Why this inflection point for TRON could propel TRX price by 26%

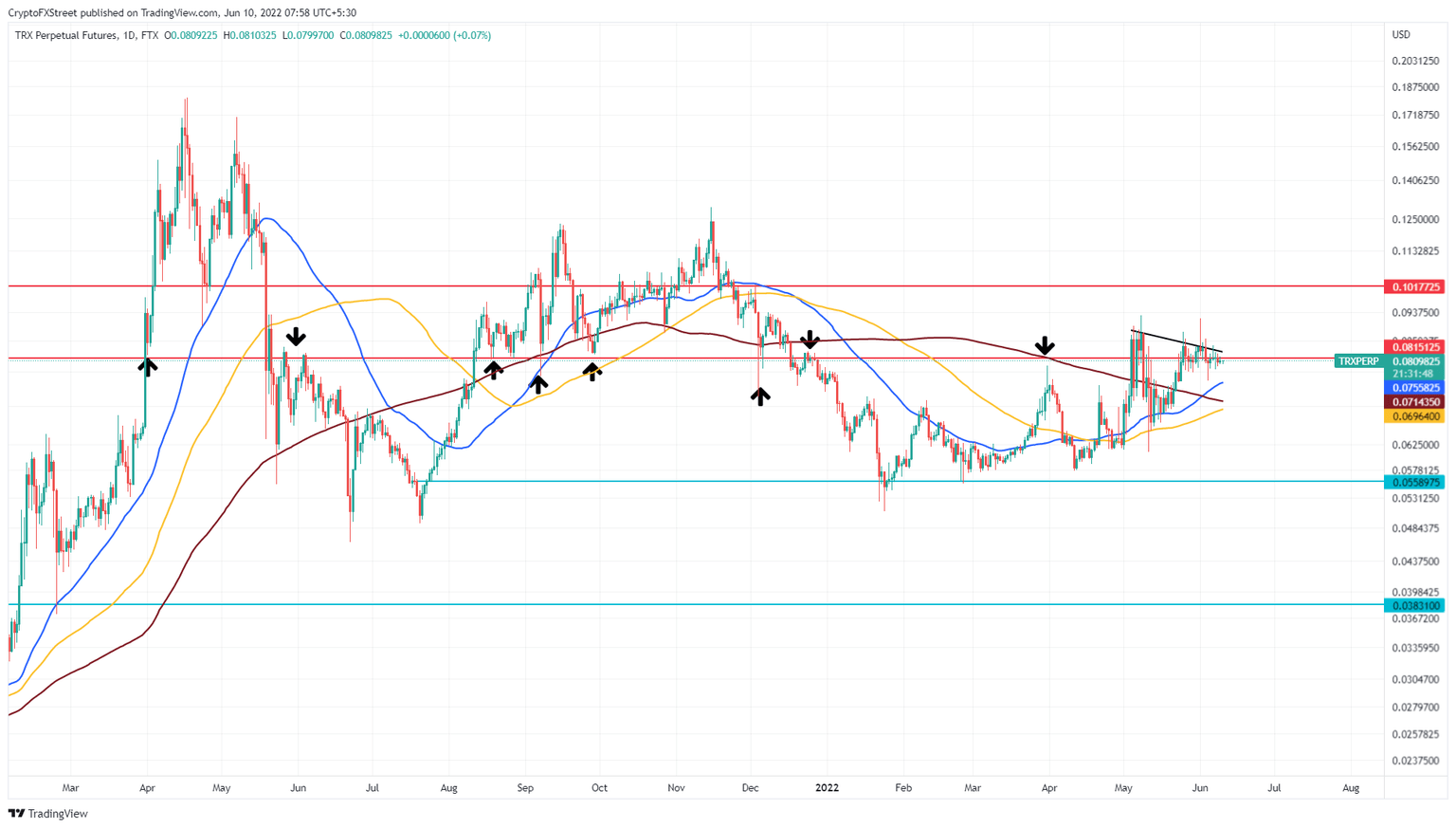

- TRON price is grappling with the $0.0815 resistance barrier, looking to flip it into a support floor.

- If successful, TRX bulls could trigger a 26% run-up to the next hurdle at $0.101.

- A daily candlestick close below the 100-day SMA at $0.069 will invalidate the bullish thesis.

TRON price is at a comfortable position relative to other altcoins in the bear market. Moreover, it has been trying to breach a high-time-frame resistance barrier and flip it into a support floor. If this move is successful, it will allow TRX bulls a chance to rally.

TRON price at a make-or-break point

TRON price is at a better position than most altcoins when compared to where it is relative to the 50-day, 100-day and 200-day Simple Moving Averages (SMAs). While most altcoins are trying to move above these barriers, TRX is sitting comfortably above these SMAs.

Additionally, TRON price has been looking to flip the $0.0815 resistance barrier into a support level for more than a month. If the buyers step in a produce a daily candlestick close above it, it will be the first sign that TRX wants to head higher.

However, investors need to wait for a retest to confirm the successful flip of the said hurdle into a support level. This development will open the path for TRON price to revisit the next blockade at $0.101.

In total, this move would constitute a 26% ascent and is likely where the upside is capped for TRX.

TRX/USDT 1-day chart

While things are looking extremely choppy for TRON price, investors need to be patient and not get caught in the back and forth of intraday volatility. However, if TRX produces a daily candlestick close below the 100-day SMA at $0.069, it will signify weakness from buyers.

This development will invalidate the bullish thesis for TRON price and potentially crash it to the immediate support level at $0.0558.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.