Why traders must approach ApeCoin price with caution

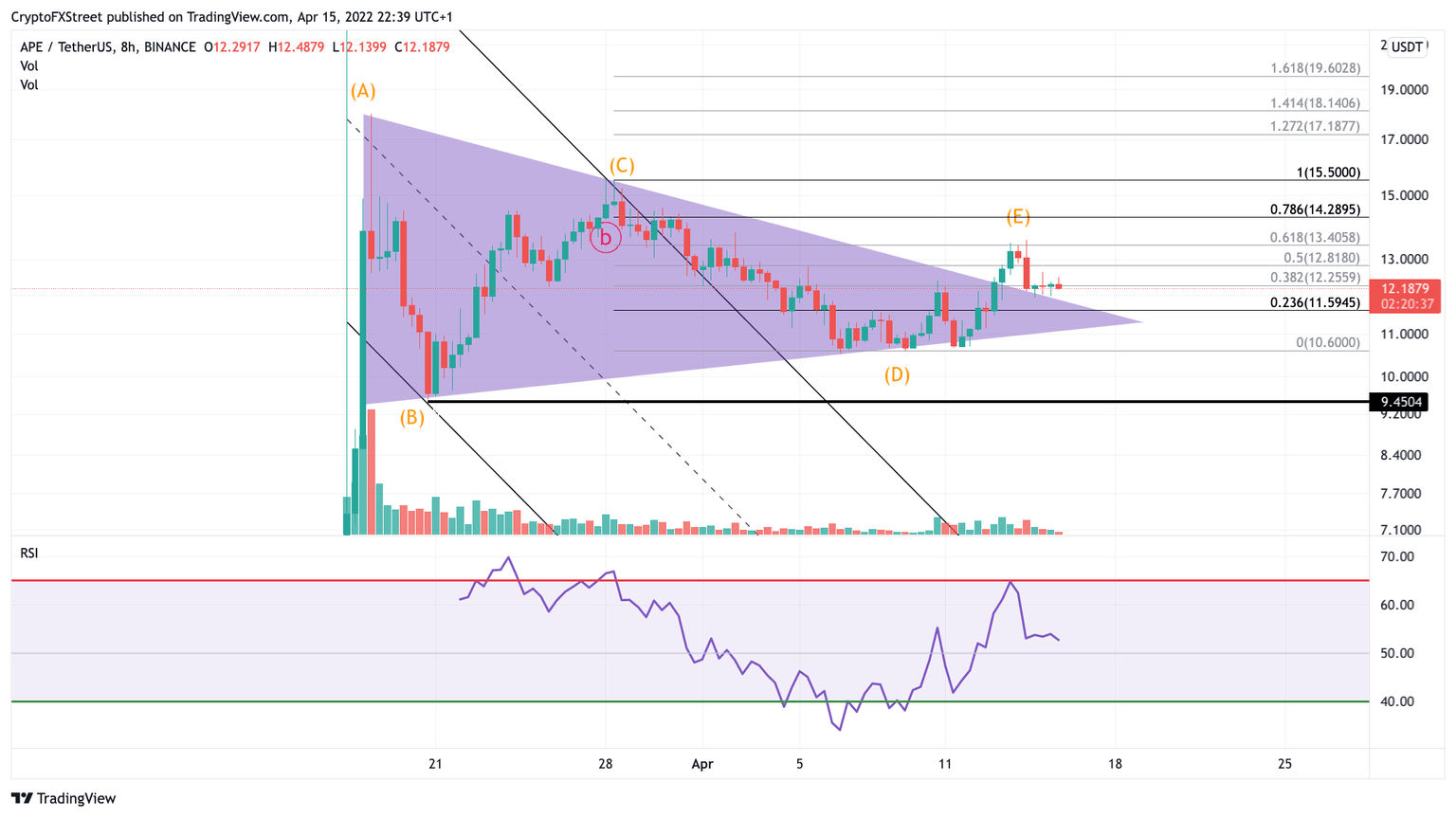

- ApeCoin price rejected off a strong Fibonacci level.

- APE price triangle consolidation could be over.

- Invalidation of the bearish trade setup is a close above $15.50.

ApeCoin price is one to watch as a 60% rally could commence in either direction. The bullish scenario may be too good to be true.

ApeCoin price looks like a trap

ApeCoin price could be showing early evidence of an end to the consolidative triangle. The APE price has failed to establish a close above the 61.8% retracement level. The sell-off at $13.40 also lines up in sellers’ territory on the 8-hour chart. Traders could be reading the current APE price as a bullish breach of a trendline only to be trapped within a larger bearish trap.

APE price could be fooling many traders by reading the current price action as bullish. Ultimately, ApeCoin price could continue sideways, so the safest entry for the bears will be a close below $10.60.

If this were to occur, the APE price could easily fall to $7 and potentially $4.00. It is worth noting that the volume profile shows no evidence to support who is in control of the current consolidation. Thus, being an early trader is very risky.

APE/USDT 8-Hour Chart

Smart money is likely to place their stop loss above the Wave C at $15.50. A breach of this level is the first invalidation of the bearish scenario. If this bullish event occurs, investors can expect ApeCoin price to surge towards $18. and $20 resulting in a 60% increase from the current APE price.

Author

FXStreet Team

FXStreet