Why the Chinese mining ban is bullish for Bitcoin

After multiple years and “bans”, the Chinese government is actually cracking down on cryptocurrency mining this time. While this has been causing headwinds and panic in the short-term, the so-called great mining migration is likely to be beneficial for Bitcoin over the long-term.

First off, it is worth clarifying the events that have been taking place over the last few months relating to the recent Chinese mining ban. On May 21, the Chinese Vice Premier Liu He first called for the banning of mining, excluding previous attempts. Then on May 25, the coal-heavy Inner Mongolia region proposed eight measures to phase out crypto mining, with the measures taking effect on June 1st. Other Chinese regions followed suit with Xinjiang and Sichuan implementing similar bans two weeks later.

While at first many pointed to environmental concerns as the reason for these measures, Sichuan’s energy is hydro-based, raising doubts about ESG being behind China’s moves. The reasons behind the mining ban might never be uncovered, but it is certain that Bitcoin mining has undergone one of the largest shifts in its twelve year history.

These effects are noticeable on the hash rate — a frequently used indicator measuring the aggregate computing power contributed by miners to the blockchain.

As of June 29, 2021 using IntoTheBlock’s Bitcoin Mining Indicators

Bitcoin’s hash rate has decreased by 40% in June, making it one of the sharpest drops in its history. This is important because miners secure the network, and with their aggregate contributions declining it becomes less costly to attempt to attack the blockchain.

Although this may seem worrying, Bitcoin has incentives in place such that more miners increase the hash rate again. Since Bitcoin’s price has dropped 6% while hash rate decreased 40%, it is relatively more profitable to mine now than it was a month ago. This is the case as there is less competition to mine Bitcoin’s next block, but nearly the same reward (in dollar terms).

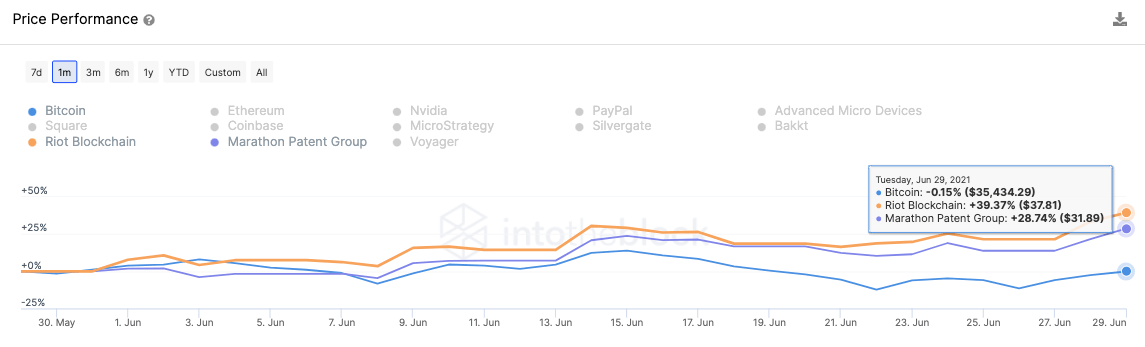

Traditional markets appear to have priced in this increase in miner profits as is apparent from the performance of American-based crypto mining stocks.

As of June 29, 2021 using IntoTheBlock’s Capital Markets Insights

Both Marathon and Riot have large-scale mining operations in the United States. Given the mining crackdown in China, companies such as these have profited with Marathon and Riot appreciating 29% and 39% respectively. With these increases in profits, as well as with the network difficulty dropping, the hash rate is expected to increase again.

Another factor that worries some people short-term is miners selling. As Chinese miners have to incur expenses to relocate elsewhere, they may have to sell part of their Bitcoin holdings. Using on-chain data we can track that miners have indeed been transferring out their holdings.

As of June 29, 2021 using IntoTheBlock’s Bitcoin Mining Indicators

Netflows display the amount being received by miners minus the amount leaving their addresses. On aggregate, miners appear to have transferred out 30,000 more Bitcoin than they received on June 7 and 15, making it the largest negative netflows in the past three months. This points to miners selling some of their holdings during the migration taking place in June.

While 30,000 Bitcoin sounds like a large amount, it is not as significant when put relative to the total volume of Bitcoin traded on a daily basis. At its height just 6% of Bitcoin’s volume comes from miners’ addresses.

The small percentage of volume deriving from miner flows points to fears of the market crashing because of miners selling being exaggerated. While they certainly do play a role in securing the network, miners have decreased their relevance in terms of volume with their volume share dropping consistently over the years.

Overall, the dispersion of Bitcoin mining — while disruptive in the short-term — is a net benefit over the long-term as Bitcoin becomes more decentralized and less dependent on Chinese miners. Concerns about China potentially controlling Bitcoin should largely come to rest with this shift.

Moreover, fears of near-term selling from miners may also be overstated with their share of volume making at most 6% of the total. This points to panic and profit-taking being the real driver behind the price action. Ultimately, even though the mining migration has led to many’s concern, Bitcoin is heading to a more decentralized and resilient future.

Author

IntoTheBlock Team

IntoTheBlock

IntoTheBlock Team consists of a tribe of data scientists, crypto experts and AI geeks.