Why you rather want to be watching House of The Dragon instead of CRO price action this week

- Crypto.com coin price action dips a mild 1% this morning in the ASIA PAC session.

- CRO price, however, reveals a painful rejection over the weekend.

- A dead-cat bounce is in the making and could see price action collapse back to $0.11.

Crypto.Com coins (CRO) price action sees this Monday morning bears storming out of the gates with the US futures all down and Nasdaq even down over 2%. With this dark tone, cryptocurrencies are taking a step back as well. On the technical front, CRO price has been rejected on a fundamental level and could see more losses being eked out during the week, so it is time to walk away and look at the Game of Thrones prequel House of The Dragon instead of the markets this week.

CRO price is breaking up its summer love

Crypto.com coin price has had a slight recovery over the weekend with bulls able to move against the current as the dollar strength was paused during the weekend with forex markets closed. In that space and absence of negative pressure, CRO staged a 5% recovery to $0.13. That is as far as the good news goes, as CRO bulls received a firm rejection on Sunday against the monthly pivot near that $0.13 level and saw their gains being paired back a bit with already over 1% of losses in early morning trading.

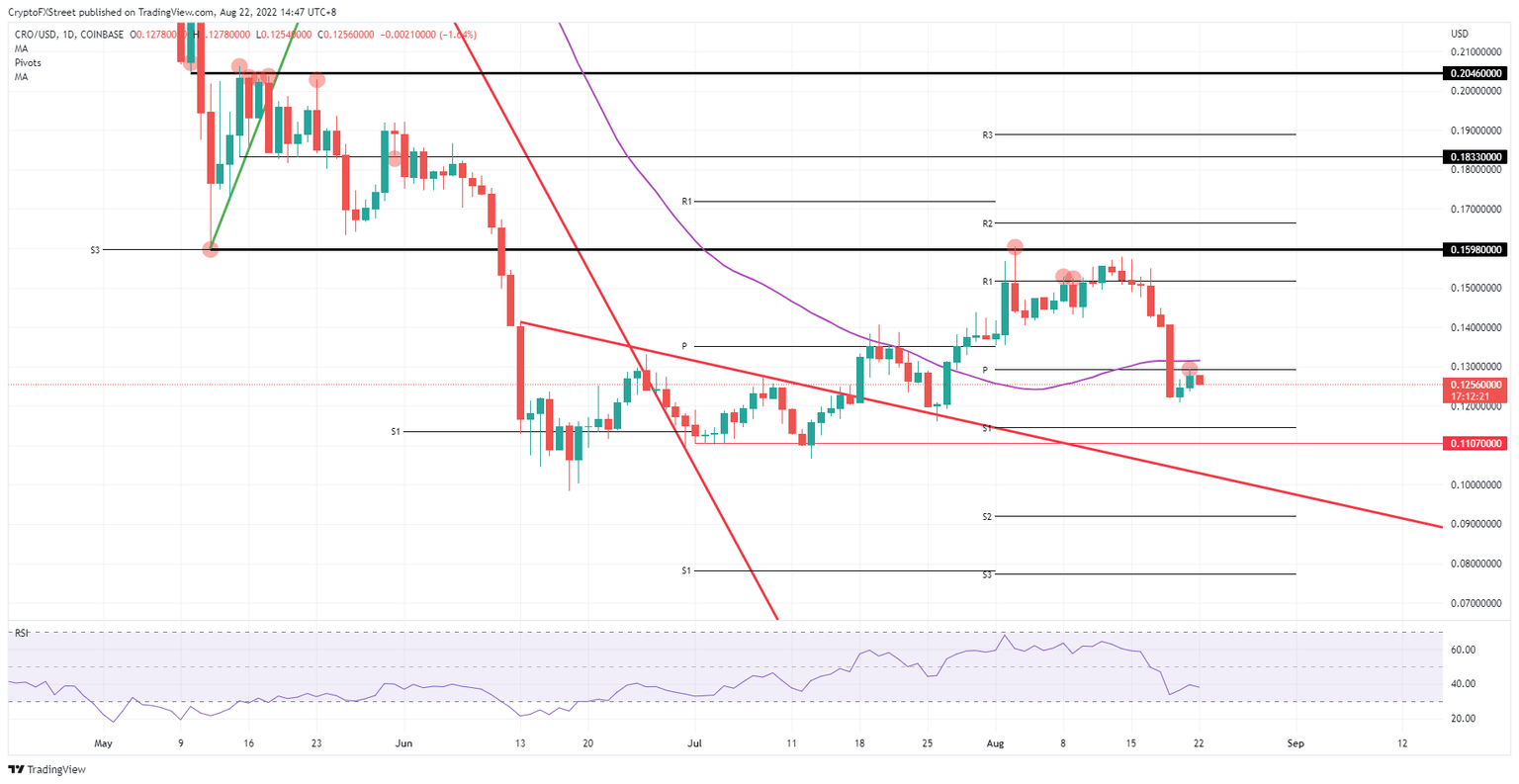

CRO price is thus at risk of further losing steam and dropping further once it breaks below the low of last week at $0.12. From there, it is only a few cents toward the monthly S1, and that red bottom line is marked up on the chart at $0.11. That barrier will be key because once that breaks down somewhere this week, roughly 20% of losses could be set forward as this year's low gets tested again at $0.10 and lower.

CRO/USD Daily chart

Financial markets are working towards a big catalyst event this week, probably one of the biggest for this year's central banking front. That is the famous Fed Jackson Hole symposium that will take place this Thursday and Friday, where several head central bankers will take the stage and will be able to channel additional comments toward the markets. Of course, the keynote speaker is Fed chair Jerome Powell who is set to speak on Friday afternoon. Should he bring some soothing comments, markets will rally on the back of that, with CRO price set to break above $0.13 and could be on its way to $0.16 in the blink of an eye.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.