Why is Ethereum lagging Bitcoin?

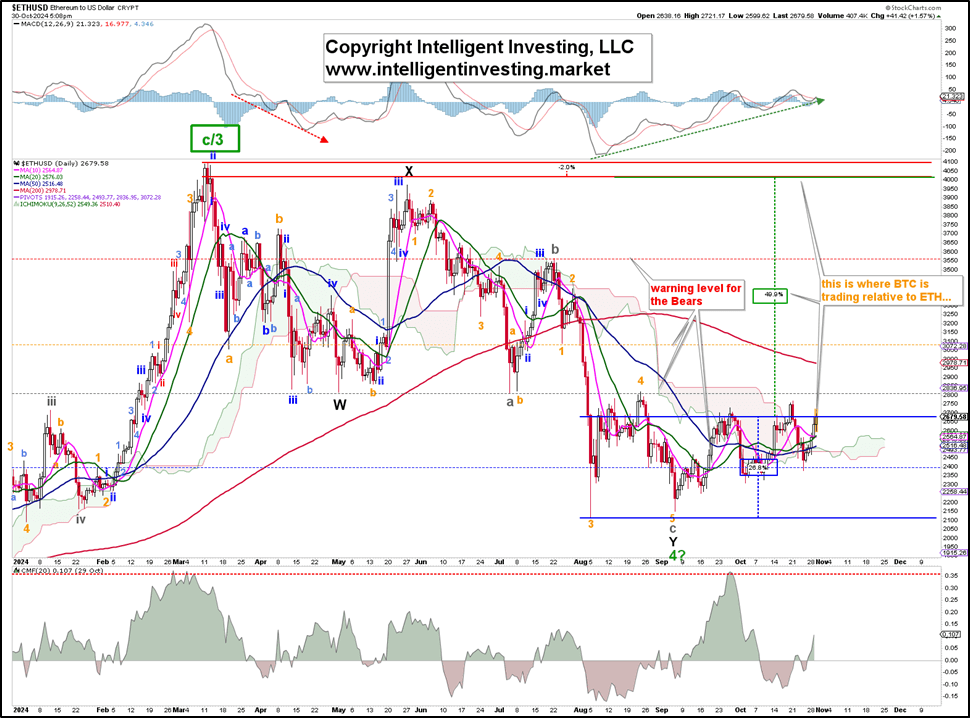

Ethereum (ETHUSD), the second-largest cryptocurrency, bottomed out on August 5 at $2121, like Bitcoin (BTCUSD) did. And that is essentially where the comparison ends. The former has increased by over 50% since then, whereas the latter has only added 27%. Moreover, while BTC is only 2% away from its ATH, ETH needs to rally 50% from current levels to play catch-up. See Figure 1 below.

Due to this lackluster performance, we have not provided any public updates. In our last analyses, we asked if it would go to $900 or $9000. Unless we see a break above $2800 that will hold, $900 is becoming more likely. We don’t know why that is, but the why doesn’t matter. Namely, price is the aggregate of all market participants’ opinions about, in this case, Ether at any given time, and it follows that this combined opinion has soured.

Moreover, Figure 1 shows that Ether has not even been able to clear the 2nd (grey) warning level for the Bears that we applied in our last update in early September. Thus, almost two months later, ETH has gone nowhere but in a sideways overlapping mess. That is often corrective price action. Therefore, it is increasingly likely that the August or September low was not the green W-4—subsequently, the March high was not a green W-3 but a green W-c. See the green box in the upper left corner of Figure 1. This means ETH’s price action may still be stuck in a more significant 4th wave, targeting $700-1000. See Figure 2 below.

In that case, the rally from the $833 low in 2022 to the $4092 high in 2023 was a more extensive (red) B-wave, and a final (red) W-c to $700-1000, depending on the exact Fibonacci extension is now underway. To confirm this thesis, a break below the August/September low (red dotted horizontal line) will be required, while Ether’s price should stay—ideally—below $2800.

Our opinion or quest for answers on why Ethereum is not rallying clearly won’t matter for ETH’s price, so we don’t bother with the why. Instead, we know for sure that only price pays, and we now have clear parameters in place to tell us if Ether is ready to rally more directly (>$2800) or if it wants to revisit the triple-digits one more time (<$2121) before it can stage its next Bull run.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.