Why is Bitcoin price up today?

Bitcoin price is up on Feb. 16 as a combination of factors sends (BTC $24,647) to six-month highs.

Data from Cointelegraph Markets Pro and TradingView shows BTC/USD hit $24,895 on the day — its best since mid-August 2022.

Bitcoin bulls are feeling the gains this week as the largest cryptocurrency puts in an impressive return to form after weeks of consolidation.

Macroeconomic tailwinds, principally from the United States, have come hand in hand with improving sentiment across risk assets, giving optimists the edge.

BTC/USD gained almost 10% on Feb. 15 and another 2% on Feb. 16, with altcoins following suit.

BTC/USD daily returns chart (screenshot). Source: Coinglass

The gains come in a key week of U.S. macroeconomic data prints, these so far feeding the narrative that inflation is ebbing — an important prerequisite for risk asset performance.

Ahead of the Wall Street open, Cointelegraph takes a look at what is moving crypto markets today.

US macro data emboldens Bitcoin bulls

It began with a Consumer Price Index (CPI) that mostly conformed to expectations despite a reshuffle in its calculation.

CPI is a classic volatility catalyst for stocks and crypto, and despite a slow initial reaction, the reaction this time ultimately proved no different.

Retail sales and manufacturing numbers then further boosted the outlook, with investors providing more “dry powder” for risk trades and sending crypto higher.

With even more data still to come, the mood is thus all about whether the good news will continue — and whether it can sustain the latest innings of Bitcoin’s blistering 2023 comeback.

“After a stampede for 10%, BTC bulls ran into a wall,” Keith Alan, co-founder of monitoring resource Material Indicators, summarized.

Clean rejection on the first test of key Weekly MAs. A hot Jobless Report could strengthen another attempt. Looking for a partial retrace to deliver another setup to scalp the volatility around the U.S. economic reports.

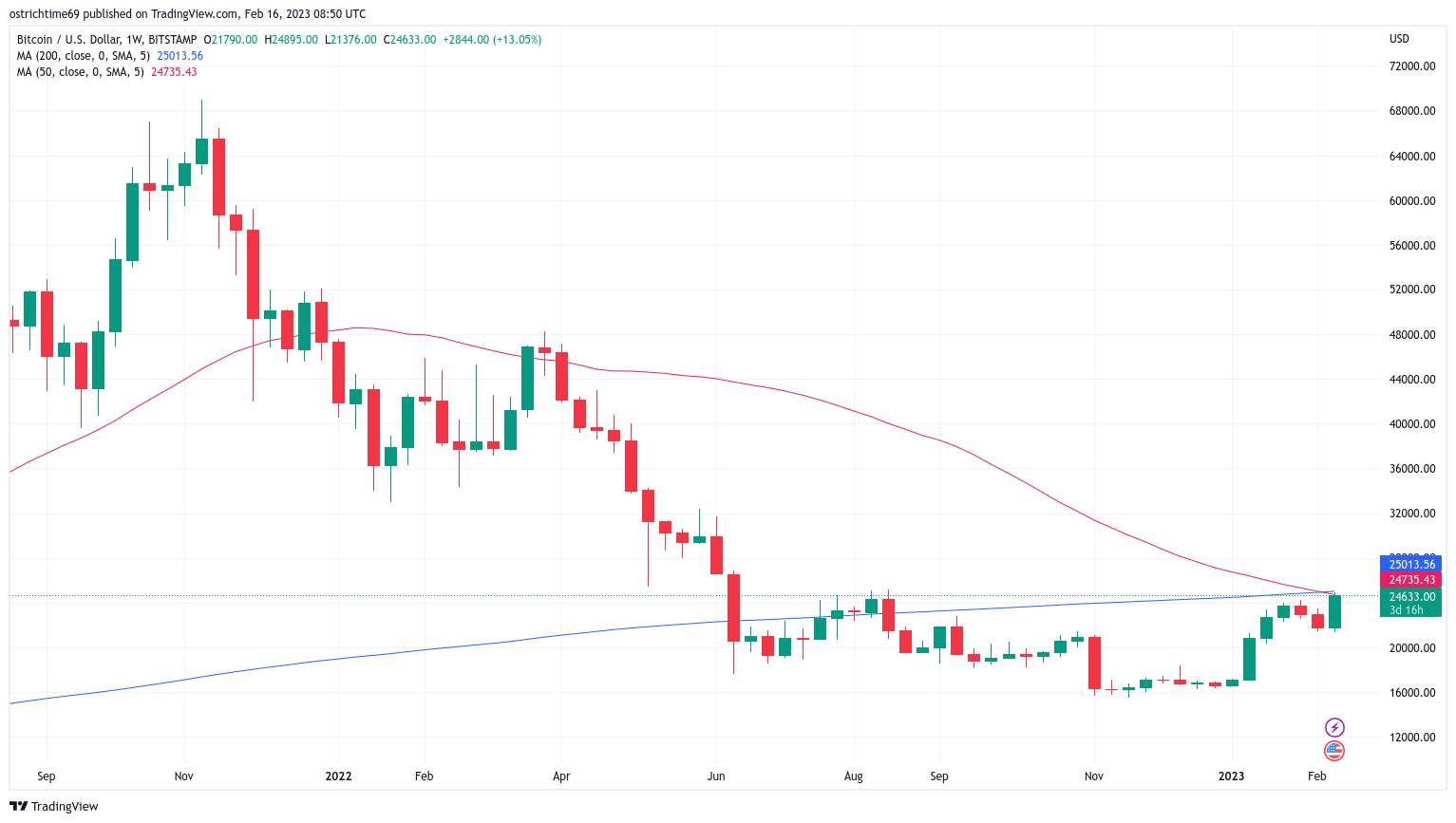

Alan referred to the 50-week and 200-week moving averages (MAs), the latter providing clean resistance since the middle of last year.

Should U.S. unemployment data come in above expectations, it could send a signal to the market that the Fed’s restrictive economic policy is working and that a turnaround could come sooner rather than later.

The Fed lowering interest rates and boosting liquidity would make risk asset trades more appealing.

BTC/USD 1-week candle chart (Bitstamp) with 50, 200MA. Source: TradingView

BTC price vies with US Dollar strength

In a curious, if temporary, state of affairs, Bitcoin is climbing in tandem with the U.S. dollar.

Traditionally negatively correlated, the two assets are both benefiting from the current climate — but for different reasons.

As explained by Dr. Jeff Ross, founder and CEO of Vailshire Capital Management, short-term treasury yields have moved higher, resulting in capital flowing into the U.S.

“BTC going higher because of increasing worldwide liquidity,” he added, referencing the aforementioned liquidity changes.

U.S. dollar index (DXY) 1-day candle chart. Source: TradingView

Others are nervous, however, querying how long the out-of-character status quo might continue.

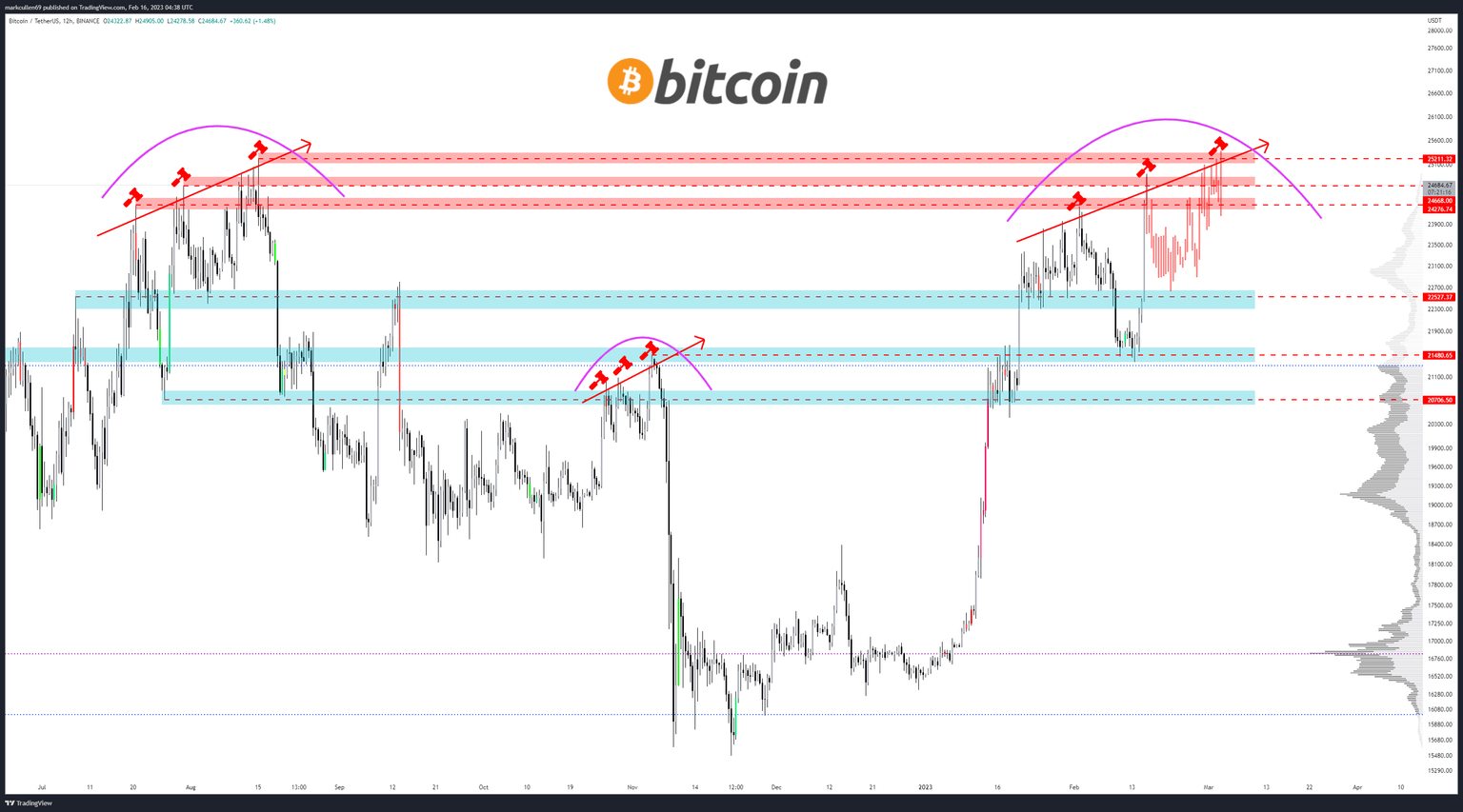

"Markets are starting to bifurcate, with Tradfi & $DXY not supporting the move yesterday," trader Mark Cullen warned in part of a tweet on Feb. 16.

I think the highs are going to get swept, but the Q is, if this move wipes out both sides 1st?

BTC/USD annotated chart. Source: Mark Cullen/ Twitter

Bitcoin whales guide support and resistance higher

As Bitcoin began to rise sharply once more, opportunities to influence the rally were not lost on some of its biggest traders.

Whales are constantly in touch with order book activity, and current conditions have seen bid and ask liquidity move up and down the order book — taking spot price with it.

“Expecting rejection at $25k and a dump to clear the way for volatility around the 8:30am ET Jobless Report, but they just laddered asks up to $28k,” a tweet explained on the day.

If they clear $25k they can exploit the upside illiquidity fast. If you can identify the game, you can mitigate risk.

An accompanying screenshot of the Binance BTC/USD order book showed $25,000 strengthening overnight, with crucial support also inching higher to $21,600.

BTC/USD order book chart (Binance). Source: Material Indicators/ Twitter

“Corrections are relatively short-lived in an upwards trending market,” Cointelegraph contributor Michaël van de Poppe meanwhile argued.

“Higher timeframe levels get one test and then markets start to shoot upwards, as people over short the correction. Breaking $25K and we'll continue towards $30-35K for Bitcoin.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.