Why XTZ traders need to be glued to the screen for next 48 hours

- Tezos price will likely take a key turn lower today after the bullish print on Wednesday.

- XTZ price is at the mercy of global markets rolling over this morning.

- Either the technical support handles hold – or break under dollar pressure.

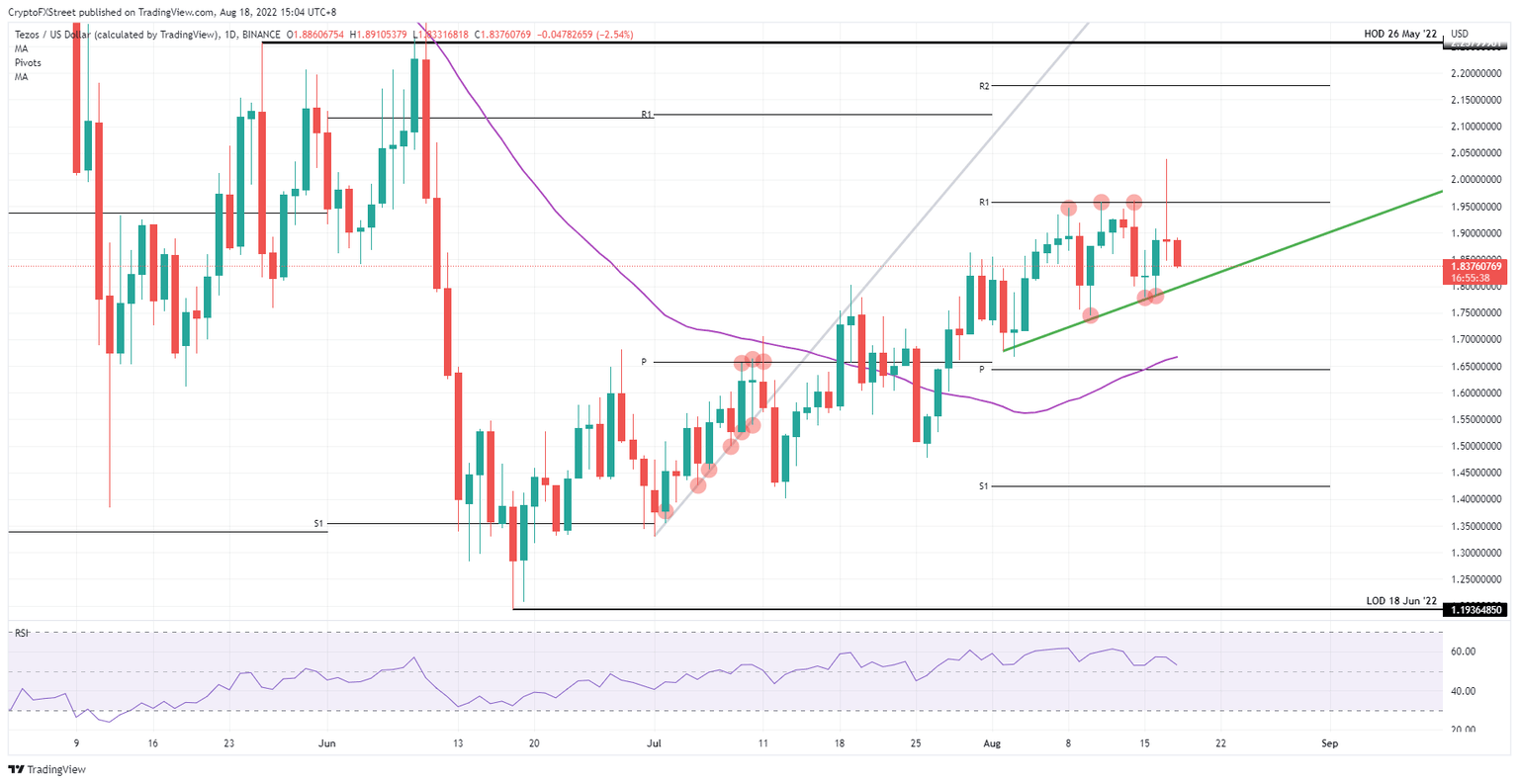

Tezos (XTZ) price action has seen its winnings evaporate in late hours trading on Wednesday after the Fed minutes came out. Although several media outlets are shouting that the minutes implied a slowdown in rate hikes, global markets are telling quite another story with all risk-on segments of global markets on the back foot. This triggers a big question: Is the breakout yesterday a bull trap, or is this a mere setback and a window of opportunity to go long again against the supportive trend line?

XTZ price set to make up its mind

Tezos price action had seen bulls playing their hand before the Fed minutes came out late in the US trading session. Normally these minutes do not hold any surprises as Powell, and other Fed members have often long channelled to the markets the view of the FOMC committee on rate hikes and its path forward. The ASIA PAC session, however, showed a diversion with what headlines hitting Twitter, Bloomberg television and other financial news outlets were saying about the minutes showing a case for rate cuts or rate hikes to slow down anytime soon.

XTZ price is thus at a crossroads, and readers who have been tracking our articles on XTZ price action are normally well aware of what is going on and what is causing the whipsaw price action in cryptocurrencies. Expect XTZ price to uphold the one most important rule: the market is always right, which boils down to XTZ price set to break below the green ascending trend line. The bull trap will see XTZ price tank 10% towards $1.66 with the 55-day Simple Moving Average and the monthly pivot slowing down and catching the drop to the downside.

XTZ/USD Daily chart

The headline of this article demands XTZ traders watch price action like hawks because should that green ascending trend line hold, another return to $2 is granted. That would come with markets getting accustomed to the Fed rhetoric, and after a short ripple, start to see the silver lining again to trade higher. XTZ price could then be on target for $2.25 near the high of May 26, 2022.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.