Why short-sellers are moving to trade Ethereum price

- Ethereum price is retesting the last line of defense at $1,049, signaling a potential crash.

- Whales holding between 100 to 100,000 ETH are accumulating at these dangerous levels.

- A breakdown of $1,049 could trigger a 35% crash to the $658 support level.

Ethereum price faced rejection after failed attempts to move past a significantly important resistance barrier. This development has led to ETH reversing the trend and returning to a stable support level, which will now decide the fate of the smart contract token.

Ethereum price crashes after the Merge testnet launch

The Merge was launched on testnets on June 8, which was a sell-the-news event, causing Ethereum price to crash 52% in the next ten days. Since then, the developers have been working non-stop to bring Merge to the beacon chain.

As of June 30, the Merge was implemented on the Ropsten and Sepolia test networks. Péter Szilágyi, team lead at Ethereum announced earlier today that Geth v1.19.20 was released, which makes, “the Sepolia hard fork simpler for people not wanting to mess with command line overrides.”

Many such major upgrades have been a sell-the-news type of event in the crypto ecosystem. For example, the launch of CME Bitcoin futures on December 18, marked the end of the 2015-2017 Bitcoin bull cycle. The launch of the Bakkt exchange on November 25, 2019, triggered a massive crash in Bitcoin price as well.

The most recent example for Ethereum is the launch of the Lonon hard fork and the most popular EIP-1559 upgrade pushed ETH price up by 25% but then crashed it by 33%.

Although the Merge has been delayed countless times, the current market conditions suggest that it would not help the Ethereum price’s case.

ETH to venture into triple-digit territory again

Ethereum price rose 45% between June 18 and June 26, from the lowest point at $880 to a peak of $1,280. While this recovery was impressive, ETH then faced the 200-week Simple Moving Average (SMA) at $1,200 for four consecutive days and failed to sustain a move above it.

On the fourth day, Ethereum price slipped below this significant level, indicating that the buyers were weak. Since then, ETH has dropped 12% and is currently hovering above the $1,049 support level.

This barrier was a major stepping stone in early 2021 that pushed Ethereum price to more than quadruple in less than a year. Despite the breach of this level during the recent June 19 crash, buyers pushed ETH to produce a three-day candlestick closes above it, further adding credence to the foothold.

Hence, a breakdown of this barrier will lead to a massive nosedive. Supporting this bearish outlook for Ethereum price is the Fair Value Gap (FVG), extending up to $658. This price inefficiency between $658 and $1,049 was formed as ETH price moved quickly in one direction, which leaves a gap in price and in volume traded.

Investors should expect a 35% crash, therefore, should the $1,049 support level break down.

ETH/USDT 3-day chart

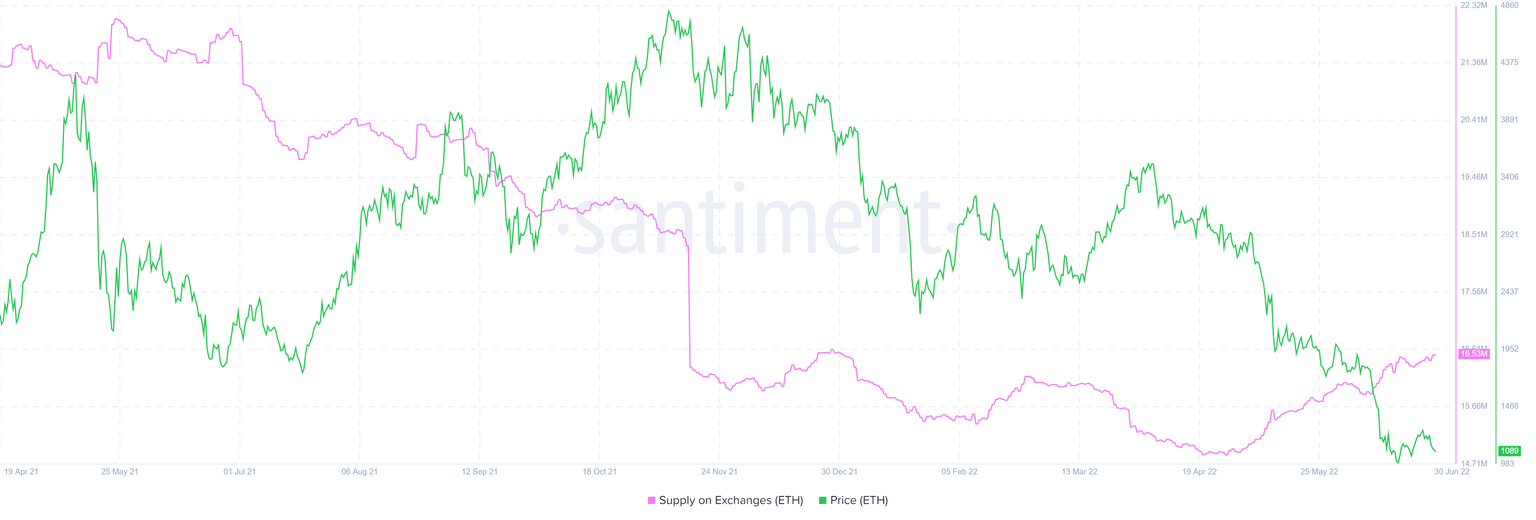

The supply of ETH held on exchanges has been on a massive uptrend since April 2022 from 14.86 million to 16.54 million. This 11% hike in ETH held on centralized exchanges serves as a sell-side pressure.

These investors could panic sell their holdings during a flash crash, adding more downside pressure. Hence, investors need to be careful with leverage trading or trying to buy the dip.

ETH supply on exchanges

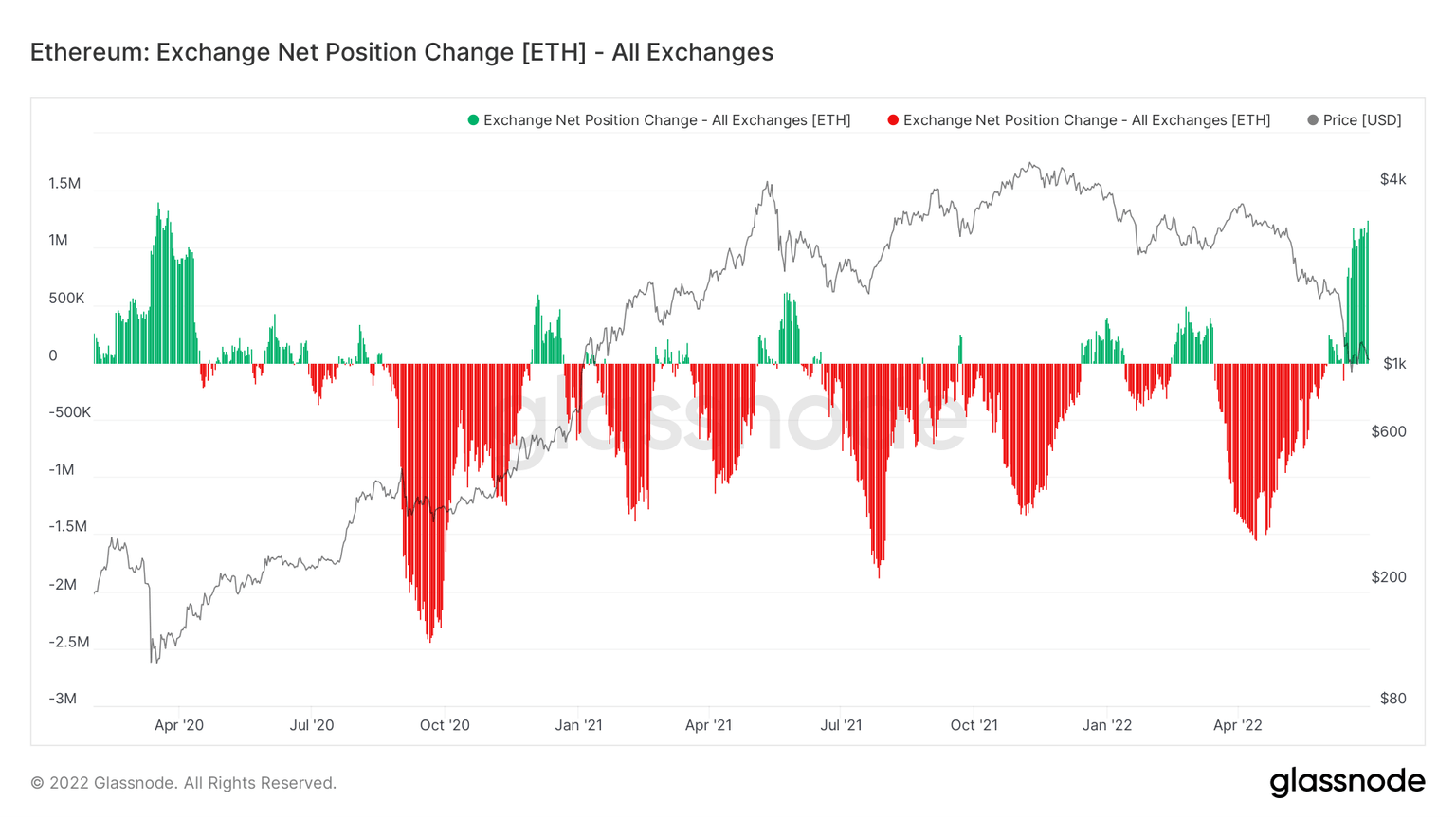

Further adding proof to the negative state of Ethereum price is the exchange net position change index, which shows that 1.24 million ETH were sent to exchanges. This inflow could mean one of two things, market participants are using their holdings as collaterals to their borrowing or they could be hoping to sell.

Either way, a sudden spike in selling pressure could turn ugly real soon for Ethereum price.

ETH exchange net position change

To conclude, things are looking extremely bad for Ethereum price from a technical standpoint. However, for a 35% crash to occur on ETH alone seems unlikely, especially without help from Bitcoin. And BTC price is nowhere near triggering another brutal crash, at least not until the $18,000 support level is breached.

So, investors can breathe a sigh of relief and hope that Bitcoin manages to bounce.

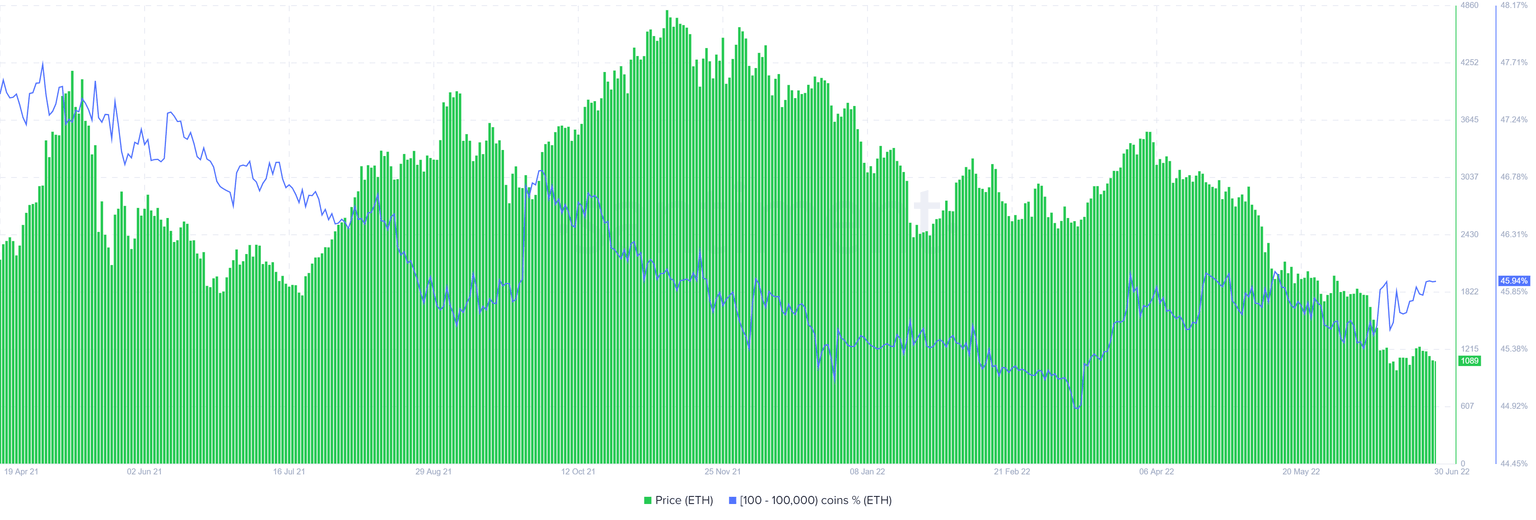

A bullish update among the sea of bearish outlooks is that Ethereum sharks and whales holding between 100 and 100,000 ETH have been accumulating since March 2022. A total of 1.03% of ETH’s supply was added to these buyers’ bags, suggesting that these investors are bullish.

ETH suppy distribution

In the case that Ethereum price bounces off the $1,049 support level and produces a three-day candlestick close above the 200-week SMA at $1,200, it will invalidate the bearish thesis explained above.

However, after this flip, ETH needs to rally higher and retest the 2017 all-time high at $1,463. In a highly bullish case, Ethereum price might extend this rally to retest the $1,726 resistance level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.