Why MATIC value gain is imminent, despite fee collection in Ethereum

- Sandeep Nailwal of Polygon confirmed that fee collection for all future 0xPolygon solutions will be in Ethereum.

- The MATIC team revealed how staking pushes the Ethereum scaling token’s value higher.

- Analysts believe MATIC price has bullish potential and expect an 11% gain in the altcoin.

The co-founder of Polygon explained why MATIC is the only staking token for all chains, and gas fees will be collected in Ethereum by default. While gas fees are not being collected in MATIC, Nailwal assured the crypto community that value gain is imminent.

0xPolygon solutions will collect gas fees in Ethereum

Sandeep Nailwal, the co-founder of Polygon, responded to the MATIC community’s concerns regarding the gas fee token of new 0xPolygon solutions. Nailwal explained that MATIC would be the staking token of all the Polygon chains, and Ethereum would be used to pay gas fees.

The community was concerned about MATIC’s value if the altcoin is not used to pay gas fees on new 0xPolygon solutions. However, MATIC’s value gain is imminent for two key reasons.

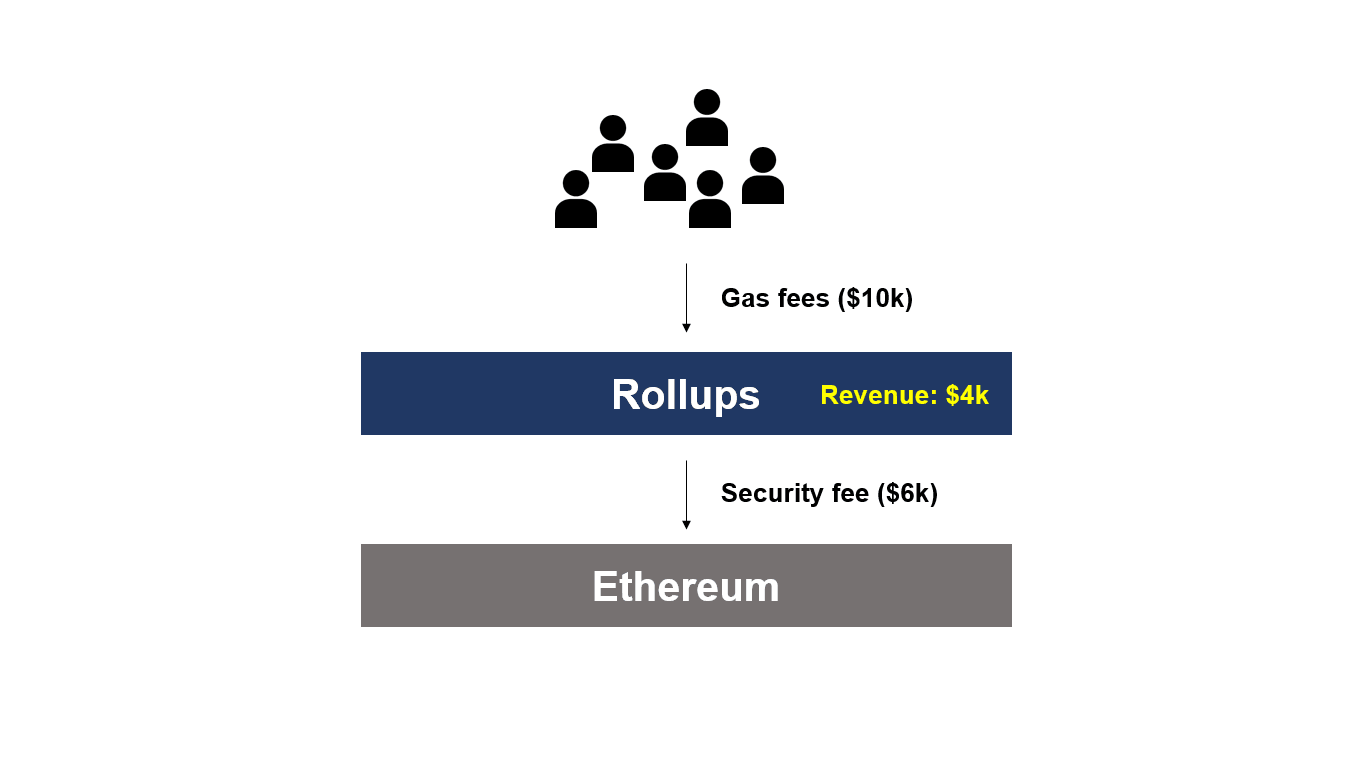

To understand why MATIC will gain value in either scenario, irrespective of not being used as a gas fee token, let’s understand how rollups generate revenue. Rollups gather gas fees from layer-2 users and pay on-chain security fees to Ethereum.

The leftover is the revenue for a rollup.

How rollups generate revenue

The revenue is distributed to MATIC stakers in the layer-2 scaling token. If users paid gas fees in MATIC, the rollup would sell MATIC and buy ETH to pay security fees, and the leftover MATIC would be distributed to stakers. There will be a net buying pressure on MATIC, pushing the altcoin’s value higher.

If gas fees is collected in MATIC

Similarly, if rollups pay Ethereum to buy MATIC and distribute it to stakers, the net buying pressure on MATIC will push the layer-2 solution’s value higher.

If gas fees are collected in ETH

Therefore, MATIC value gain is imminent in both scenarios and that being so ensures that buying pressure on the asset is maintained.

Analysts predict an 11% rally in MATIC

Analysts have predicted an 11% gain in MATIC based on the Ethereum scaling solution’s price trend. FXStreet analysts believe MATIC has bullish potential, and the altcoin is ready to post 11% gains in the short term. For price targets and more information, check this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.