Why this level will trigger a volatile breakout for Solana price

- Solana price has breached its downtrend but still awaits an uptrend.

- A flip of the $38.03 hurdle into a support level will confirm a 30% move to the upside.

- However, if SOL faces rejection at this hurdle, investors can expect a 30% pullback to the $24.52 foothold.

Solana price faced a sell-off after a quick recovery rally that pushed past a crucial resistance barrier. This rejection followed by a pullback below the said hurdle indicates the significance of that level. Investors need to be cautious with SOL as it is preparing for a volatile breakout.

Solana price ready to make a move

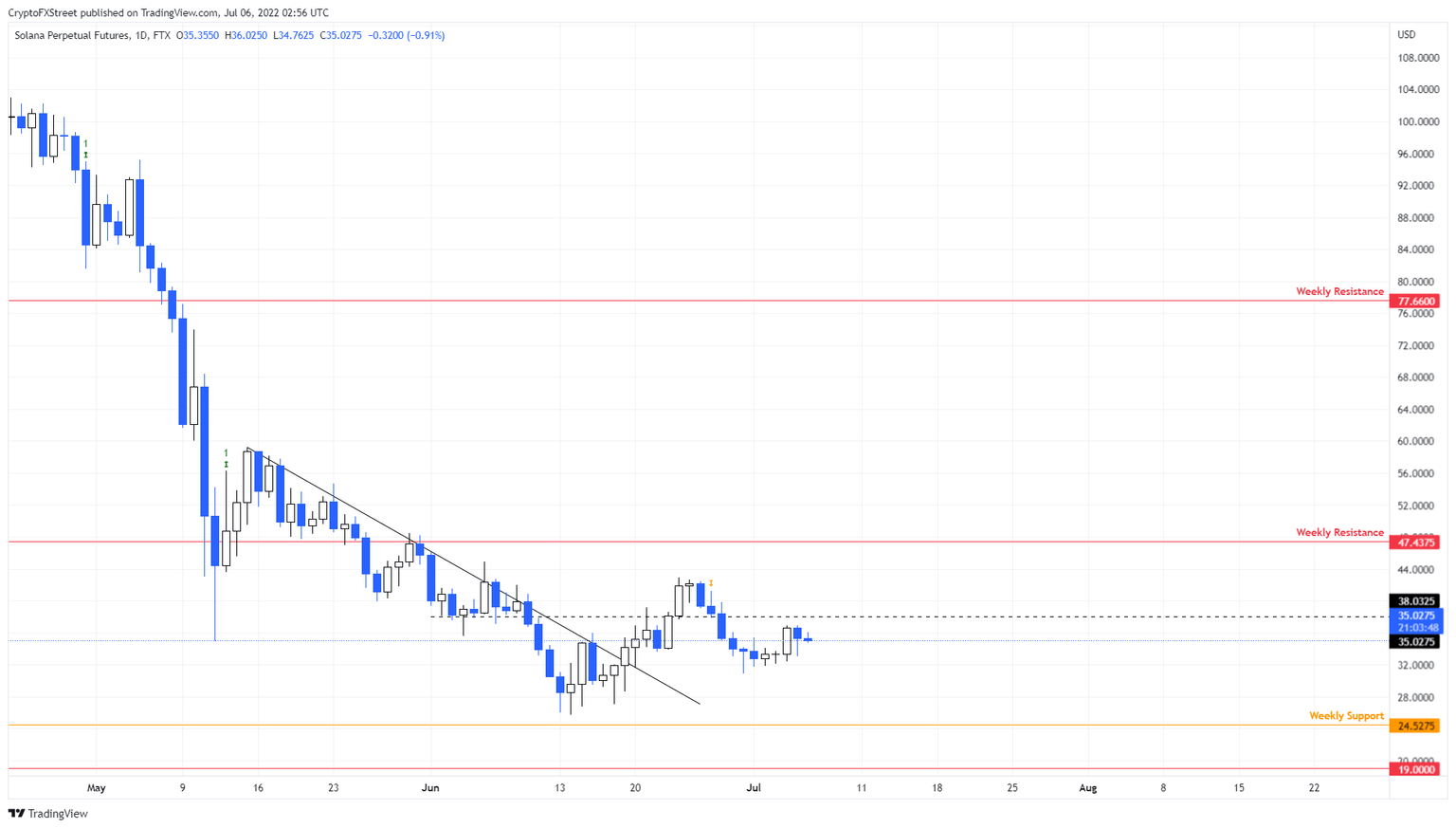

Solana price produced lower lows and lower highs since May 16. Connecting the swing highs shows that SOL was in a downtrend. However, things changed as the altcoin bottomed on June 14 at $25.71.

Since then, Solana price has tried recovering its losses, rallying 66% and pushed above the $38.03 resistance level. While this move was impressive, the retest that flips the said hurdle into a support floor failed. As a result, SOL dropped 28% from the June 24 swing high at $42.89 and formed a base around $30.

Since June 30, Solana price has been slowly moving up and is likely to attempt a flip of the $38.03 barrier again. If the attempt is successful, SOL bulls are likely to trigger a 30% upswing to $47.43, a high-time-frame resistance level.

SOL/USDT 1-day chart

The bullish outlook for Solana price is based on an assumption that SOL manages to flip the $38.03 hurdle. But investors need to pay close attention to Bitcoin before establishing a directional bias for Solana price. In the case where Bitcoin price does not cooperate and starts to dive, then SOL is unlikely to hold up a steady uptrend.

In such a case, a rejection at $38.03 could trigger a 30% crash to the weekly support level at $24.52. Here, buyers may attempt a recovery rally again.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.