Why the Dogecoin price could print new lows during Autumn

- Dogecoin price has witnessed a sharp sell-off, losing 30% of market value since August.

- The largest candlestick within the 3-day chart is in favor of the bears.

- Invalidation of the bearish thesis remains a breach above $0.118.

Dogecoin price shows the bears are still in control. Key levels have been identified.

Dogecoin price is under pressure

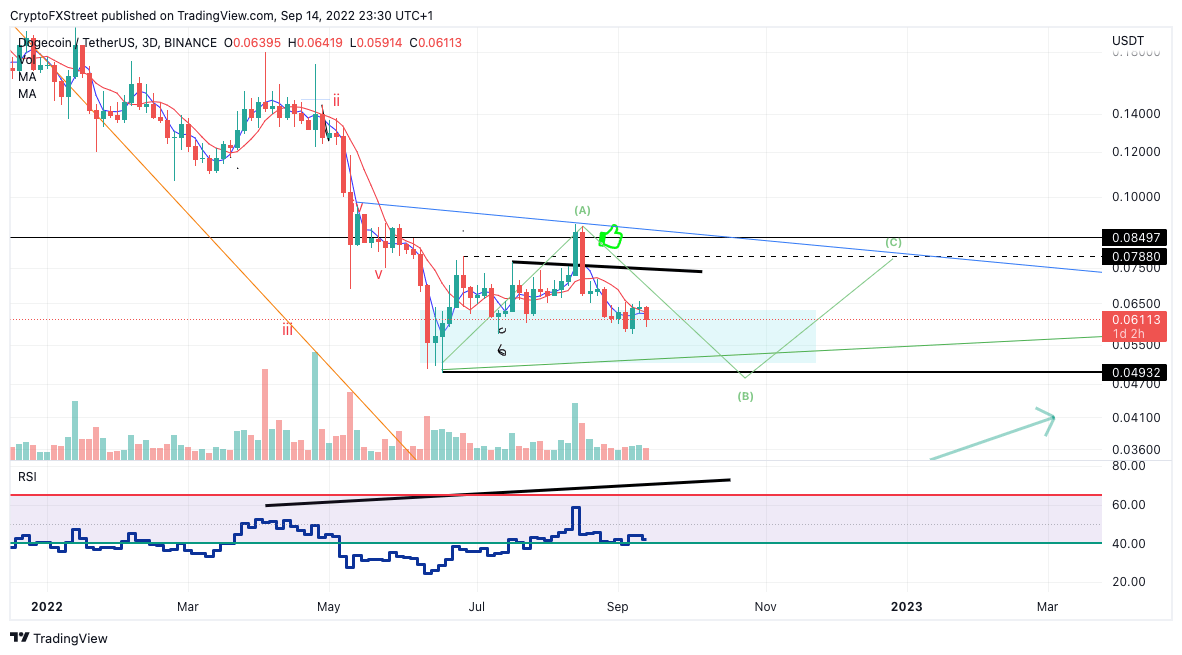

Dogecoin price shows reasons to be concerned as the notorious meme coin has yet to retaliate against the bearish onslaught. Since the final days of August, Dogecoin price witnessed a devastating crash as breakout bulls were coerced into buying a smart money fake out near the $0.08 level. The resultant large bearish engulfing candle decimated all hopes for the anticipated bull run.

Dogecoin price currently auctions at $0.06 as the bears are forging resistance near the 8-day exponential and 21-day simple moving averages. The uptrend scenario looks ever more challenging as the largest candle within the trend currently owns the bears based on the 3-day chart. The bulls will need to find stable support above the moving averages to challenge the large candlestick high at $0.088, or an imminent fall occurs.

If an additional plummet of equal value to the strongest candle occurs within the current trend, the DOGE price could fall to $0.049. Such a decline would result in a 22% decrease from the current market value.

Still, last month’s bearish thesis remains in play with a definitive close above $0.118 to call an end to the downtrend mayhem. If the bulls can hurdle this barrier, a favorable bull market environment could be underway, giving bulls the power to target the 2021 swing high at $0.22.

In the following video, our analysts deep dive into Dogecoin's price action, analysing key market interest levels. - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.