Why Solana could be the next altcoin to explode

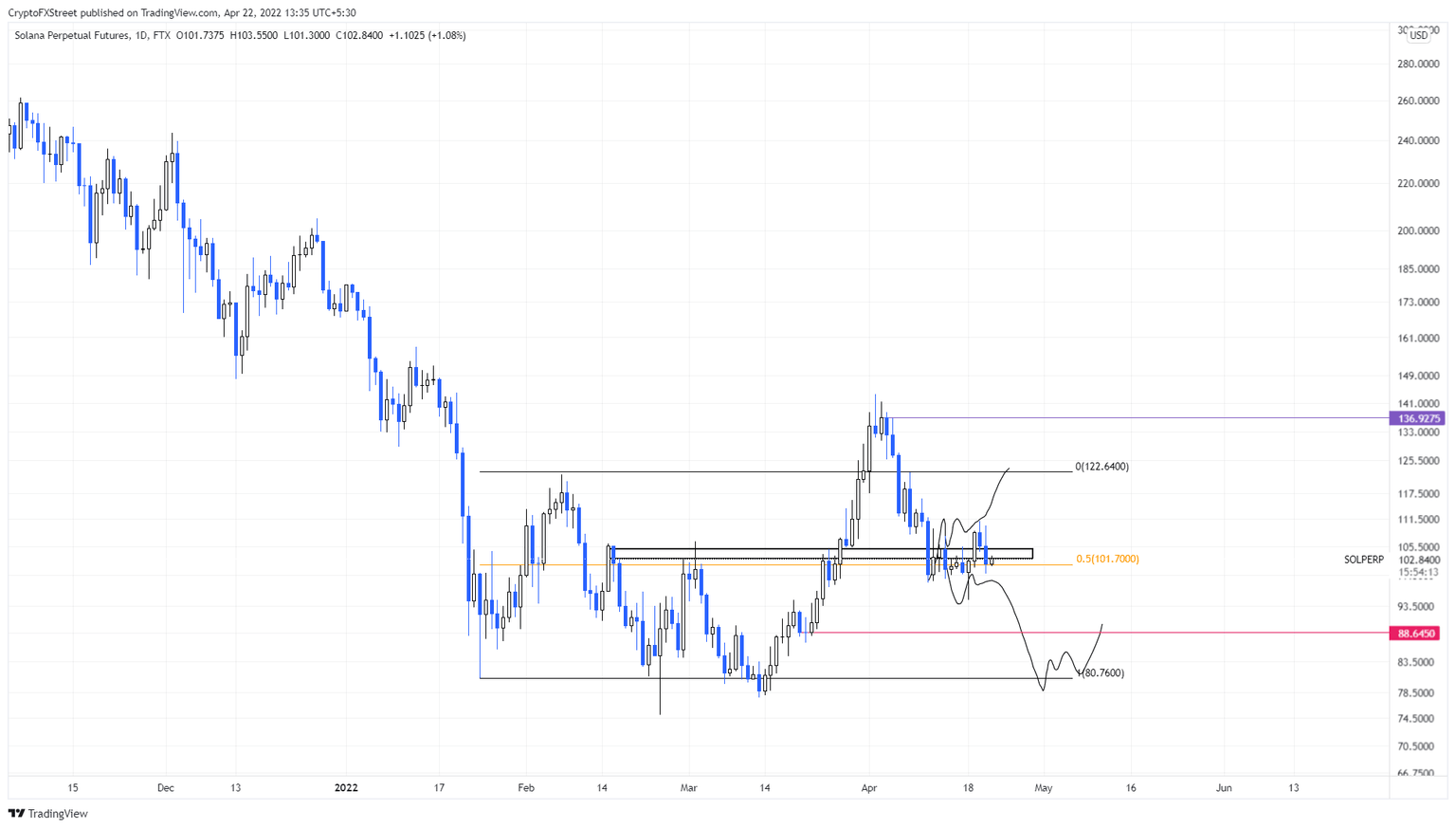

- Solana price readies itself for a move to $122 after recovering above the trading range’s midpoint.

- Investors can expect the run-up to extend to $135 if bullish momentum continues to pour in.

- A daily candlestick close below $80.76 will invalidate the bullish thesis for SOL.

Solana price has been consolidating below a stiff resistance barrier for quite some time. The recent uptick in buying pressure has pushed it above the said level, flipping it into a support floor. As a result, market participants can expect SOL to kick-start an explosive move to the upside.

Solana price awaits a breakout

Solana price set a range extending from $80.76 to $121.52 after it rallied 51% on January 24. SOL has been trading in between the two levels with no signs of escaping. Although SOL tried moving out of this range in April, the bulls were hammered down.

Often, rangebound moves sweep one side to collect liquidity and target the next limit to do the same. On a similar note, SOL price deviated below the swing low on February 20 and triggered an 83% rally.

This upswing set a swing high at $143.56 and was immediately followed by a corrective wave due to the bearish market structure combined with investor profit-taking. As a result, Solana price dropped 32% and reentered the range.

Additionally, the immense selling pressure also pushed it below the 50% retracement level at $101.70. As of April 11, Solana price began its consolidation below $101.70 and has not produced a substantial move away from it. Although SOL has managed to flip it into a support level, only a resurgence of buyers will kick-start an upswing.

Therefore, an uptick in buying pressure could propel SOL by 20% to retest the range high at $121.52. In a highly bullish case, SOL can extend the uptrend to tag the $136.92 level, bringing the sum total run-up to 32% from the current position - $103.2

SOL/USDT 1-day chart

Regardless of the recent flip of the $101.70 hurdle, a sudden shift in Bitcoin’s market structure will cause altcoins to go haywire. Such a development that sees Solana price produce a daily candlestick close below $80.76 will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.