- Bitcoin price remains underpinned just above $20,000.

- BTC price could be seeing bulls making a colossal mistake and burning through cash reserves for something that will inevitably happen.

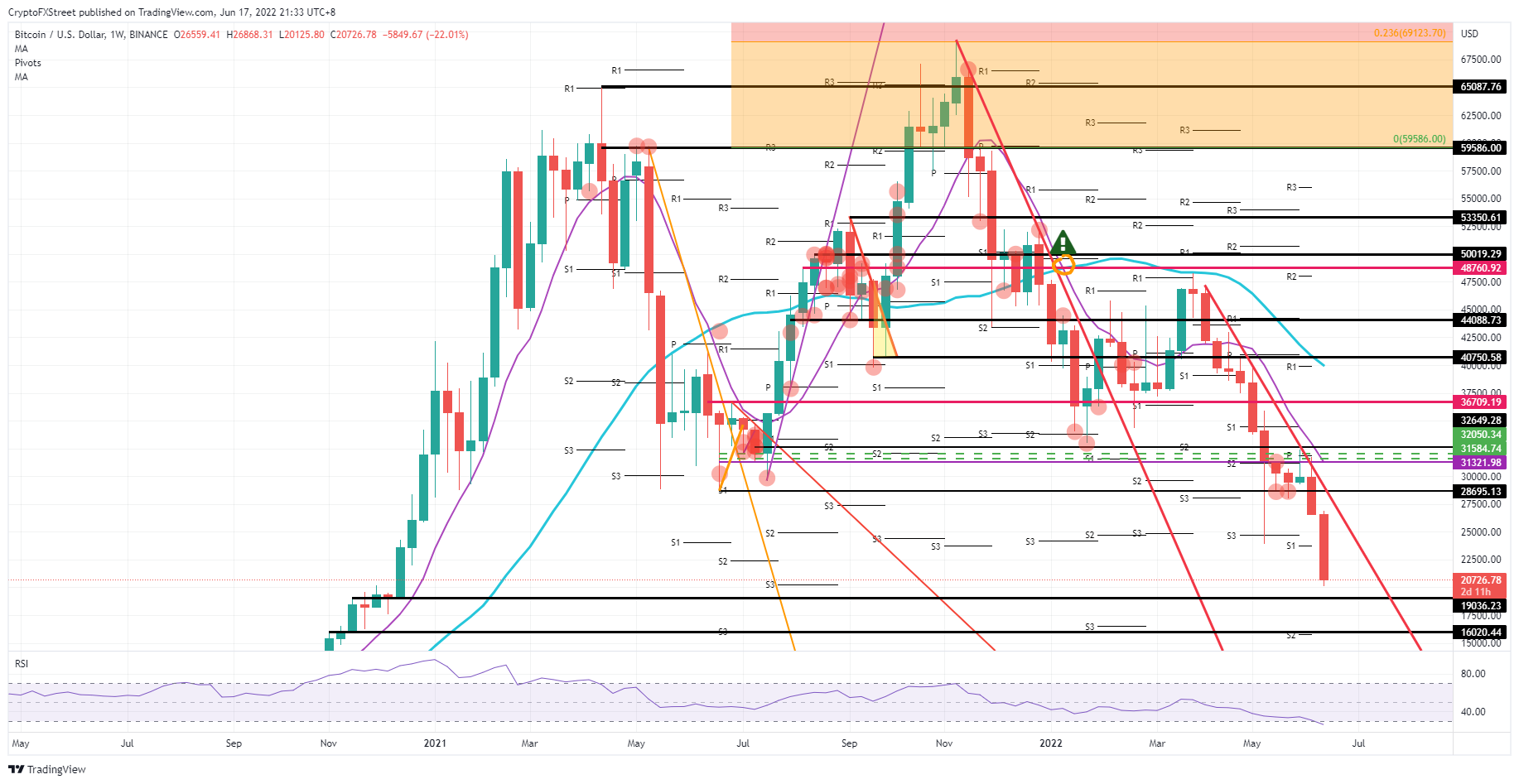

- Expect a better and healthier rally when BTC price hits $19,036 or $16,020 for a turnaround.

Bitcoin (BTC) price is set to close out the week with another loss in the books as bulls are grasping and struggling to balance price action above $20,000. But bulls could be in for a disappointing treat as bears will sit on their hands refraining from buying BTC to close out their short positions. With that imbalance, bulls could quickly stop and see their cash being burned by losses as BTC prices will inevitably move below $20,000 in these current headwinds.

BTC price is looking for a junction to turn

Bitcoin price is set to go out the week with another double-digit loss as bulls have been at it all week to maintain support above $20,000. Those efforts must have cost loads of cash, where traders and investors thought that BTC price could not get any lower, and with equities rallying towards the end of the week, cryptocurrency traders must have thought that a turnaround was due but did not come. Risk is now that early-bird buyers are stuck in losing trades and might start to cut those losses, triggering the inevitable: a drop below $20,000.

BTC price will then hit $19,036 quite quickly and print new lows for 2021 and 2022. That pivotal technical level, with $16,020 as a fail-safe system, could be where Bitcoin finally hits its turning point. Do not expect a V-shaped recovery but rather an L-shape or W-shape once that lower-level around $16,000 is reached, mainly because the catalyst that currently is suppressing cryptocurrencies is not a theme that will change overnight but needs a gradual change backed by data and signs of a turning before dreaming back of $30,000.

BTC/USD weekly chart

Headline risk could rather be, this time, a headline surprise. ALready a few headlines came out this week saying that Russia is ready for peace talks now that aggression in Ukraine has died a bit to the background, and it almost looks like Russia has secured the provinces it wanted to add for annexation. A breakthrough headline would quickly see investors forget about the headwinds from inflation and purely focus on the rallies in cryptocurrencies and equities as algorithms will have triggered already a massive amount of buy-orders purely on the analysis of the headline. BTC price would not look for ground but would see a break above $26,868 and would be inches away from $30,000 in just a matter of one or two trading days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.