Why is Ethereum (ETH) price up today?

Ethereum is witnessing a price breakout on the back of increased gas fees and the upcoming Shanghai upgrade, hitting a year-to-date high of $1,855 on March 23.

The Ethereum decentralized finance (DeFi) ecosystem received more daily fees, growing 9% in 24-hours on March 23 in tandem with Ether’s price growth. With the increase in Ether fees, the Ethereum proof of stake (PoS) token economics have turned deflationary and revenue is up 10% in the past 24-hours.

Ethereum network fees and revenue. Source: TokenTerminal

Although the Ethereum network is showing positive momentum, regulators are trending toward taking swift action against the crypto sector. Debates on whether Ether is a security token under the Howey test continue, and this could be weighing on investor confidence.

Such uncertainty about Ethereum’s future is likely contributing to why the price possibly faces 6-month lows versus Bitcoin. Investors are also awaiting the Ethereum Shanghai upgrade which is planned for March 2023, which some believe will unlock staked Ether and potentially increase sell pressure.

Analysts believe Ethereum can scale post-merge and on-chain data confirms a positive Ether short-term price future.

Here are three reasons why Ether is up today.

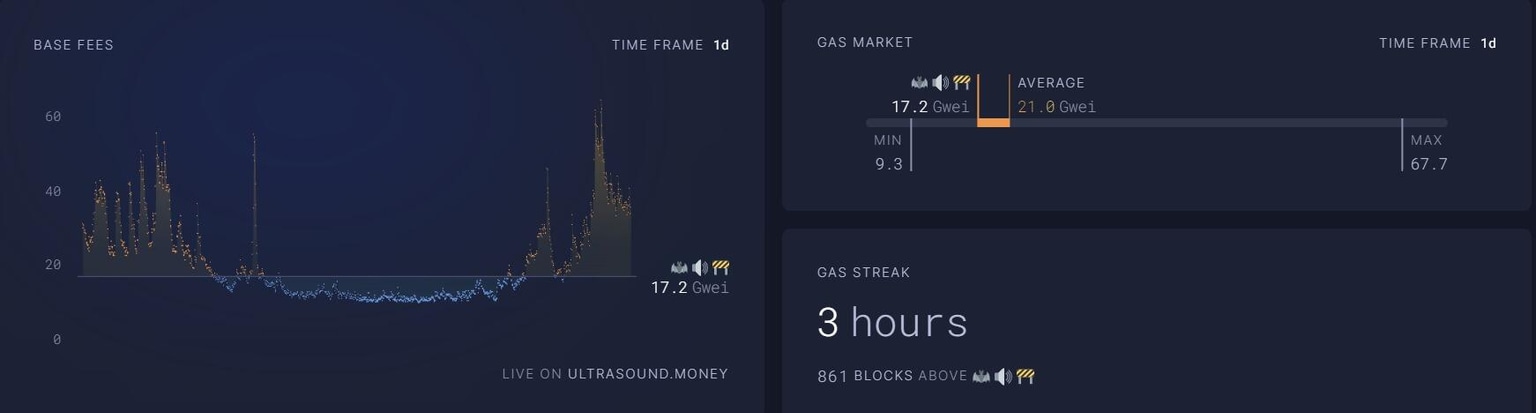

Ether is becoming increasingly deflationary

Ether price rose as 1,755 Ether were burned over the past 7 days leading into March 23.

Part of the Ethereum merge was designed to make Ether deflationary and on March 23, Ether reached an all-time token emissions low of -0.1% on a yearly basis.

Ethereum post-merge supply. Source: ultra sound money

1% of Ether’s total supply has been burned since the London upgrade which began on August 6, 2021 and this equates to over 1,853 Ether burnt in 595-days.

1% of Ether’s total supply has been burned since the London upgrade which began on August 6, 2021 and this equates to over 1,853 Ether burnt in 595-days.

Ethereum post-burn supply. Source: ultra sound money

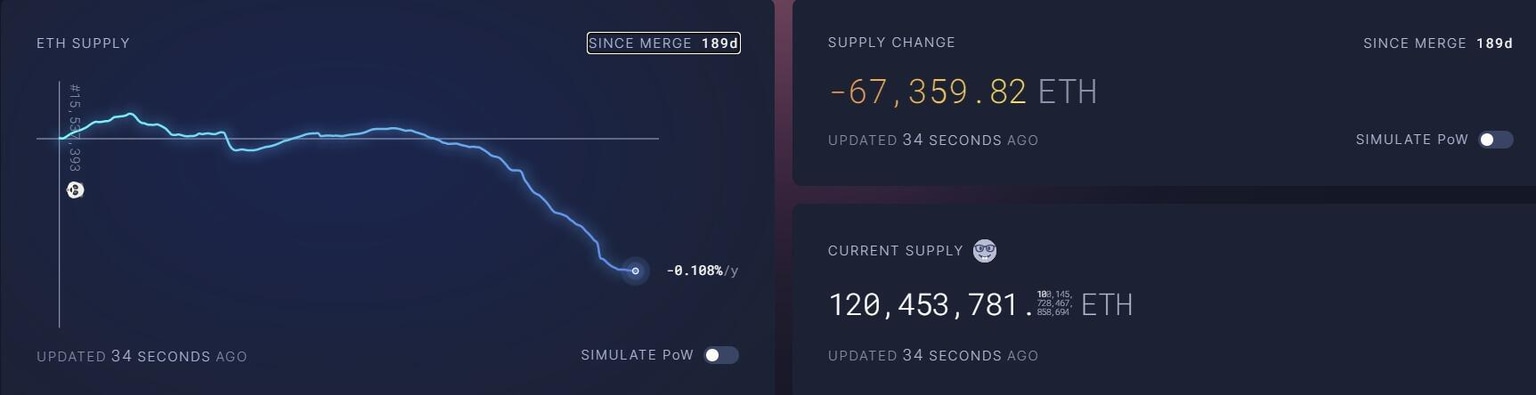

Arbitrum’s ARB airdrop increases gas costs

The long-awaited Arbitrum airdrop opened on March 23 for eligible wallets to claim the ARB token. The airdrop has created a major buzz on crypto Twitter.

In the first 3-hours of the launch, over 47% of airdropped ARB has been claimed. This amounts to over 543 million tokens distributed to 282,663 wallets.

Arbitrum airdrop. Source: Nansen

Fees for claiming the ARB airdrop on the Arbitrum network are paid for in Ether. When users became able to claim the airdrop, Ethereum gas costs rose as users sought speed by paying higher gas.

Ether fees. Source: ultra sound money

In addition to Arbitrum adding in the high fees, Ether transfers to Arbitrum and Uniswap’s universal router also led the way for 1-day burns.

Ether burn leaderboard. Source: ultra sound money

The upcoming Shanghai hardfork

The long-awaited Shanghai mainnet upgrade will allow a phased withdrawal of staked Ether on the Beacon Chain.

The Shanghai hard fork was first slated to commence on March 14. On March 2, Ethereum developers announced a delay in the hard fork until April. On-chain data suggests the Shanghai hard fork will not bring massive sell pressure, yet Ether price will likely remain volatile ahead of the upgrade.

Ether price analysis from Max Kalmykov, the CEO of trading automation platform Bitsgap, also sees upcoming volatility but is still bullish,

"Ethereum which is often referred to as the "silver" of the crypto sphere is a leader in the blockchain space. The forthcoming Shanghai upgrade could potentially result in significant fluctuations in the market; however, Ether's recent breach of the $1,400 resistance level suggests that its value might continue to climb."

Macro factors like inflation-caused interest rate hikes and potential U.S. industry crackdown will continue weighing on Ether’s price slightly hindering short-term price growth potential. Factors such as positive regulatory clarity and an easing of interest rate hikes may prove to be long-term catalysts for price growth. Ether’s price volatility is likely to continue ahead of the Shanghai upgrade.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.

-638152073311105219.jpg&w=1536&q=95)