Why LUNA traders do not have to be in the market all the time

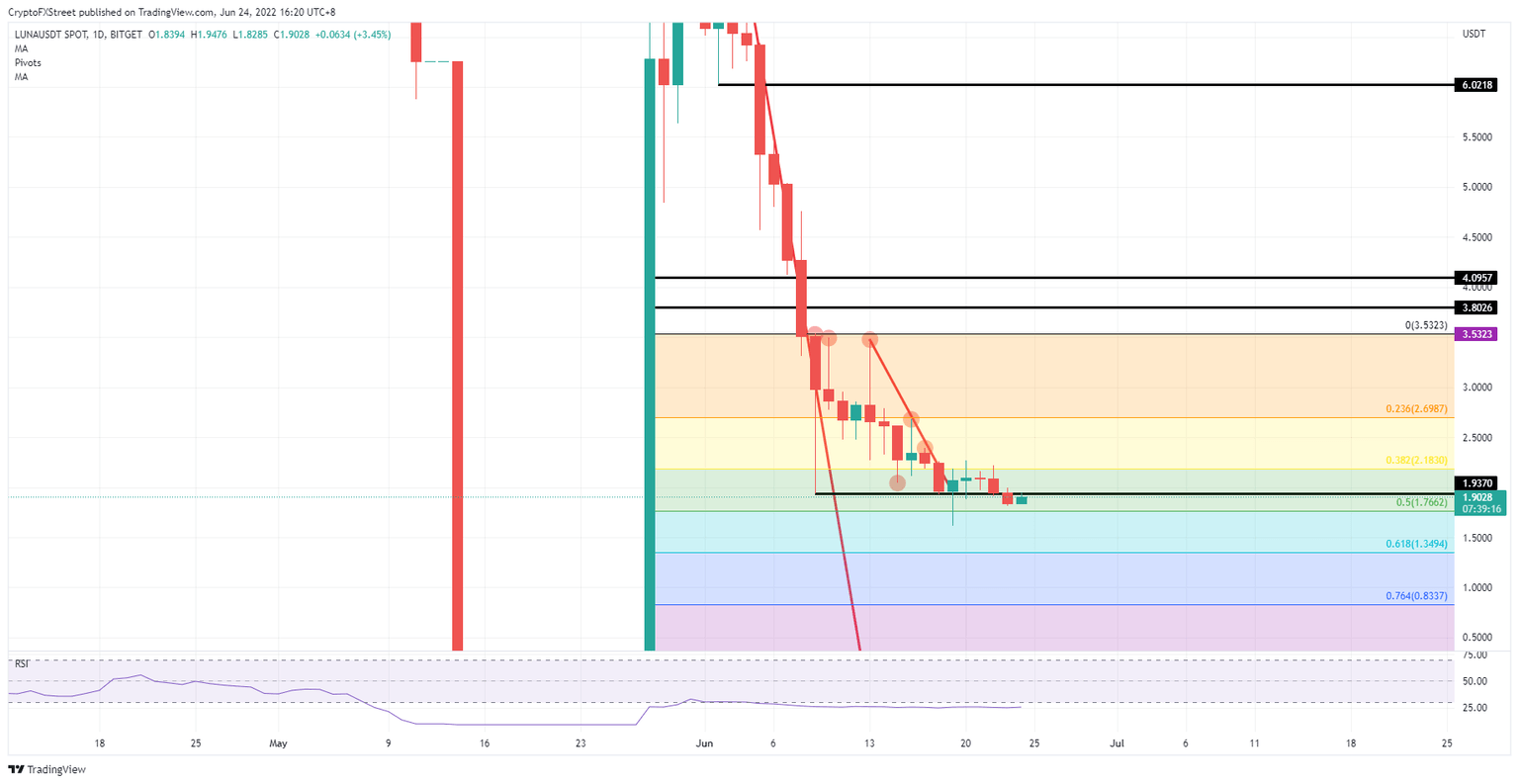

- Terra price flip-flopping around $1.9370 as bulls claw back.

- LUNA price goes nowhere as global markets are starting to track back from the rate hike cycles from central banks.

- With inflation being tackled, the question is how far central banks will go as further hikes could start to trigger layoffs, kills growth and outline recession.

Terra (LUNA) price action has slipped below a critical level outlined a few days ago. As price action moves start to get smaller, a big move is set to happen, but it is very cloudy to see where that move will be going. Until last week it was clear that central banks would keep tightening and squeezing to kill inflation, but this week some changes got mentioned as it becomes clear that further tightening will spark a recession. Should you be part of this cloudy market and not wait until the next step becomes clearer?

LUNA in need of a coffee break

Terra price looks to continue its downward trajectory backed by the global scenario where central banks are further tightening monetary policy. With this monetary approach, borrowing money gets more expensive, and investors are losing their leverage as returns in cryptocurrencies are not there to pay back and level up from the credit margins that need to be paid for those loans. This explains the cash drain that has been going on these past few months.

LUNA price, however, sees a slowdown in its downward path as markets are getting puzzled by the mixed signals from several central banks. It almost looks like the FED is willingly pushing the US into recession with further aggressive rate hikes, while CEE banks are signaling that the rate hike cycle is coming to an end by attempting to go for a soft landing. On the back of this, it is best as a trader to stay vigilant as this moment could be the eye of the storm, and everything appears to wind still, awaiting a break back above $1.9370 before getting long and targeting $2.6987 to the upside with 40% of the gains on the table.

LUNA/USD daily chart

Risk at the moment could come from a firm rejection against that $1.9370 and would see another drop in the price action. That would mean that a retest of $1.6139 is being put back on the table and could trigger another leg lower towards $1.3494, which falls in line with the 61.8% Fibonacci level. This amounts to another 30% devaluation of Terra's already troubled price action.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.