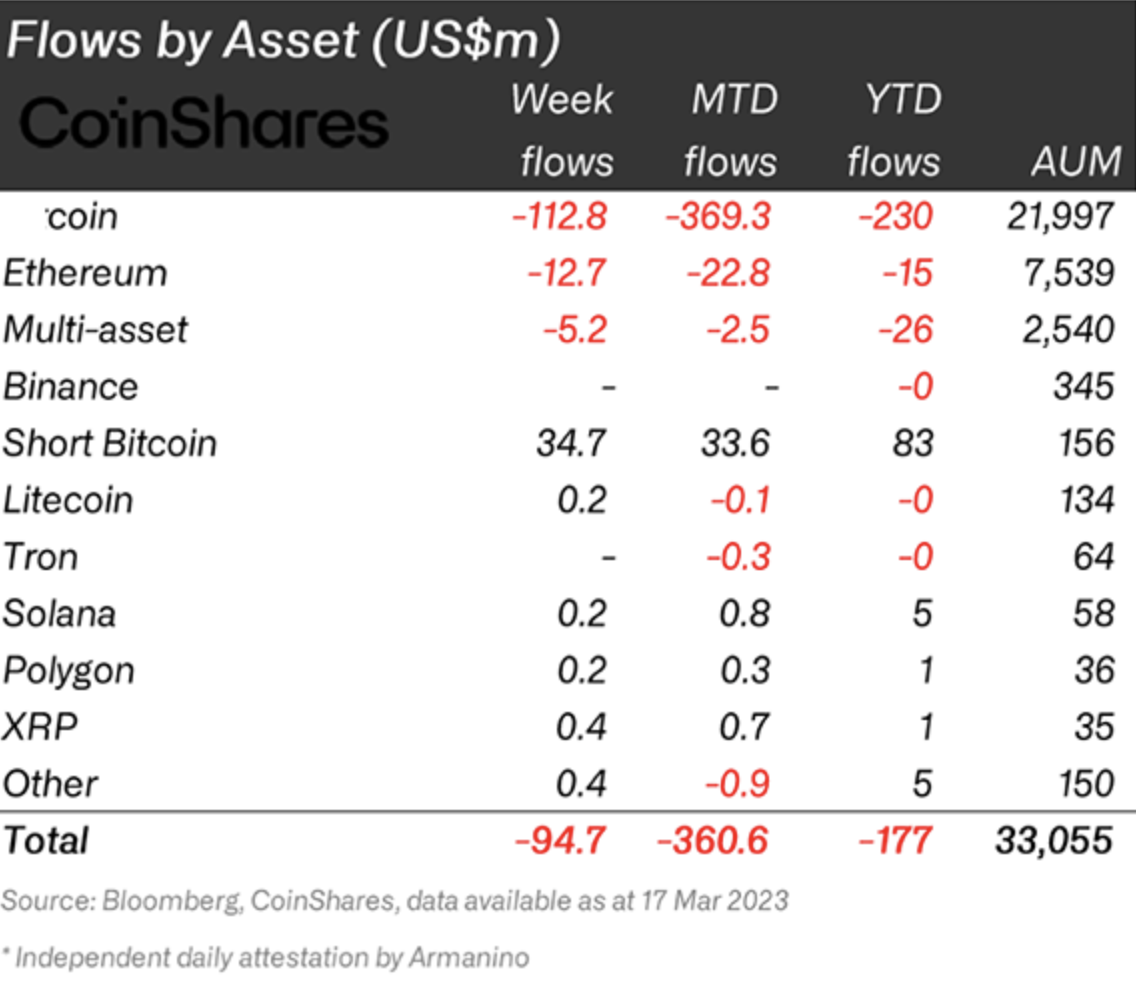

With Bitcoin’s recent price rally and several BTC holders sitting on unrealized profits, the largest crypto by market cap noted the sixth consecutive week of outflows. A total of $406 million has flown out of Bitcoin, as of March 20, according to a CoinShares report.

Bitcoin remained the focus of negative sentiment, while altcoins like Litecoin, Solana, Polygon, XRP and others witnessed a net positive weekly flow.

Week flows for altcoins by CoinShares

In addition to these large cap altcoins, crypto Twitter has noted a rise in narratives like the China coin narrative for Aptos (APT), Filecoin (FIL), NEO and Huobi Token (HT); and the Artificial Intelligence (AI) narrative for assets like SingularityNet (AGIX) and Fetch.ai (FET).

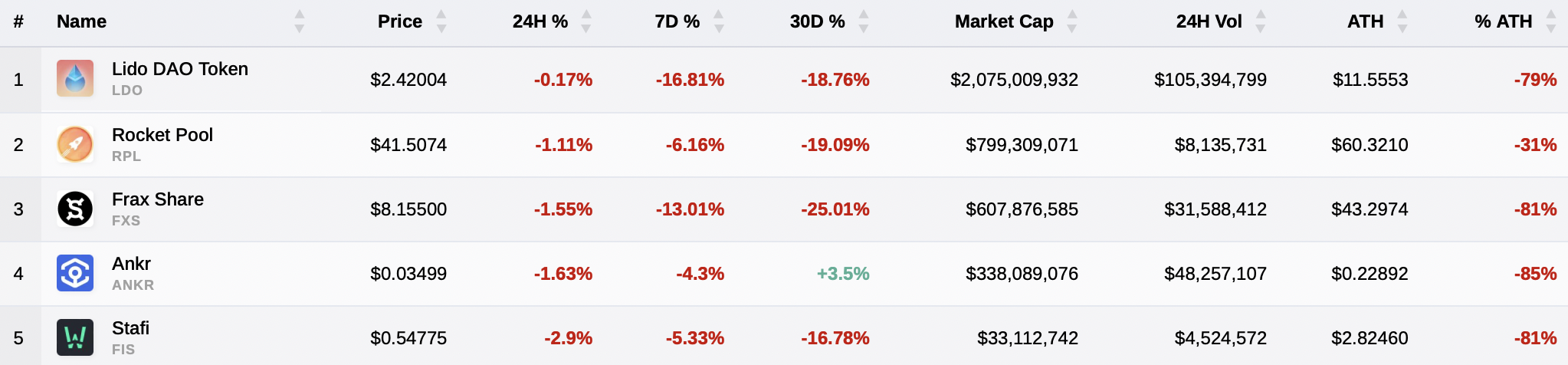

While the narratives keep changing with developments and announcements by crypto and tech giants, the upcoming key events like Ethereum token unlock could fuel a rally in Liquid staking tokens Lido DAO (LDO), Rocket Pool (RPL) and Frax Share (FXS).

Liquid staking tokens

Another popular category of altcoins is Zero-Knowledge (zk) tokens. As the technology gains popularity in the Ethereum ecosystem, these tokens Polygon (MATIC), ImmutableX (IMX), Mina Protocol (MINA), Loopring (LRC) and Zcash (ZEC) could witness a boost in capital inflow and wipeout recent losses.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.