- Ethereum price stalls near the critical $3,500 price level.

- Consolidation between $3,300 and $3,500 may continue until early April.

- Very few warning signals for a broad sell-off exist, but downside risks remain a concern.

Ethereum price action looks poised to take a breather before continuing its spectacular run. After two consecutive days of late-session selling pressure, buyers appear apprehensive for the first time in over three weeks.

Ethereum price could see profit-taking before pushing on towards $4,000

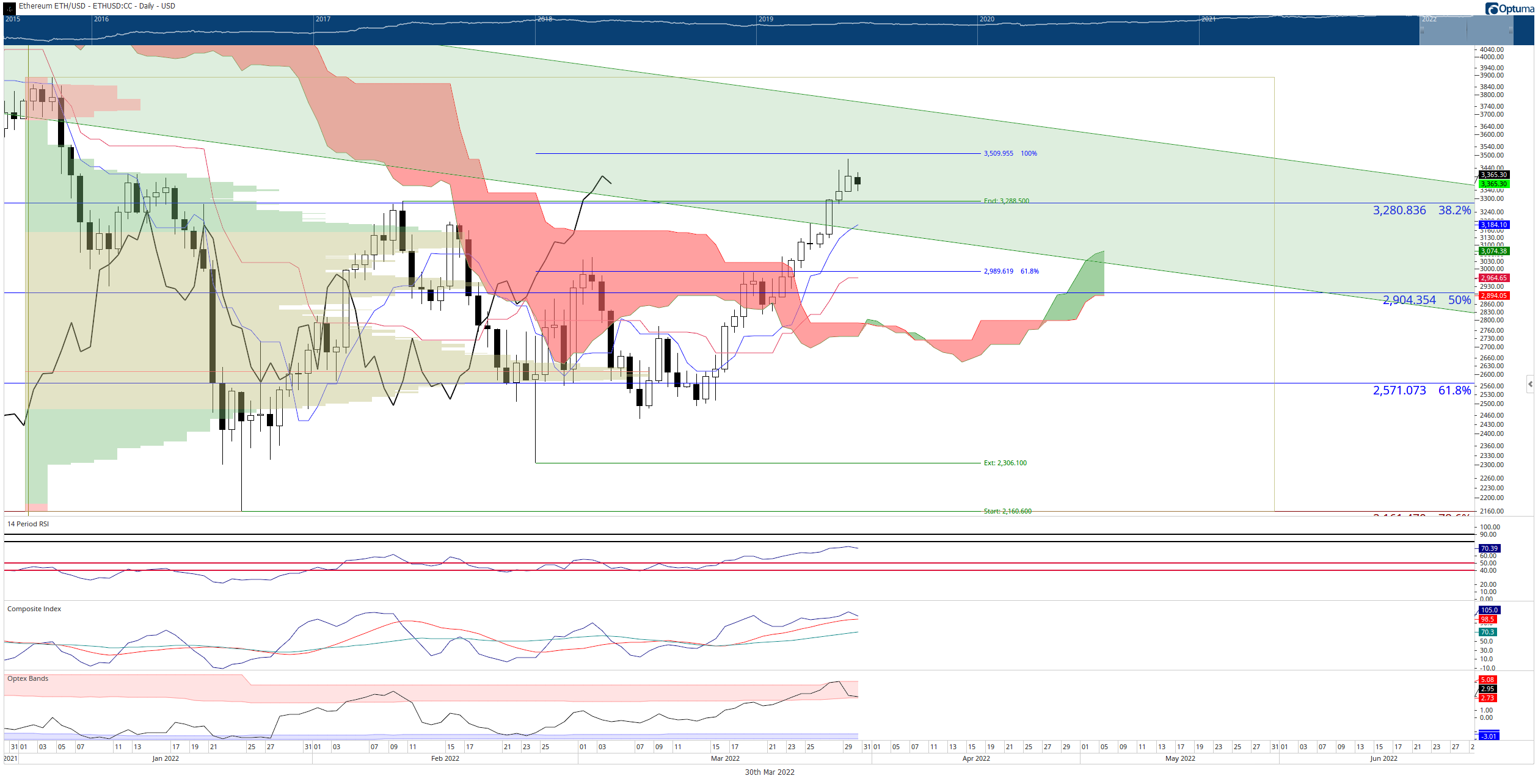

Ethereum price is having some difficulty cracking the $3,500 resistance level. That difficulty is not much of a surprise when you consider the collection of resistance at $3,500: the weekly Kijun-Sen and 100% Fibonacci expansion. Achieving a breakout above this level will likely create another massive bullish drive for ETH.

The daily Relative Strength Index remains in bull market conditions and is not yet at the first overbought level of 80. This suggests that the Ethereum price could continue to push higher to at least the $3,800 value area. But even if that occurs, buying pressure may not cease. The weekly Relative Strength Index is just coming out of the long congestion zone of trading between the oversold levels of 40 and 50 since the beginning of 2022.

Additionally, because many new traders continue to view, incorrectly, the RSI as overbought as 70, Ethereum bulls may be developing a bear trap near $3,500. The interpretation of 70 as an overbought level was changed in 2012 with Connie Brown's groundbreaking work, 'Technical Analysis for the Trading Professional' – required reading for the CMT certification.

Upside potential could extend as high as the 161.8% Fibonacci expansion at $4,550. Downside risks are likely limited to the bottom of the bull flag and top of the Ichimoku Cloud (Senkou Span A) at $3,175.

ETH/USD Daily Ichimoku Kinko Hyo Chart

Downside risks for Ethereum price should be limited to the $3,000 value area, where the 50% Fibonacci retracement and daily Kijun-Sen exist.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.