Will AAVE price overcome this resistance following V3’s deployment on the zkSync 2.0?

- AAVE’s price is looking to invalidate a 15-month-long resistance.

- The Aave community voted overwhelmingly in favor of expanding V3 reach and deploying it on zkSync 2.0.

- Aave V3 on ZkSync will serve as a major boost to user activity and reduce costs.

As the biggest lending protocol in the Decentralized Finance (DeFi) space, Aave holds a significant influence over the DeFi user base. With over $5.4 billion locked across all its versions, Aave’s expansion will be highly beneficial to its further growth. The deployment of the liquidity protocol’s third version (V3) on ZkSync will work to the same effect, potentially even impacting its price positively.

Aave comes to zkSync

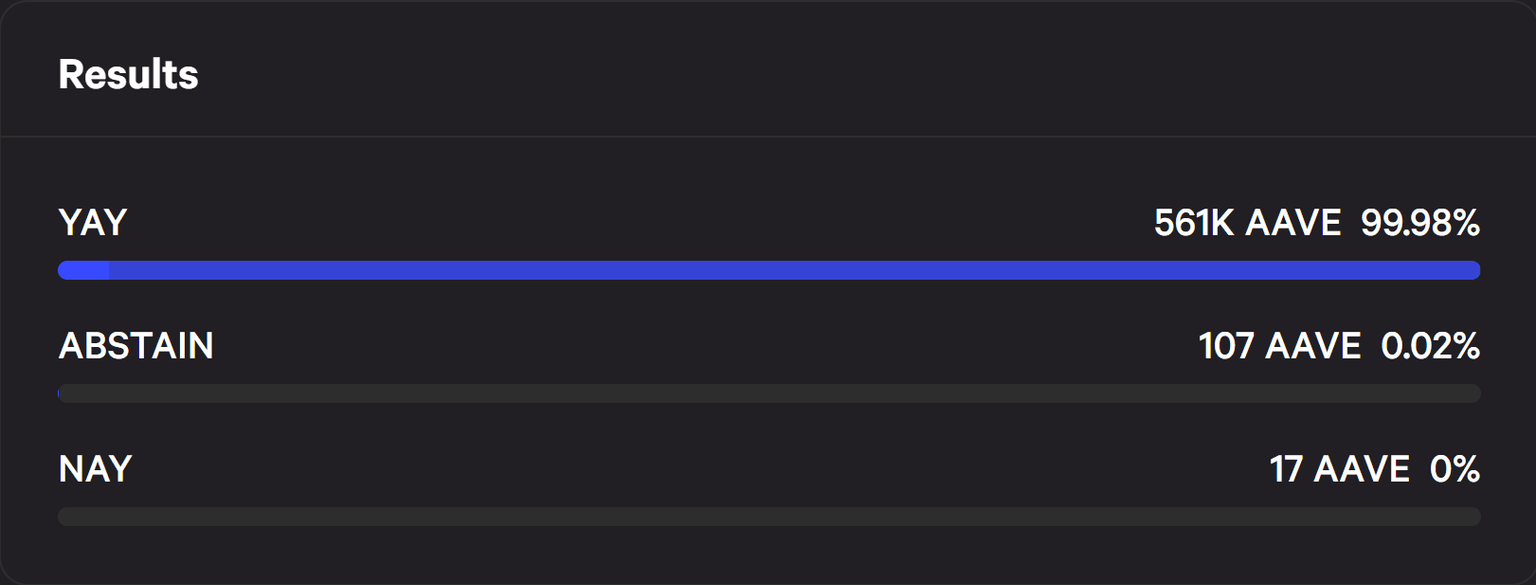

The Aave community voted overwhelmingly in favor of expanding the protocol’s third version reach and deploying it on zkSync 2.0.

zkSync 2.0 is a layer-2 (L2) solution making use of the ZK rollups on Ethereum. This L2 chain is expected to be of significant value to developers as it will introduce significant improvements to the L2 space. Developers can access features including EVM compatibility, Future Proof and Ethos compatibility. This will allow them to gain the advantage of far lower gas fees and higher transaction rates.

Aave V3’s deployment is also targeted to tap these features to further its multichain mission and expand cross-chain experiences.

For the same, the proposal suggested initial deployment on zkSynce 2.0 testnet until the liquidity on the protocol improves, post which V3 will be deployed on the mainnet. This is expected to take some time since the zkSync mainnet is still in its “baby alpha” phase, running on the testnet since February this year.

Aave proposal result

With the proposal receiving more than 99% approval from the community, it will come into effect soon, and the price impact following might make AAVE holders very happy.

Where is AAVE headed to?

Currently trading at $84, AAVE price is looking to test the 15-month-long downtrend line. Forming a downtrend wedge, this line could be flipped into support if external bullish factors persist. The immediate bullish sign would be AAVE testing the 100-day Simple Moving Average (SMA) as support at $85.84.

Following that, if the upswing continues, $115 is the next critical resistance for AAVE, after which traders could initiate profit booking.

AAVE/USD 1-day chart

However, if the breach fails and AAVE’s price declines, $68.7 will be the immediate support. If this is invalidated, investors can expect a drawdown to $47, which is tagged as the altcoin’s 2-year low.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.