Why Polygon’s MATIC inability to break above $1.00 is a canary in the coal mine

- Polygon is performing a second test at $0.96, just inches away from the $1 barrier.

- MATIC price looks set to undergo another rejection as traders wake up with a headache after the euphoria of Wednesday.

- Expect a fade as the summer rally starts to slow down.

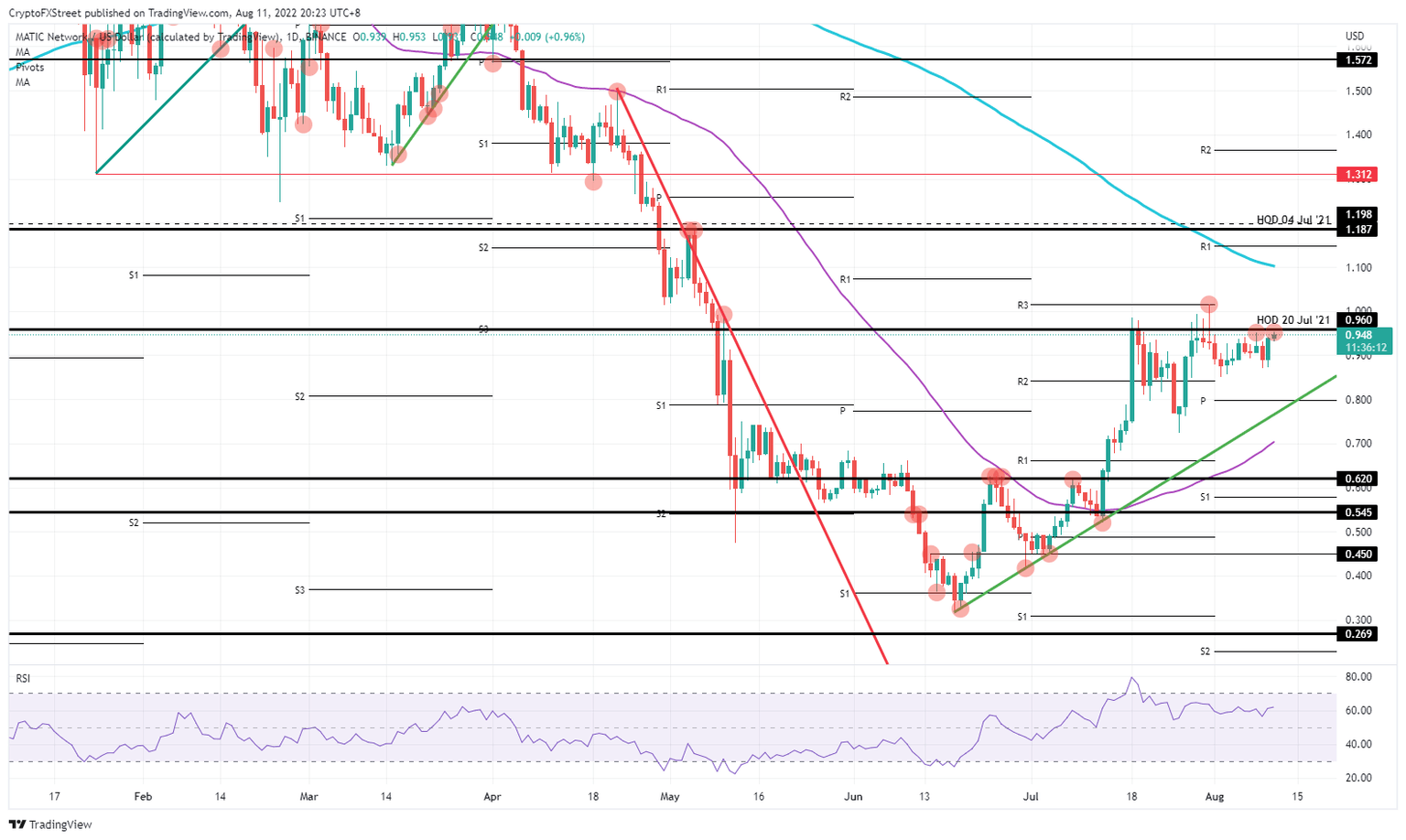

Polygon (MATIC) price is set to undergo another rejection at the $0.96 historic pivotal level identified on July 20th, 2021. With a possible rejection in the making, it could become clear that a breakout is not for now as investors start to rethink and second guess what the Fed will do after several officials came out warning markets that they are far from done hiking 75 bp and more. This could pour some cold water on the hot crypto rally thus far.

MATIC price set to drop back to $0.80

Polygon price looks to be in doubt where to go next after Wednesday’s euphoria, when investors jumped the gun on their buy-orders as they started to believe the drop in inflation numbers was the first of many more to come. Markets remained ignorant of the warnings of Fed officials in the aftermath, who said they didn’t have any plans to slow down policy tightening, and kept pumping up price action in equities and cryptocurrencies. As the dust settles today, the warnings of these Fed officials now looks to have taken over sentiment as equity markets are mixed during the European session, and Fed Futures are already creeping back up towards pricing in a 60 bp hike instead of 50 bp as they did on Wednesday, after the release.

MATIC price could put further pressure on $0.96 and is likely to get another rejection, as has been the case throughout July, where not one body of a daily candle was able to close or open above $0.96. Expect a fade towards $0.85, the low of last week and then a dip back to $0.80 at the monthly pivot. With the backbone of the green ascending trend line and the 55-day Simple Moving Average, for now, still, alongside it, bulls will be present to start buying into the price action.

MATIC/USD Daily chart

Upside potential, of course, could still be present if traders put aside the remarks of Fed officials given it is still forty days until the next Fed meeting and rate decision. So still plenty of days left to rally and would need to be confirmed with at least a daily close above $0.96 and preferably even above $1. From there, MATIC price could rally another 10% towards $1.10, where the 200-day SMA will be trading as a cap.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.