Why Solana price could crash to $30

- Solana price is positioned for a strong bearish continuation move into the $30 value area.

- Only one support level in the Ichimoku system is currently providing support.

- A 35% to 40% wipe from SOL's present value area is expected.

Solana price action continues to face selling pressure since hitting a weekly high near the $60 value area. While SOL is down 15% from the weekly high, it is still up nearly 34% from the new 2022 lows established during last week's flash crash. However, the current price action is warning that a return to the 2022 lows is increasingly likely to surpass those lows.

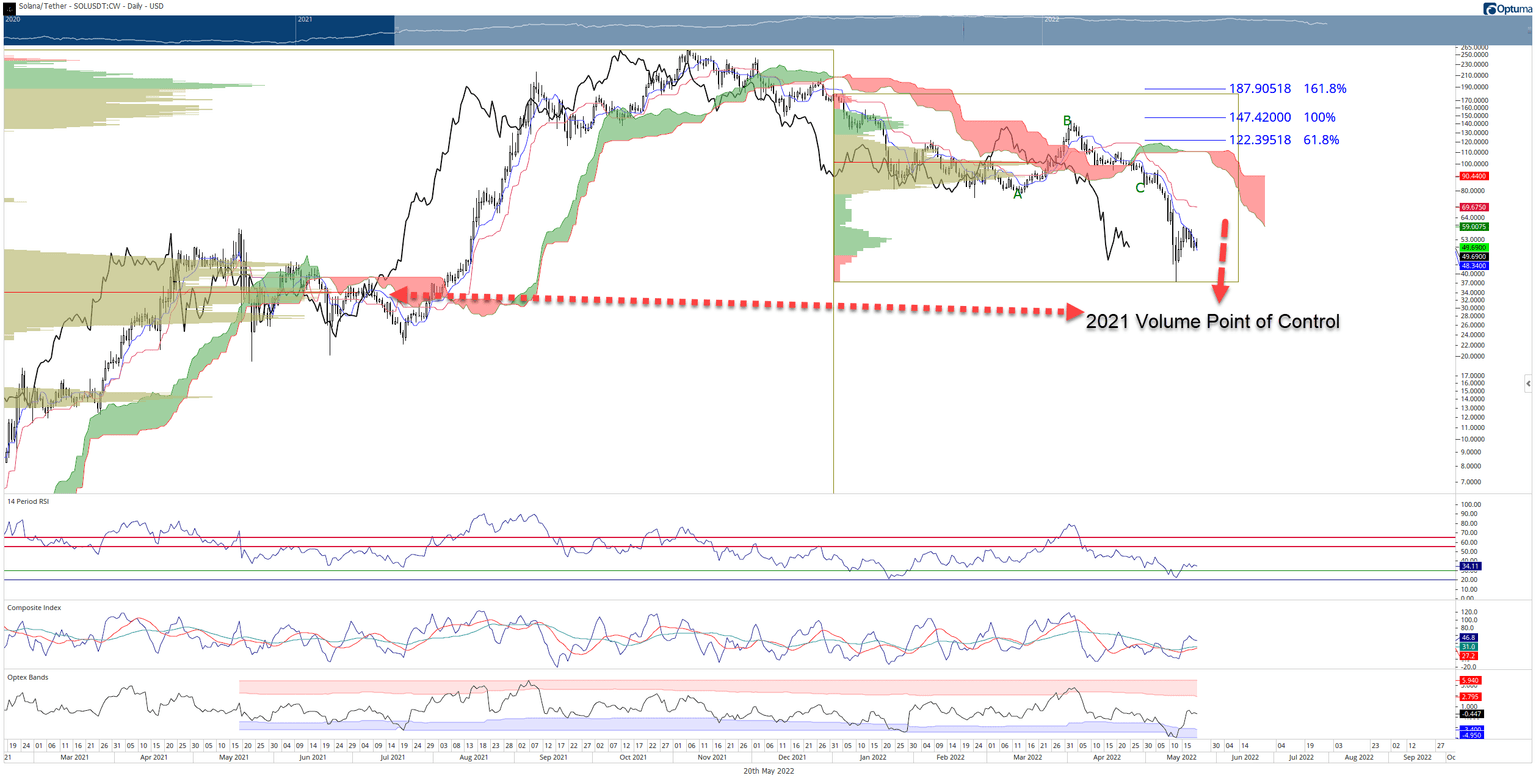

Solana price is positioned to fall back to the 2021 Volume Point of Control

Solana price is in a very touchy spot on the daily chart. Currently, it is just above the daily Tenkan-Sen. Unfortunately for bulls, the Tenkan-Sen has acted as the primary resistance level for SOL since April 6, 2022, as bulls have been unable to create any meaningful or sustained move above it.

If Solana price closes below $48, then SOL will be below the current high volume node, likely triggering a fast sell-off until the next high volume node. Unfortunately, that next high-volume node doesn't appear until $33, where the 2021 Volume Point of Control exists.

SOL/USDT Daily Ichimoku Kinko Hyo Chart

Fortunately, for bears, the conditions that buyers would need to create to reduce any further near-term threats are extremely difficult. Even if bulls could push Solana price to a close above the Kijun-Sen at $70, they would still be stuck with the high volume node and 2022 Volume Point of Control between $87 and $100.

The only near-term bullish condition is the presence of a Kumo Twist. Kumo Twists are occurrences where Senkou Span A crosses Senkou Span B (the Cloud changes color). If an instrument is trending into a Kumo Twist, then there is a strong probability that the trend will face a correction or a trend change.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.