Why patience will help provide a better entry for XRP investors

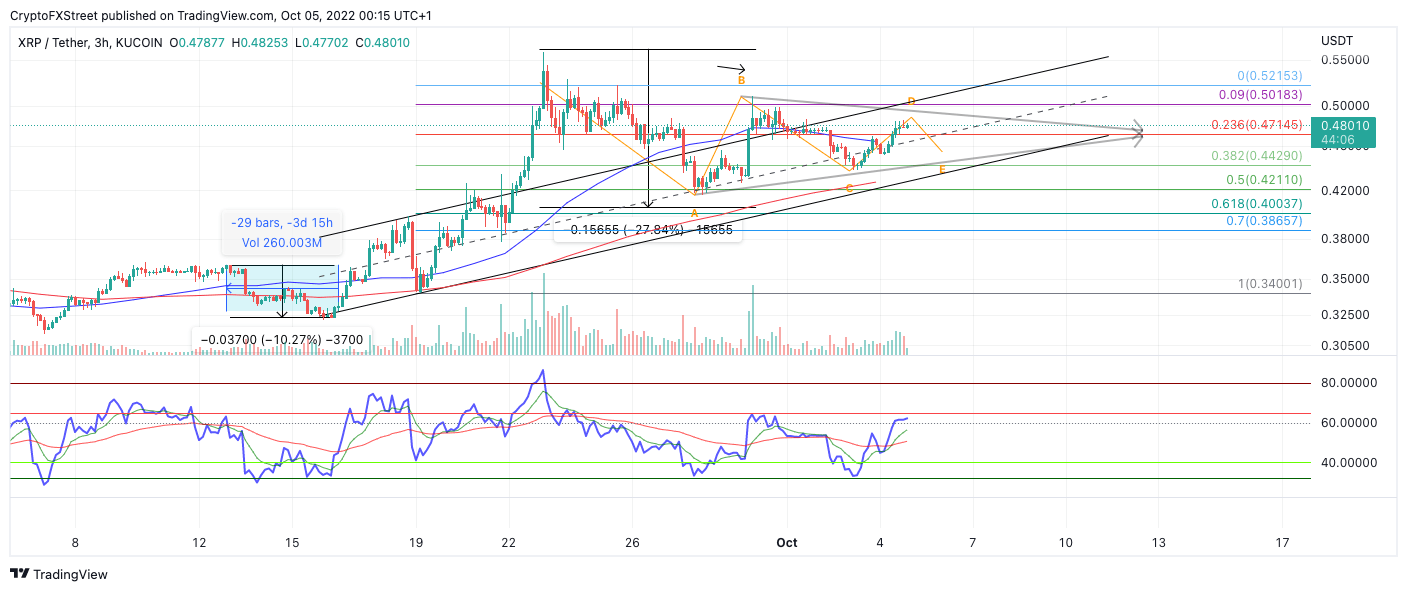

- XRP price consolidates within an ascending parallel channel.

- RIpple price shows less volume than the previous bull run, while the Relative Strength Index shows resistance.

- Invalidation of the countertrend thesis is a breach above $0.51.

XRP price should pull back once more before the real rally occurs. Key levels have been identified.

XRP price has cushions pace to fall

XRP price currently auctions at $0.48 as the bulls have reconquered the ascending parallel channel's median line that provided support during the early stages of the September rally. As price consolidates, the Relative Strength Index remains wedged just beneath the key level that qualifies a trending market. Based on this subtle evidence, the XRP price will likely retreat into the $0.45 level before the anticipated bull run occurs.

The countertrend thesis is supported by the Volume Profile indicator, which shows that XRP is climbing with less volume than it did during the last rally that established the $0.51 swing high. If market conditions persist, a retest of $0.45 stands a fair chance of occurring. If the $0.45 support level fails to hold, an 11% decline is expected, targeting the $0.43 liquidity level.

A breach above the $0.51 swing high from September 29 would invalidate the bearish scenario. If the bulls break this barrier, last month's bullish trade idea towards $0.61 will likely commence. Said price action would result in a 26% increase from the current XRP price.

In the following video, our analysts deep dive into Ripple's price action, analysing key market interest levels. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.