Why selling pressure could be lower than expected post Ethereum’s Shanghai/Capella update

- There is speculation that selling pressure could be high after Ethereum’s Shanghai Capella update, this may not be the case.

- Most stETH on the Beacon Chain were locked in at a loss, hence less likely to be dumped, CryptoQuant says.

- Ethereum’s Implied Volatility could increase as Shapella draws near, Blofin market analyst says.

Ethereum Shanghai/Capella update (Shapella), scheduled for April 12 at 22:27:35 UTC is almost here. The upgrade will enable users to withdraw their staked ETH (stETH) via the “Beacon Chain,” a platform that initially supported the Proof-of-Stake (PoS) migration. As the days draw near, speculation about its potential impact on the market also grows.

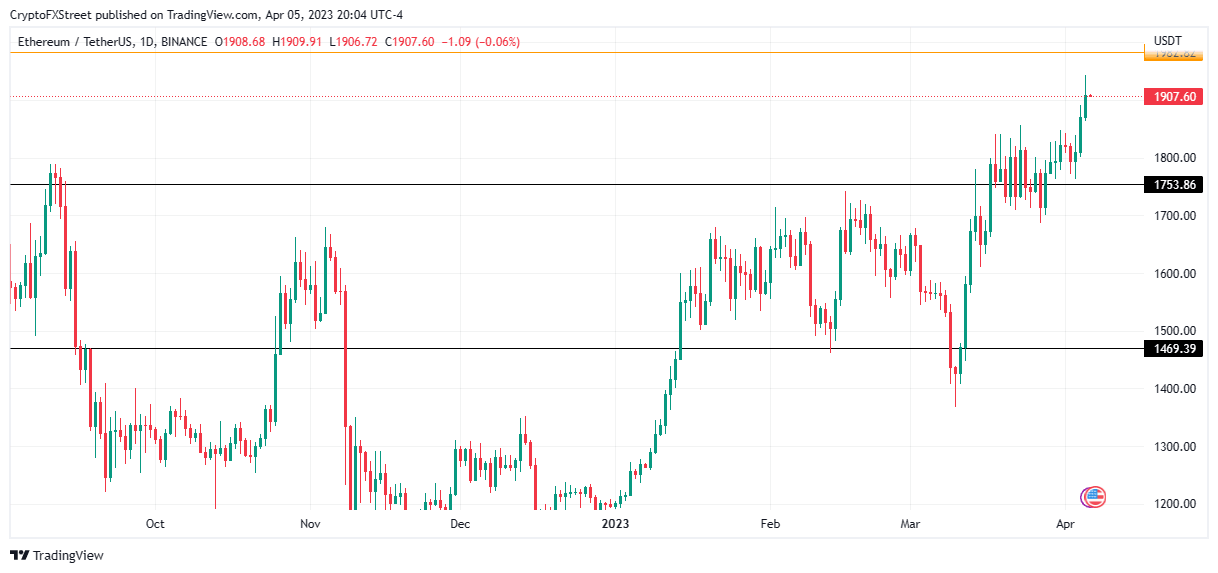

At the time of writing, Ether is on an uptrend and shows signs of maintaining the route-bound movement beyond the $1,900 level to cross into the $2,000 territory.

ETH/USDT 1-day chart

Notably, however, the last time the Ethereum network performed an upgrade, a market sell-off followed, causing ETH to drop below critical support levels.

Ethereum investors at an inflection point

Cryptocurrency research company, CryptoQuant, is of the opinion that the selling momentum due to the Shapella update “will be lower than expected,” because most of the Ether staked on the Beacon Chain were locked in between late 2020 and 2021.

There is an ongoing fear that the activation of withdrawals on April 12th with the Shanghai upgrade would bring more than usual selling pressure.

— CryptoQuant.com (@cryptoquant_com) April 5, 2023

However, our profit and loss analysis shows otherwise.

During that period, ETH skyrocketed from below $100 to record a peak price of $4,000. Accordingly, these millions of Ether were staked at a loss and are unlikely to be dumped post Shapella.

With the current ETH prices, more than half of the staked ETH (9.7 million out of 17.9 million) is currently at a loss. pic.twitter.com/232BRTOIb7

— CryptoQuant.com (@cryptoquant_com) April 5, 2023

The researcher also highlights that most investors with Ethereum staked on the Beacon Chain are large of institutional investors. Cognizant of this fact, CryptoQuant evaluated Lido and other similar platforms to establish retail investors’ sentiment.

The researcher established that just like large investors, retail investors are also holding staked ETH at a loss. In this regard, CryptoQuant notes:

Also, it is worth noting that a significant portion of the deposits made by the Lido pool is currently underwater. For the sole reason that the significant staked ETH is currently at a loss, we believe that the selling pressure will be lower than expected.

Ether’s Implied Volatility could increase as Shapella update nears

Blofin has also offered insight into expectations post Shapella after exploring “smart money” and the Ethereum options sector. According to the crypto market analysis firm, the structure around these smart contracts remains unchanged until today. With the update approaching, it is highly likely that Ether’s Implied Volatility will increase.

Nevertheless, options investors, who previously demonstrated a lack of aggression in their bets on price fluctuation, have since changed opinion.

Interestingly, the significant rise in ETH prices did not drive investors' aggressive betting on ETH's performance expectations before and after the Shanghai upgrade. There is only about one week left before the upgrade, but the IVs of ETH options have not risen significantly,… pic.twitter.com/wR44Ey0mjH

— Blofin Academy (@Blofin_Academy) April 4, 2023

This, according to the crypto market analyst, suggests a “potentially a no-event for ETH post the Shapella update.”

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.