- Cryptocurrency markets have lost $230 billion in market capitalization in just six days.

- This move comes as Bitcoin shed 11.65% from its all-time high of $73,949 in the last five days.

- The AI category of altcoins contributed the most to the recent crash by losing 41% of their value in the past week.

The two most important contribution to the ongoing bull market is the meteoric rise in Bitcoin due to the ETF approval and the sudden interest spike in Solana ecosystem. But the recent move suggests that the upward momentum is dissipating and a correction looms.

Also read: Bitcoin Weekly Forecast: Can BTC hit $100,000 without a correction?

Crypto’s recent bull rally

Despite the massive popularity of Solana and the meme coins, they are dependent largely on Bitcoin’s cues for directional bias. As long as BTC continued to climb higher, the altcoin markets soared – Artificial Intelligence (AI) sector and meme coin categories continued to outperform and yielded massive gains.

As mentioned in previous publications, Worldcoin (WLD) and Fetch.AI are two notable altcoins that surged roughly 500%. Meme coins like dogwifhat (WIF) and Book of Memes (BOME) have also registered meteoric gains as well.

Although ETF flows have stabilized, Bitcoin price seems to be slowing down after 54% year-to-date returns. From the start of 2023, the pioneer crypto has shot up 347%.

BTC/USDT 1-day chart

Why is the crypto market crashing?

On the weekly time frame, Bitcoin price has created a bearish swing failure pattern (SFP). Since this SFP led to BTC closing below the previous ATH of $69,000, investors should exercise caution.

BTC/USDT 1-week chart

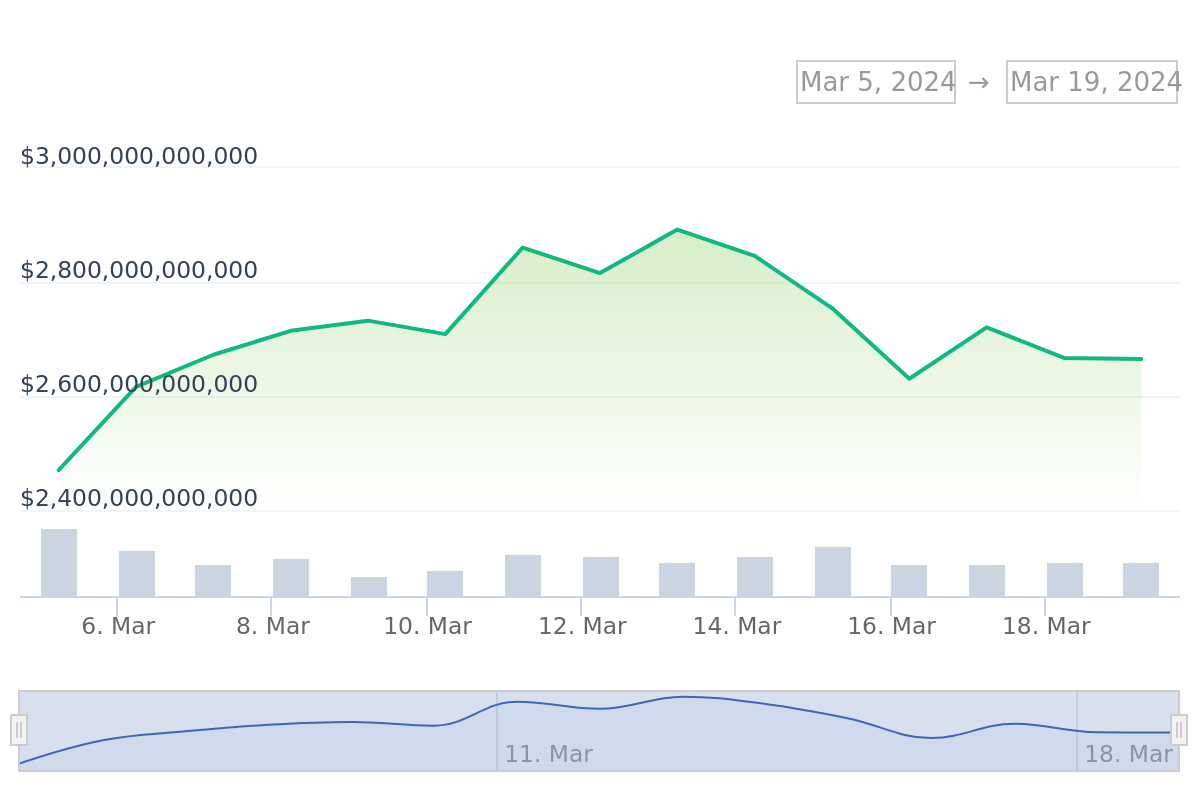

As mentioned in the previous article, BTC’s momentum is slowing down, which could be one of the main reasons why the market is crashing. This short-term waning of buying pressure has resulted in market participants booking profits, resulting in the total cryptocurrency market capitalization heading down from $2.89 trillion to $2.66 trillion, according to CoinGecko data.

Crypto market capitalization

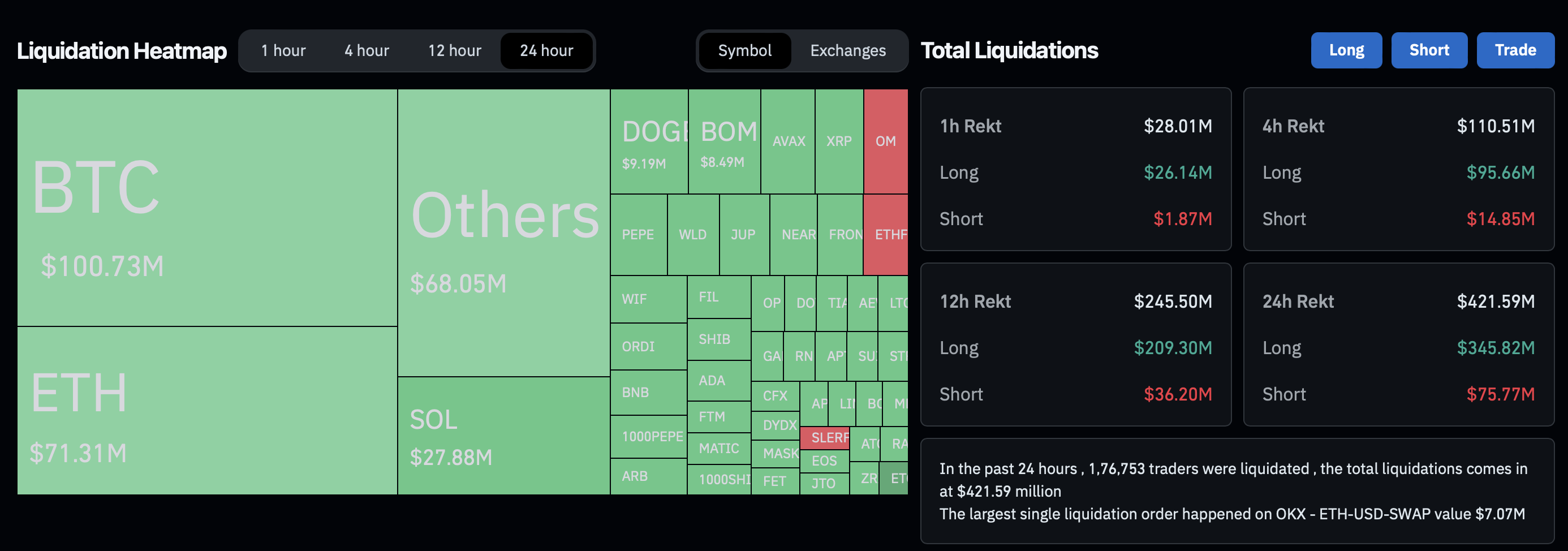

According to CoinGlass data, Bitcoin price has shed nearly 10% in the last four days, leading to $400 million in total liquidations in just the past 24 hours. In the last 24-hours, BTC long traders’ positions worth $100 million have been wiped out, along with $71 million in Ethereum and $28 million in Solana.

Crypto liquidation heatmap

This development is only likely to continue if Bitcoin price continues to slide lower.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple Price Forecast: Could open interest, buy signals, Coinbase Derivatives-backed XRP futures drive price to $3?

Ripple (XRP) edges higher on Monday, climbing 1.54% on the day to trade at $2.11 at the time of writing. Bulls have shown resilience and determination in the last week, upholding XRP above the $2.00 level.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC finally breaks out, ETH and XRP could follow

Bitcoin's (BTC) price broke above its key resistance level after facing multiple rejections around it the previous week. Ethereum (ETH) and Ripple (XRP) prices are approaching their key resistance levels; a breakout could signal a rally ahead.

Mantra shares buyback and 300M token burn details as CEO commits personal holdings

Mantra intensifies recovery efforts following a 90% price crash this week. CEO John Patrick Mullin commits personal holdings to the upcoming burn.

Arizona passes bill to create crypto reserve using public Treasury funds

Arizona is moving closer to creating a crypto-backed reserve as the state's Strategic Digital Assets Reserve Bill (SB 1373) advances, despite veto threats from the Governor over unrelated funding disputes.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.