Why these altcoins may not rise despite Ethereum ETF impact

- Altcoins market cap against Ethereum has been on a multi-year decline.

- Ethereum has outperformed several altcoins despite wider market assumptions that they provide leveraged exposure to its price.

- 2x long ETH could yield better results than purchasing altcoins ahead of the Ethereum ETF launch, said analyst.

A recent analysis by onchain analyst Thor Hartvigsen reveals that Ethereum could outperform altcoins after the launch of ETH ETFs despite wider market assumptions that these tokens provide leveraged exposure to ETH.

Ethereum has performed fairly better than most altcoins

In a recent issue, Thor Hartvigsen of On Chain Times noted that investing in Ethereum-related altcoins to gain leveraged exposure to ETH may be a poor strategy ahead of the ETH ETF launch.

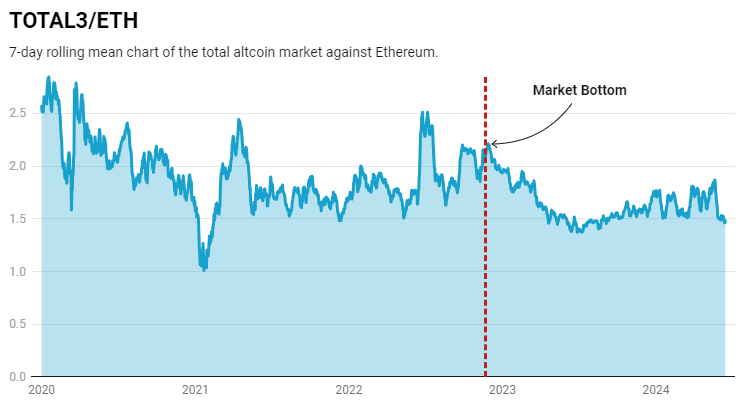

Hartvigsen highlighted that it's difficult to find specific altcoins that can outperform ETH, as the total altcoin market cap vs. Ethereum has been in a multi-year decline.

In an analysis comparing Ethereum against tokens across the Layer 2 ecosystem, alternative Layer 1s, DeFi and memes that are assumed to have a high correlation with it, ETH outperformed several of these tokens year-to-date except TON, BNB, PENDLE, ENS, MKR, PEPE and SHIB.

ETH vs. Altcoins

The price correlation between ETH and the tokens that managed to outperform it also reveals a different story, as most of them are 60% or less correlated with ETH. This "indicates that more of their performance is a result of other factors (potentially BTC correlation or idiosyncratic variables)," wrote Hartvigsen.

The analysis also revealed that only a few altcoins have significantly higher volatility than Ethereum, leaving less potential for huge upside should ETH rally following ETH ETFs going live.

"Buying these altcoins as a way to get leveraged exposure to ETH is, in my opinion, a foolish game as you're taking on a lot of additional risk you might not be aware of. If you're looking for leveraged ETH exposure, simply putting on a 2x ETH long on e.g., Aave is more sensible. Here, you achieve a 100% correlation and a beta value of 2," Hartvigsen advised.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi