Why the current XRP price slump has nothing to do with the SEC

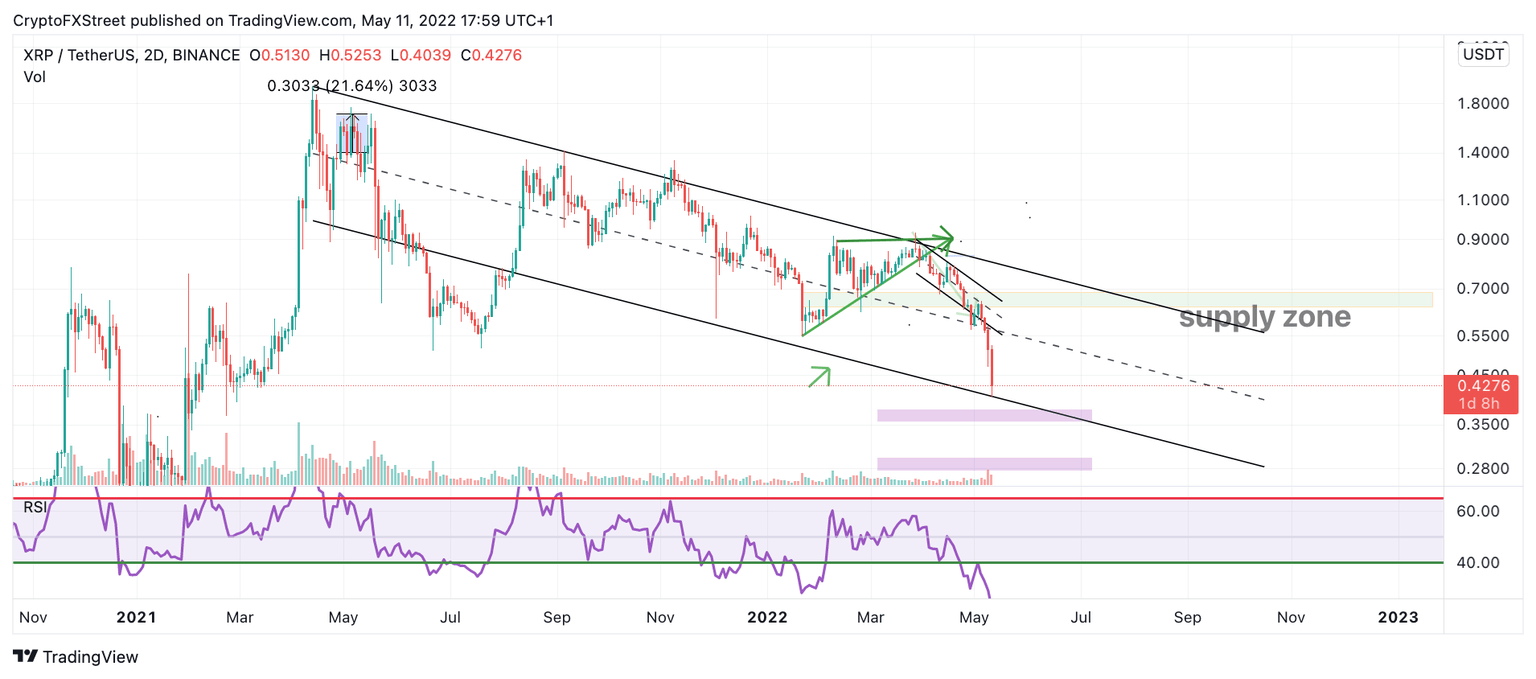

- XRP price has fallen to the lower half of the consolidative trend channel.

- Ripple price fails to find support on the Relative Strength Index.

- Invalidation of the bearish outlook is a breach at $0.55.

XRP price displays significant market maker involvement as liquidity levels under $0.50 have been breached.

XRP price on a liquidity hunt

XRP price is likely a sore thumb for investors as the digital remittance token has revisited the $0.44 price level, which was last traded in March 2021. The XRP price action signals significant liquidity hunting from market makers as the selloff continues to occur under relatively low volume. Thus one can assume the selloff is disingenuous and not based on fundamentals or shocking news events, unlike LUNA token, which has seen a 90% decrease in 24 hours based on technological and fundamental misfortunes.

XRP is undoubtedly a coin to consider accumulating through a dollar-cost average approach that could yield better results in such an unpredictable market. The bears could be targeting liquidity under $0.38, and $0.28 as the final capitulation low before new gains are made. The bulls have failed to breach through the lower end of a parallel channel, which leaves reasonable doubt that the final low has been established. The Relative Strength Index also shows XRP price failing to find support in buyers’ territory, which confounds the potential for more downswings in the future.

XRP/USDT 2-Day Chart

Invalidation for those looking to be early buyers could be a breach of the previous wave of 4 degrees at $0.56. If this were to happen, traders could place their stop loss below the ultimate swing low and aim for $1.00, resulting in a 140% increase from the current XRP price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.