Why LUNA price will reward patient traders, and how you can be one of them?

- LUNA price has dropped 23% since July 20, indicating more losses around the corner.

- Investors can expect at least another 12% drop over this week as bears take control.

- A daily candlestick close below $1.46 without a quick recovery will invalidate the chances of recovery.

LUNA price shows that it is out to repeat the fractal that was spotted nearly two weeks ago. If such a development does occur, investors should be aware that more corrections are on the horizon.

LUNA price needs to exhaust downside liquidity

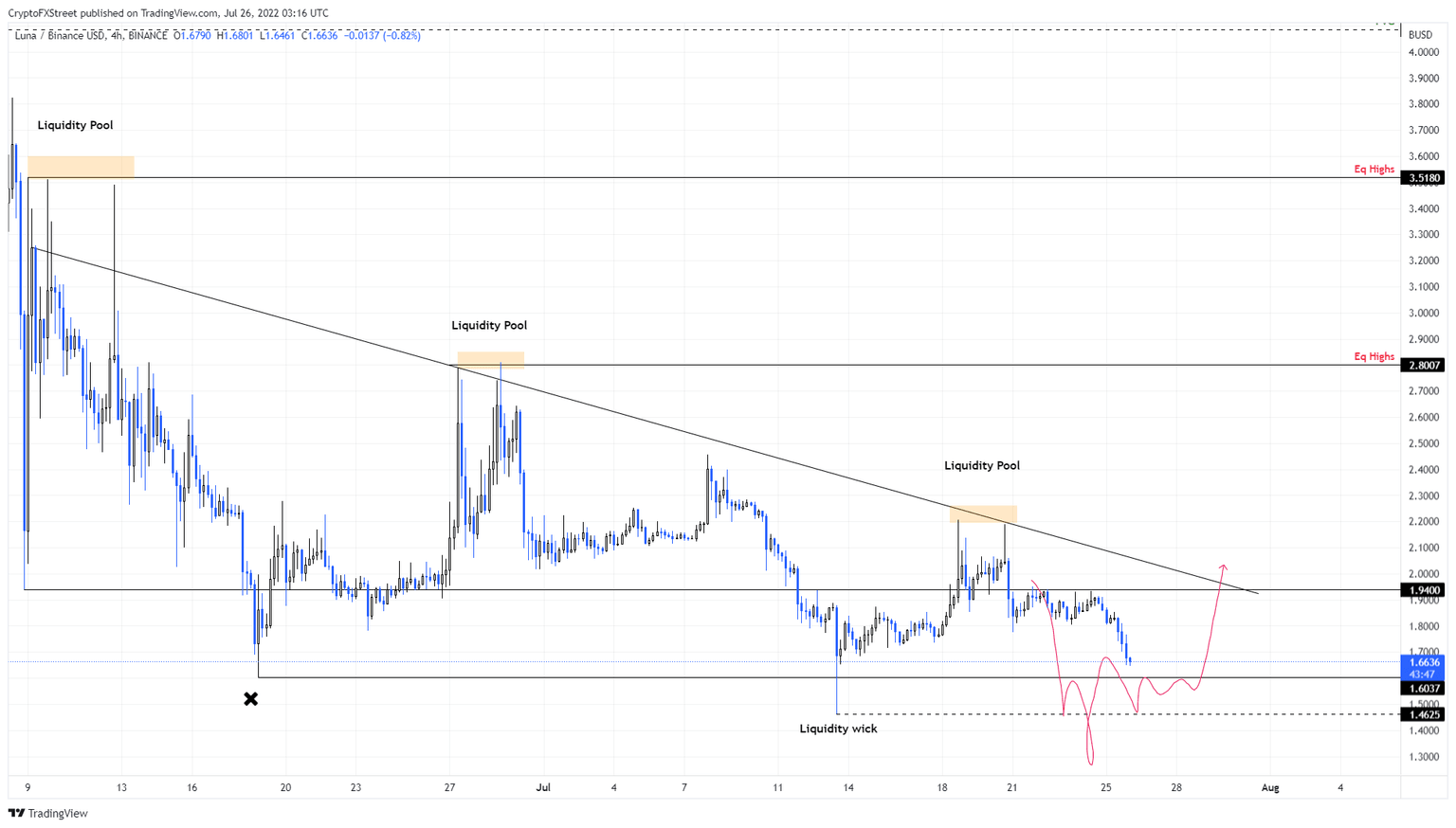

LUNA price produced a fractal that had two parts to it; the first step consisted of a liquidity run below a previously formed swing low, and the second step was a rally.

The June 8 swing low at $1.94 was swept as LUNA price dropped below it on June 18 to collect the liquidity. This development was followed by a surge in bullish momentum that pushed the altcoin up by 73% in the next week or so.

This upswing was exhausted after the altcoin created a double top.

The second time this setup was repeated was on July 13, when LUNA price wicked below the June 18 swing low at $1.60. After this liquidity run, the altcoin triggered another run-up that pushed Terra by 50%.

Interestingly, this rally also faced exhaustion after producing a double top at $2.20.

Since creating a local top, LUNA price has dropped 25% to where it currently trades - $1.64. If the fractal is still in play, Terra is likely to drop at least 12% before sweeping the July 13 swing low at $1.46. This development, according to the fractal, should trigger a bullish move.

In such a case, market participants can expect a 32% move to $1.94.

LUNA/USDT 4-hour chart

While things are looking bearish in the short-term, LUNA price is positioning itself for a bullish move. If the sweep of the July 13 swing low at $1.46 fails to see a quick recovery, it will invalidate the fractal.

In such a case, LUNA price could collapse to the $1 psychological level before attempting another recovery rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.