Why is XRP price up today?

XRP (XRP $3.13) is up more than 12% over the last 24 hours to trade at $3.11.

The latest rebound in XRP has seen its price rise from a low of $2.66 on Jan. 27, rising as much as 20% to set an intraday high of $3.21 on Jan. 28, as per data from Cointelegraph Markets Pro and TradingView.

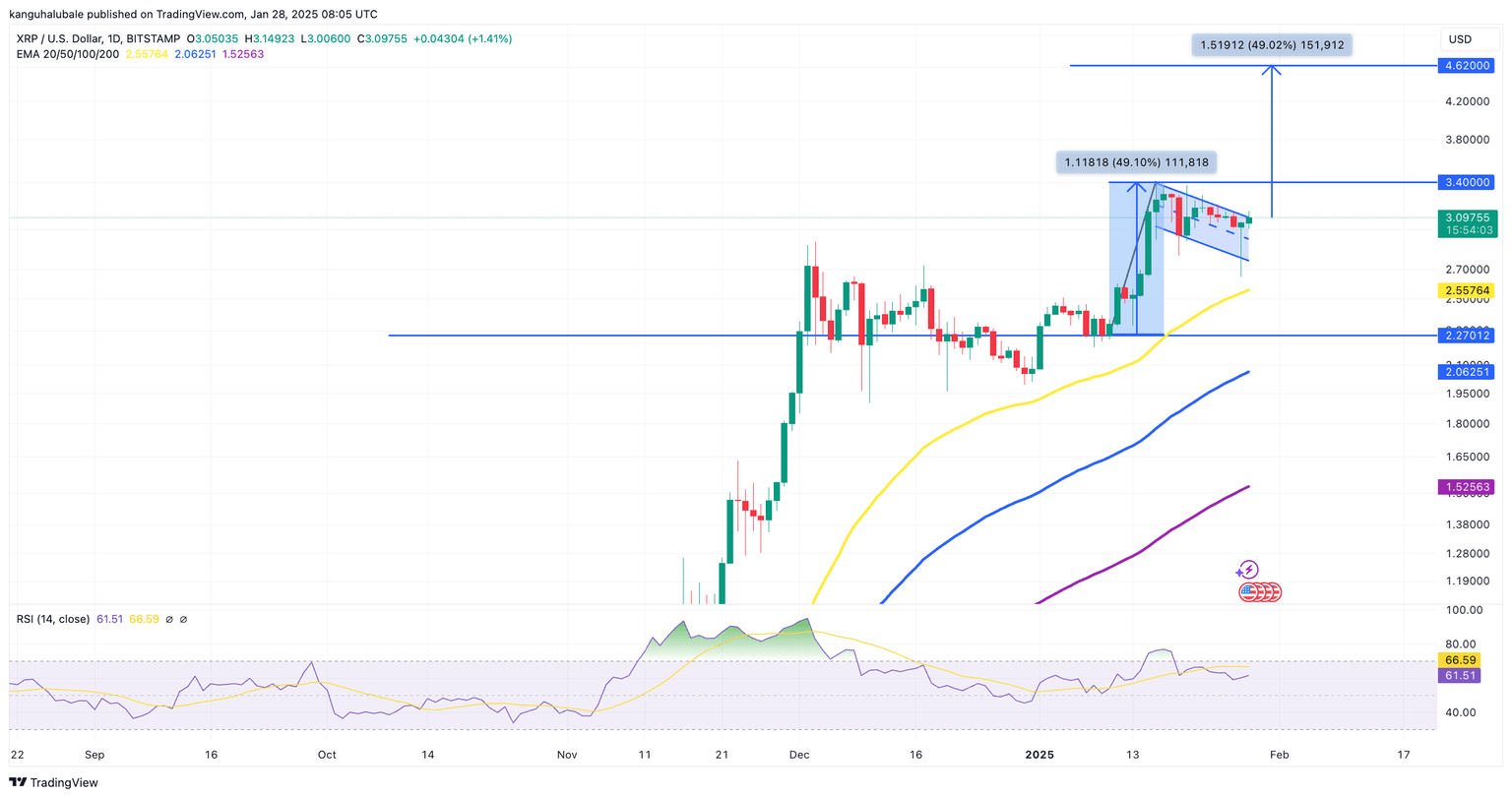

XRP/USD daily chart. Source: TradingView

Several factors contributed to this recovery, reflecting both the broader macro market and specific technical analysis developments related to XRP.

These include:

-

Ripple’s regulatory push in the US with new Money Transmitter Licenses in New York and Texas.

-

The wipeout of overleveraged short positions in the XRP Futures market.

-

Strong XRP price technicals suggest a potential breakout to new all-time highs.

Ripple secures MTL in New York and Texas

XRP’s bullish momentum on Jan. 28 is fueled by Ripple’s push to gain regulatory compliance in the United States.

What happened?

- Ripple has just announced the acquisition of Money Transmitter Licenses (MTLs) in both New York and Texas, two states known for their rigorous regulatory standards.

-

This achievement marks a significant expansion of Ripple’s compliance footprint in the US, bringing its total to over 50 MTLs.

-

This adds to its portfolio of more than 60 licenses across the globe, including a Major Payment Institution License in Singapore and registrations as a virtual asset service provider in Ireland and the Cayman Islands.

- These licenses are crucial as they legally enable Ripple to facilitate cross-border payments for customers in these markets, enhancing trust and potentially increasing the use of XRP in real-world financial transactions while boosting price.

Over $3.3M in XRP shorts liquidated in 12 hours

XRP’s price rally has triggered significant liquidations in the derivatives market, signaling strong bearish pressure.

Key points:

-

Over the last 12 hours, $4.1 million worth of short XRP positions were liquidated, compared to just over $847,000 in long liquidations.

-

Bearish traders are forced to sell their positions when short positions are liquidated.

Crypto market liquidations ft. XRP. Source: CoinGlass

-

XRP’s price rebounded due to the cascading liquidation effect.

-

The scale of these liquidations mirrors the period between Jan. 13 and Jan. 16, when $56 million in short positions were wiped out, accompanying a 46% price uptick to a seven-year high of $3.40.

XRP bull flag targets $4.62

The XRP/USD pair is expected to resume its prevailing bullish momentum despite the recent drop to $2.66 as it paints a classic technical structure with an upside outlook.

Key takeaways:

- XRP price action has formed a bull flag pattern on the daily chart, indicating the possibility of regaining bullish momentum if key support levels hold.

XRP/USD daily chart w/ bull flag. Source: Cointelegraph/TradingView

-

The bull flag developed following XRP’s rally from $2.27 on Jan. 10 to a seven-year high of $3.40 on Jan. 16, confirming a larger symmetrical triangle breakout.

-

XRP is currently testing resistance at $3.10 at the flag’s resistance line. A break above this level could trigger another rally.

-

The bull flag’s upside target for February, derived from the height of the previous rally, is approximately $4.62, representing a 49% uptick from the current level.

-

The relative strength index (RSI) is above the midline and has risen from 58 to 62 over the last 24 hours, indicating increasing bullish momentum.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.