- Bitcoin price witnessed massive 12.5:1 ratio of profit vs transactions in loss within first two trading hours of Monday.

- Proponents note traders' confidence in Bitcoin price reclaiming the $40,000 mark are slim.

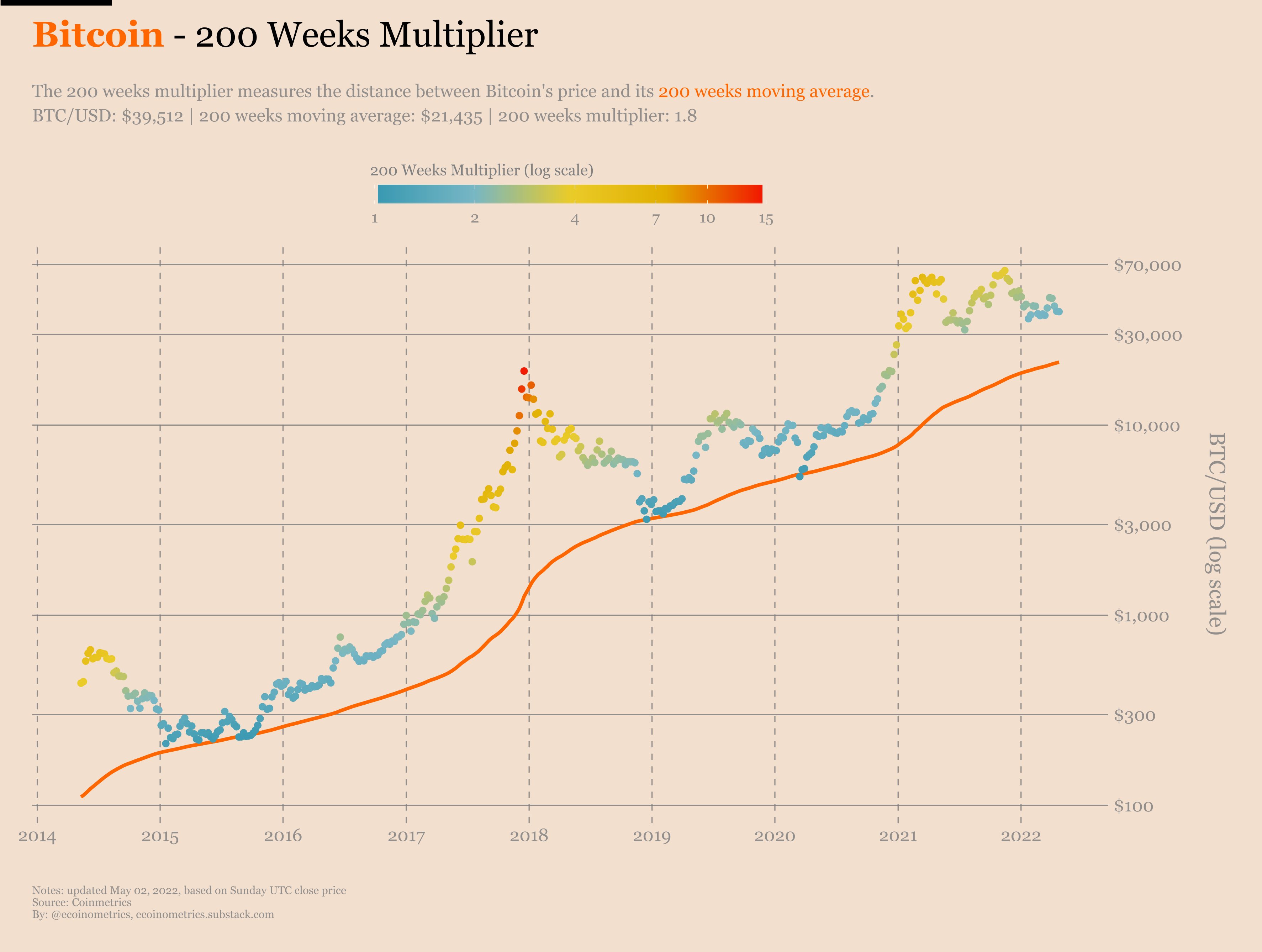

- Analysts have predicted a bearish medium-term outlook for Bitcoin, the asset is diving closer to its 200-week multiplier at $21,435.

Bitcoin price nosedived after fears the Federal Reserve will hike interest rates, and the asset remained highly correlated with tech stocks and the S&P 500. Analysts fear BTC could fail to make a comeback above $40,000.

Bitcoin price struggles to make a comeback

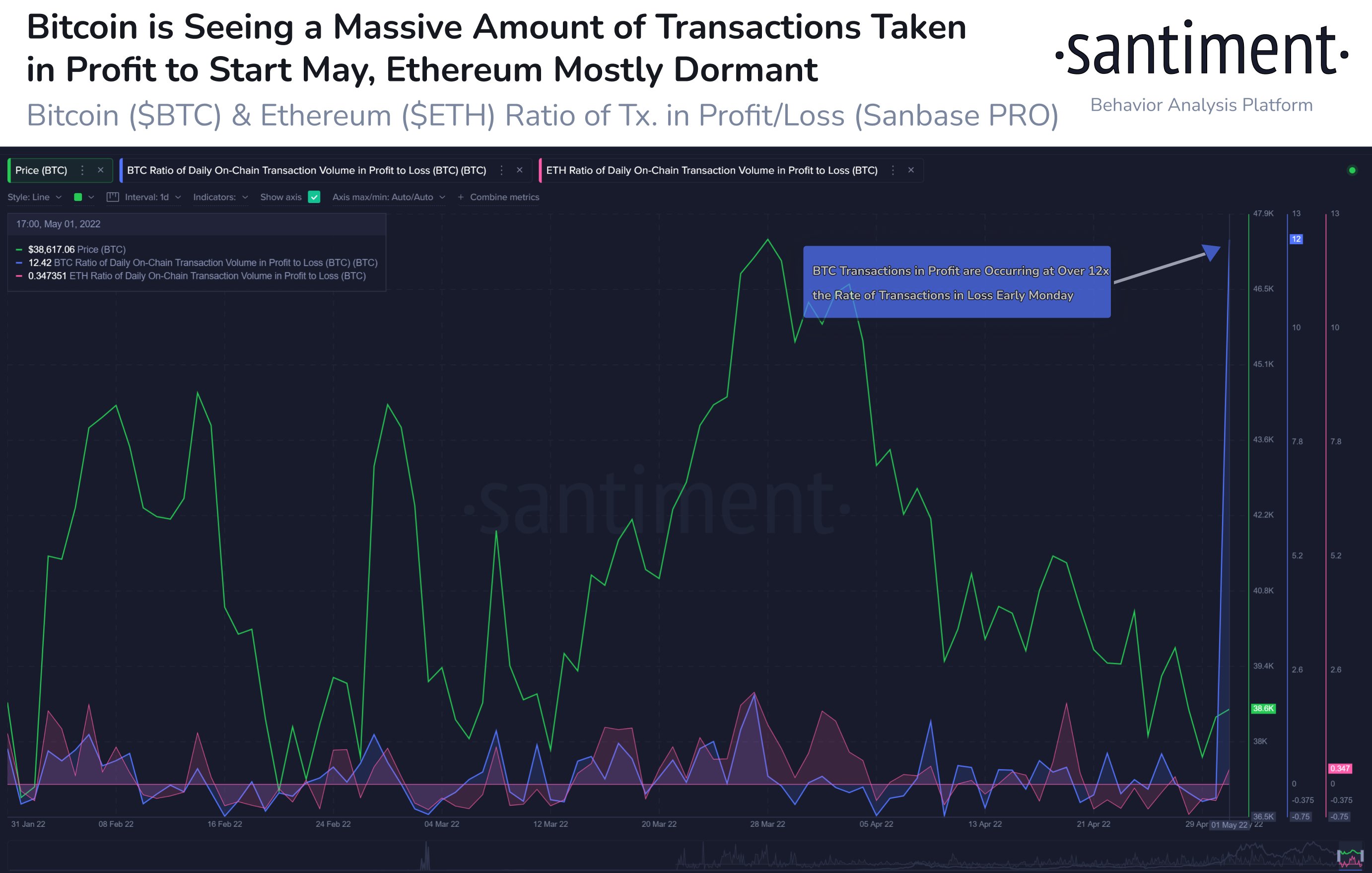

Bitcoin price is wavering as a key metric identifying holders’ sentiment towards the leading cryptocurrency reached extreme readings. Based on data from crypto intelligence platform Santiment, within the first two hours of Monday the Bitcoin network witnessed a massive increase in the ratio of transactions in profit vs transactions in loss.

The ratio is 12.5 to 1, revealing a loss of trader’s confidence in Bitcoin’s recovery and its ability to make a comeback to the $40,000 level. This implies that traders and holders continue to remain unsure of Bitcoin’s chances to reclaim a key psychological barrier at $40,000.

Bitcoin profit taking in the beginning of May 2022

Warren Buffett of Berkshire Hathaway was quoted in an annual shareholder meeting about Bitcoin and its utility. Buffett said,

If you told me you owned all the bitcoin in the world and you offered it to me for $25, I wouldn't take it. What would I do with it?

Buffett believes Bitcoin is not a productive asset and it doesn’t produce anything tangible. The billionaire has a bearish outlook on Bitcoin.

@davthewave, a crypto analyst and trader believes the medium-term outlook for Bitcoin price is bearish. Bitcoin needs to complete its correction towards the end of the year, and start a rally.

Medium-term outlook.

— dave the wave (@davthewave) September 21, 2021

It may not be the prettiest picture, but at least it would have the correction complete toward the end of this year... pic.twitter.com/9kTPgOeoSO

Analysts at ecoinometrics have compared Bitcoin price to its 200-week multiplier and noted the possibility of BTC dropping to $21,435.

Bitcoin - 200 weeks multiplier

The distance between Bitcoin’s price and the 200-day Simple Moving Average has consistently decreased over the past two weeks. The 200-SMA is considered key to Bitcoin’s price trend, and a move below would be considered a very bearish sign for the coin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's (SEC) Crypto Task Force met with El Salvador's National Commission on Digital Assets (CNAD) representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

DeFi Dev Corp buys additional 65,305 SOL amid broader institutional interest: Solana price slides below $150

Solana (SOL) price faces growing overhead pressure and slides below $150 to trade at $148 at the time of writing on Thursday. The sudden pullback follows the crypto market's edging higher on improving investor sentiment, which saw SOL climb to $154 on Wednesday.

Uniswap Price Forecast: UNI whale moves 9 million tokens to Coinbase Prime

Uniswap (UNI) price hovers around $5.92 at the time of writing on Thursday, having rallied 12.8% so far this week. According to Wu Blockchain, data shows that the address potentially related to the Uniswap team, investor, or advisor transferred 9 million UNI to the Coinbase Prime Deposit on Thursday.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.