Why the Chainlink rally is nearing its end game

- Chainlink sees its weekly gains evaporate in the last trading hours during the closing session on Sunday.

- LINK price still holds a solid 25% return going forward.

- Once one of the caps is hit, expect to see a big fade or even a reversal back to lower levels.

-637336005550289133_XtraLarge.jpg)

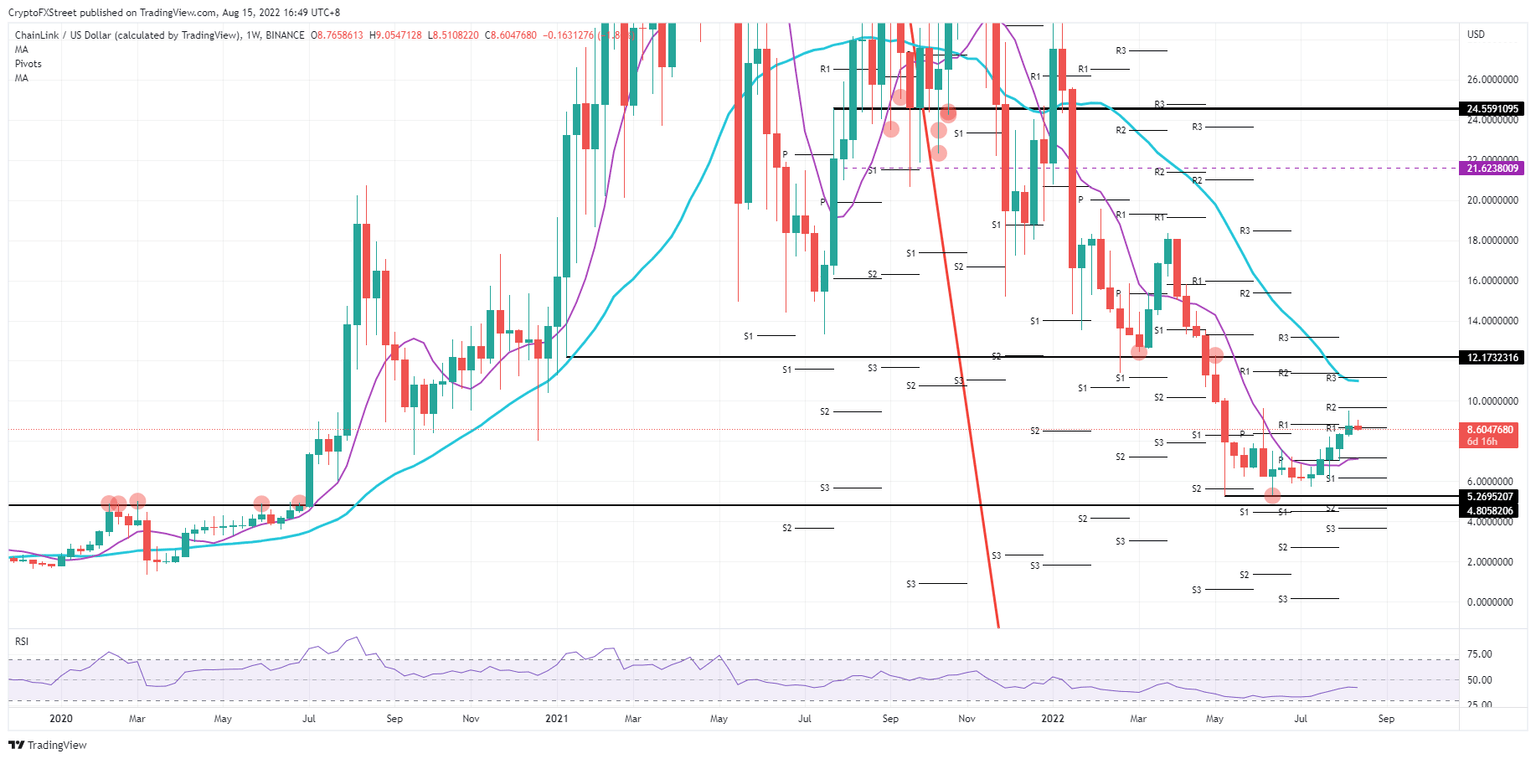

Chainlink (Link) price sees a big piece of its weekly gains go up in the air on Sunday night, while LINK price action can still close the week with a profit. The rally stays intact with a winning streak of five consecutive gains. Although there are still 20% of gains or more on the table, the rally starts to near its end game as a powerful cap is set to kick in and trigger a big fade to the downside.

LINK price on a final stretch

Chainlink price has had a very good winning streak, even withstanding some headwinds that came from several Fed officials issuing warnings about the rate expectations of the markets and the current recovery rally. Although even several investors and big hedge funds have warned about the sustainability of the summer rally in equities and cryptocurrencies, LINK price still holds some room in its tank to pop higher before hitting a key resistance level. With still a 20% profit on the table, traders should be aware that a turnaround is coming soon.

First up for LINK price is the $10 handle, just above the monthly R2 resistance level. The best scenario would be a weekly close and open next week above this area with a test or possible break on the 200-day Simple Moving Average (SMA) at $11.14. That level coincides with the monthly R3 resistance level and is slightly above $12.17 as a key cap on the price action.

LINK/USD Weekly chart

As mentioned in the opening paragraph, risk comes with possible rejection and, next, a fade or full collapse of the price action. For support, the monthly pivot would come into play at $7.10 together with the 55-day SMA. Worst case price action would drop back to $5.26, which would mean an over 40% reduction in its valuation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.