The combined market capitalization of cryptocurrencies has jumped in the last 24 hours as traders anticipate no monetary policy action after the latest U.S. inflation data.

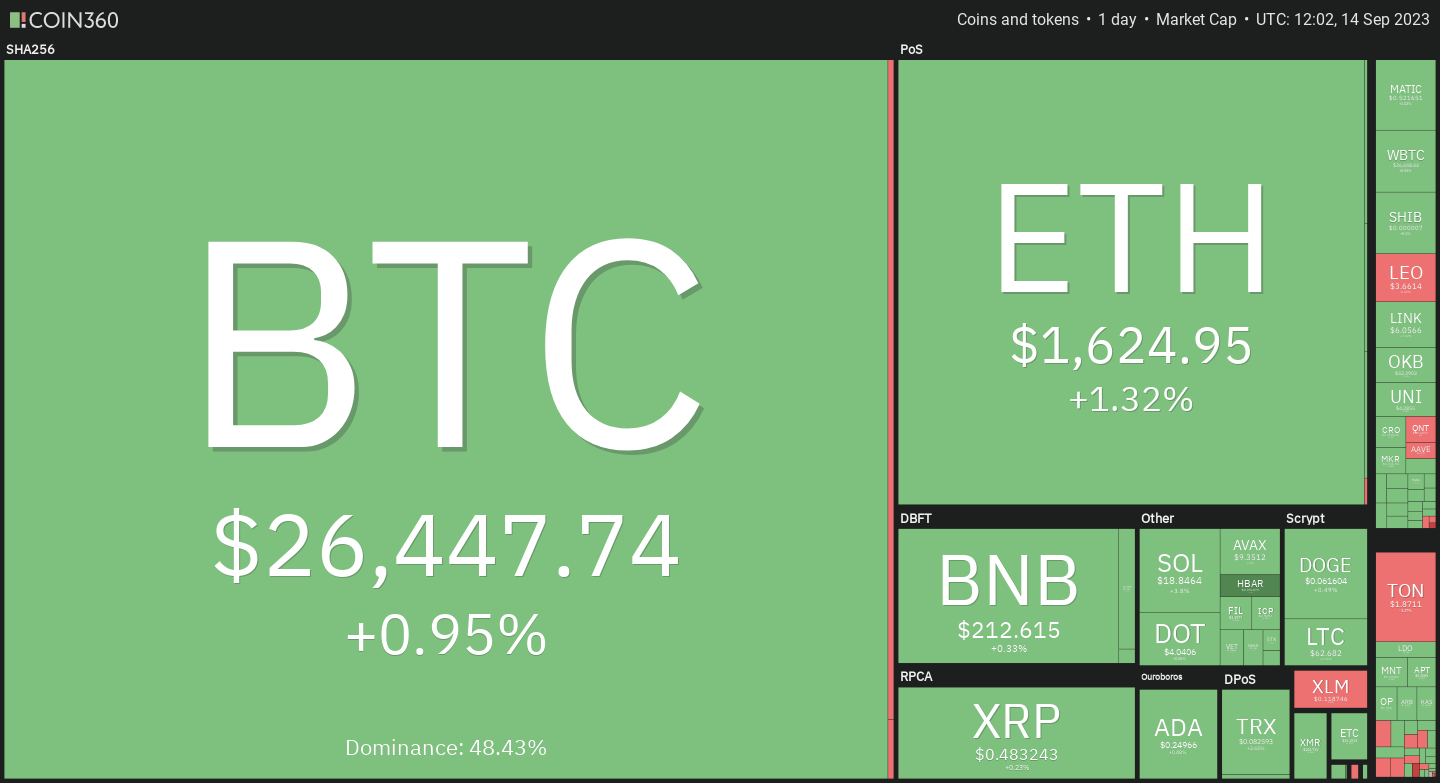

On Sep. 14, the crypto market valuation reached $1.035 trillion, with 1.58% intraday gains, which included all the top-ranking cryptocurrencies, such as Bitcoin (BTC $26,418), Ether (ETH $1,621) and Solana (SOL $19).

Crypto market performance in the past 24 hours. Source: Coin360

Crypto market reacts to Fed pause bets

Crypto investors seemingly liked what they saw in the U.S. consumer price index (CPI) report on Sep. 13.

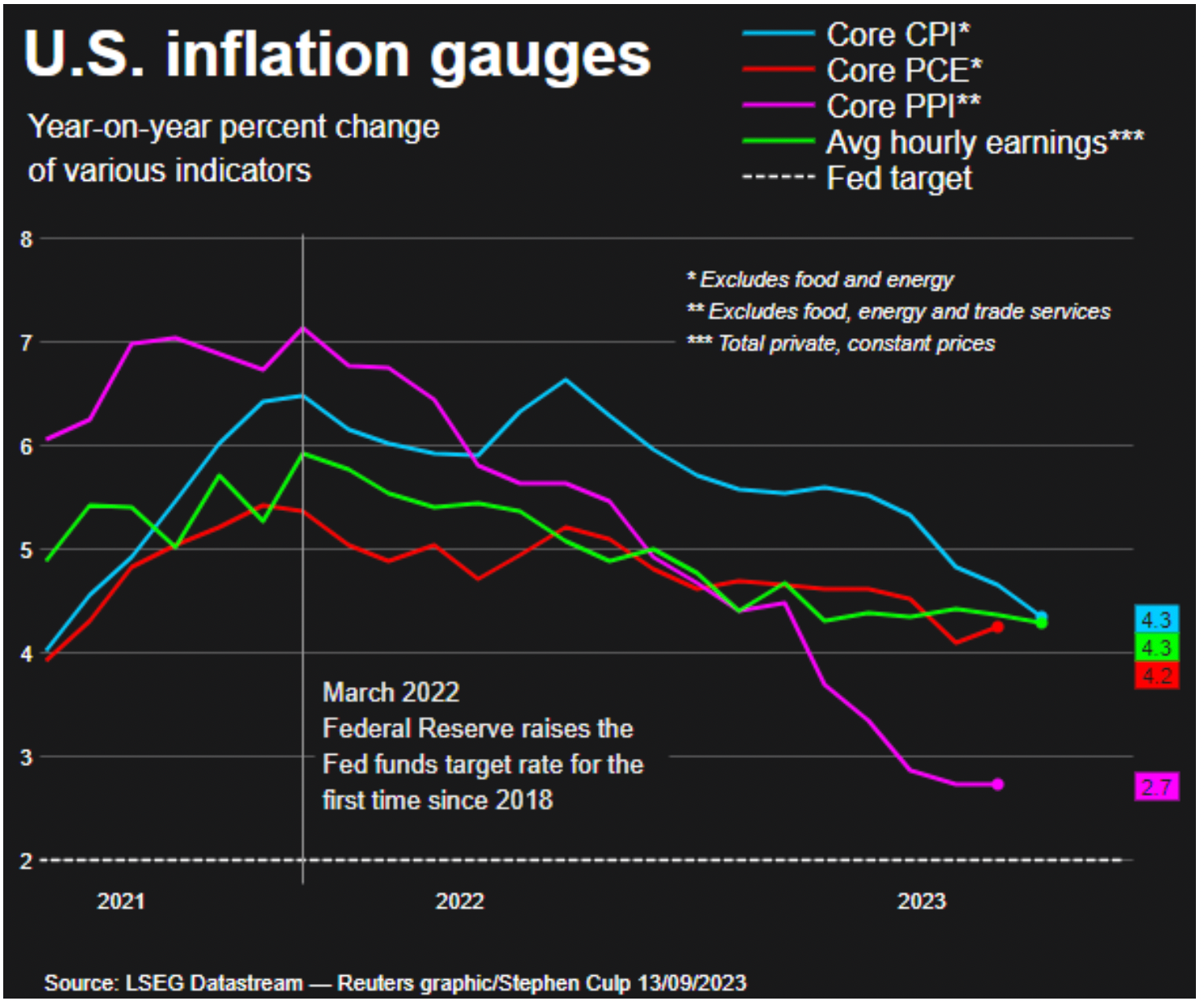

As Cointelegraph covered, the U.S. CPI jumped 0.6% in August from the previous month, the fastest monthly rise in over a year, with gasoline prices contributing to more than half of the jump. Meanwhile, the core prices, which exclude food and energy costs, rose by a modest 0.3%, slightly higher than the estimated 0.2%.

When looking broadly, however, core inflation remained on a downward trajectory toward the Fed's 2% preferred target.

U.S. inflation gauges. Source: LSEG Datastream

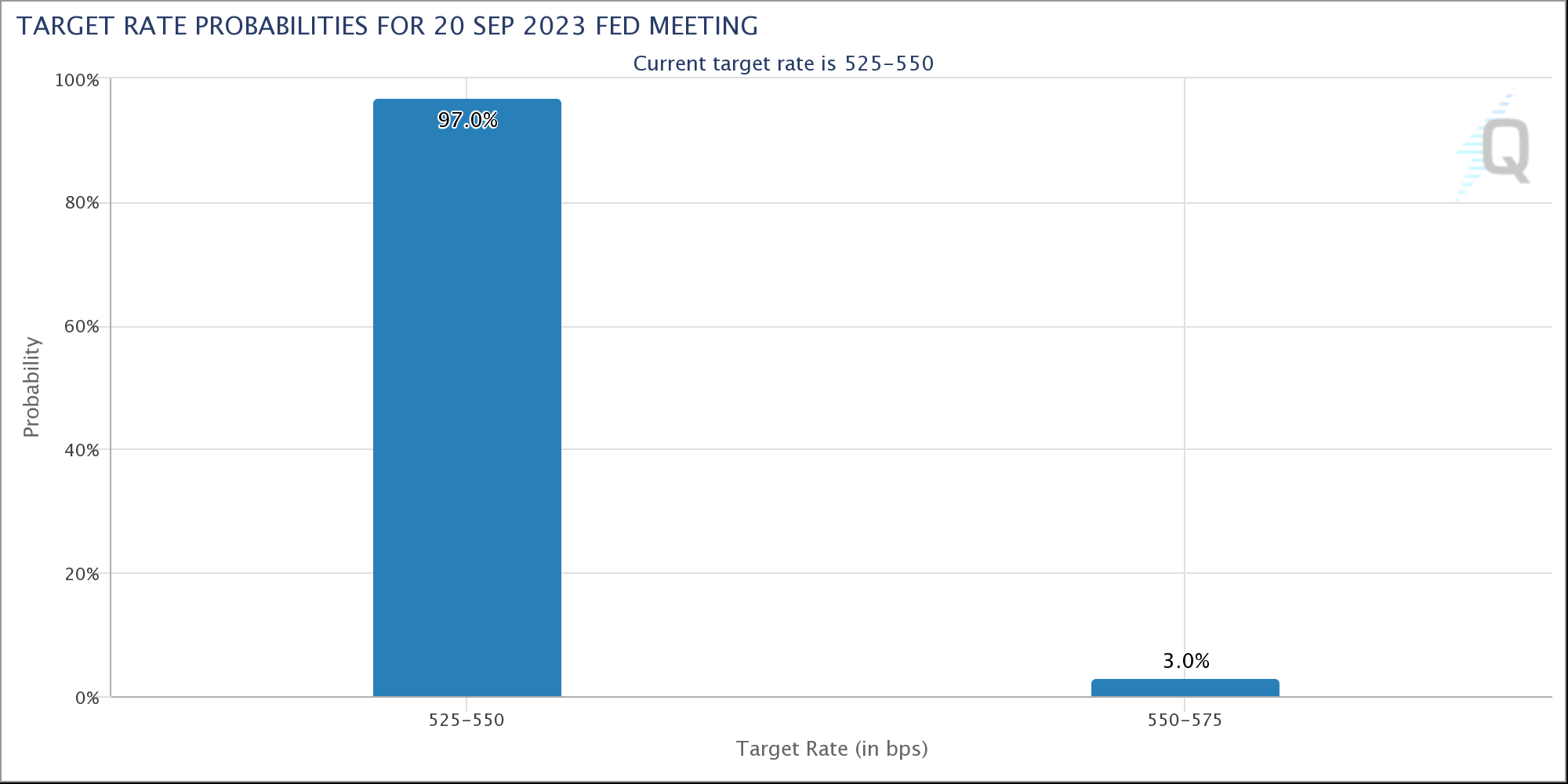

The core inflation downtrend coincides with derivative market traders upping their estimates for a rate hike pause in September. Notably, the target rate probabilities for the Fed's Sep. 19-20 meeting have jumped to 97% from 93% a week ago.

Target rate probabilities for Sep. 20 Fed meeting. Source: CME

Stabilizing or lowering interest rates has typically served as a bullish signal among crypto investors, which could explain the market's price rally in the past 24 hours.

Easing FTX concerns

Crypto investors also responded positively to the recent FTX court ruling, wherein a federal judge, John Dorse, approved the sale of the defunct crypto exchange's crypto assets.

Nonetheless, the ruling barred FTX shareholders from selling Bitcoin, Ethereum, and other affiliated assets.

These cryptocurrencies together comprise about 70% of the entire crypto market valuation. So, their exclusion in the court ruling theoretically reduces the selling pressure that FTX sales may have potentially caused, as many had feared.

Furthermore, the sales of remaining crypto holdings are limited to a maximum of $50 million per week while requiring written notice prior.

Earlier this week, data researchers at Messari had also debunked theories about FTX sales leading to massive selloffs across the crypto market, arguing that the exchange's biggest crypto holding, Solana, is subjected to vesting schedules.

SOL was among the top crypto performers in the past 24 hours, rising over 4% and, thus, contributing to the overall crypto market upside moves.

Oversold bounce

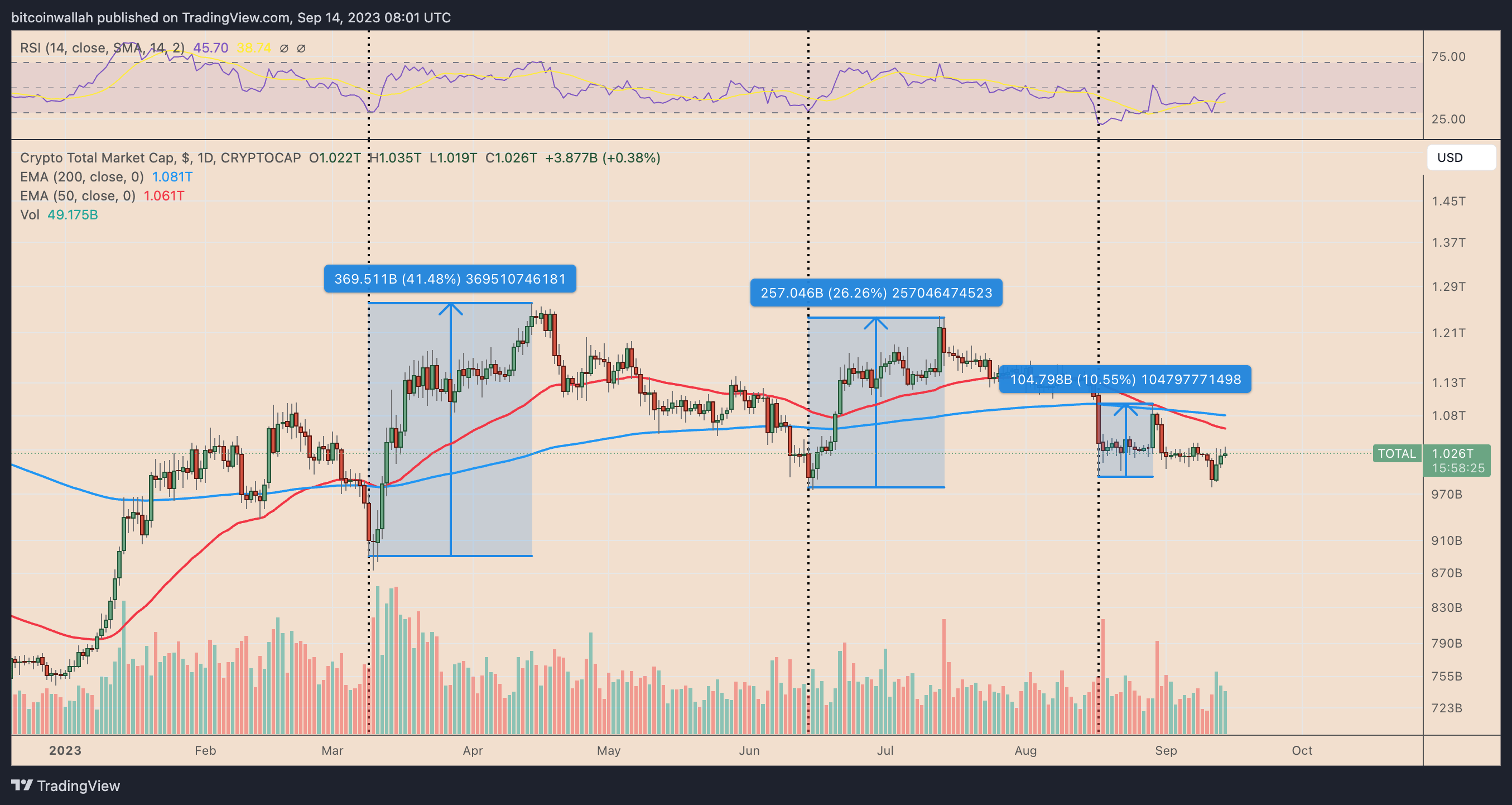

In addition, the crypto market's gains in the last 24 hours is a part of a short-term rebound that started on Sep. 11.

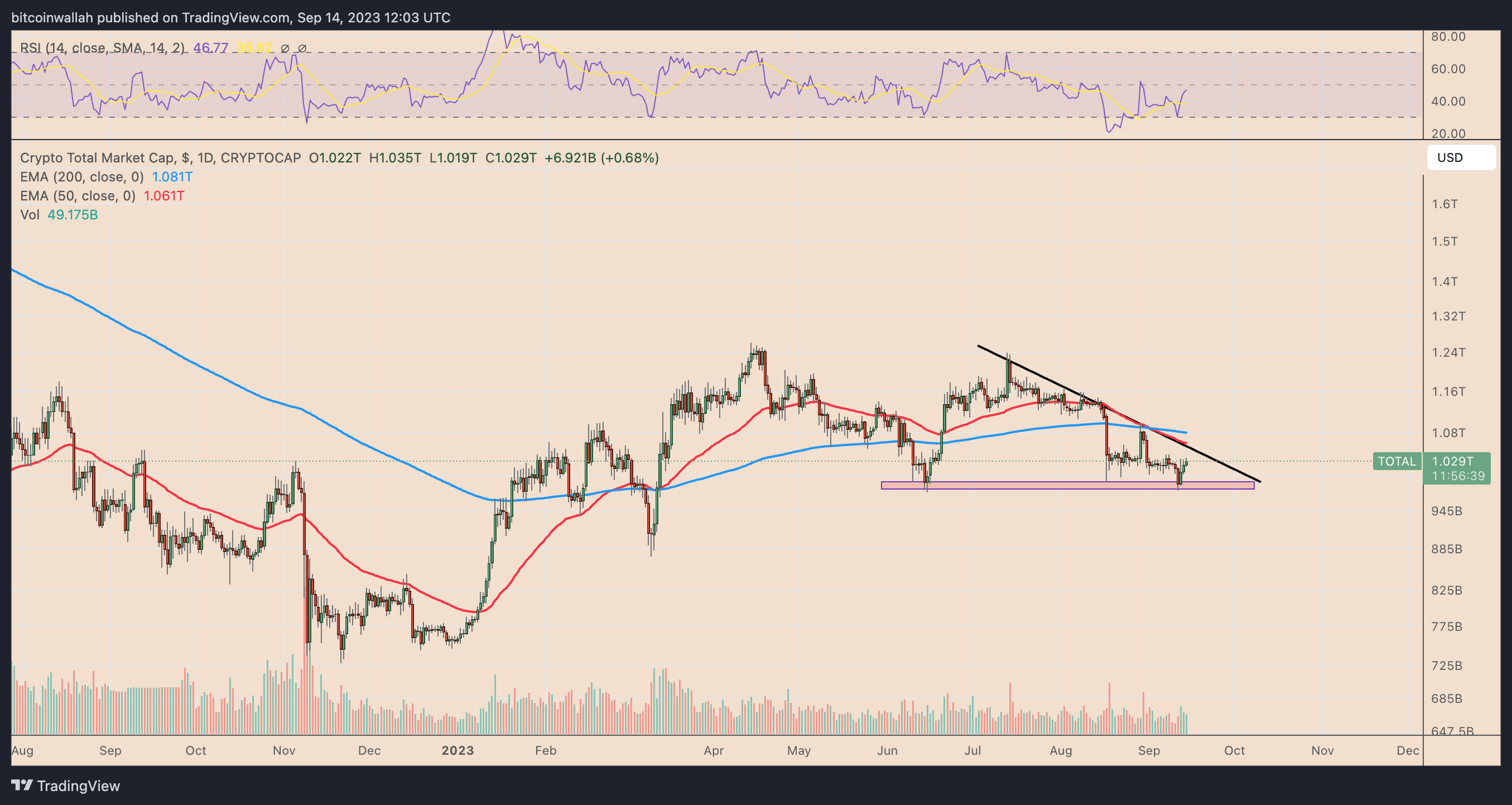

Then, the market's daily relative strength index (RSI) dropped to 30, an "oversold" threshold. Typically, traditional analysts see the RSI's drop to or below 30 as a buy signal. This strategy has been prevalent in the crypto market this year, as shown below.

Crypto market cap daily performance chart. Source: TradingView

Crypto market technical analysis

As a note of caution, the ongoing crypto market rebound does not point to an extended buying trend.

Instead, the market risks bearish continuation as long as it stays below its key exponential moving averages (EMA): the 50-day EMA (the red wave) near $1.08 trillion and the 200-day EMA (the blue wave) near $1.06 trillion.

Crypto market cap daily performance chart. Source: TradingView

In addition, the crypto market's multi-month descending trendline resistance has limited its upside prospects since July 2023. So, the ongoing rebound may continue until the market valuation hits the trendline or its 50-day EMA, both aligning at $1.04 trillion.

On the other hand, a pullback ahead or after testing the trendline-EMA confluence risks crashing the crypto market valuation to the $980-995 billion range (the red area) throug Q4.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.